Many developers of decentralized applications are choosing Ethereum as their blockchain of choice. But what about the other booming cryptocurrencies as well? Here we will compare Ethereum vs. Cardano vs. Polkadot vs. Solana, look at some startups, and try to see what cryptocurrency is more successful.

By 2027, the global blockchain market will be worth $69.04B. Today blockchain is legitimized in many industries. Over 70 million blockchain wallets have been registered. Technology can revolutionize government, finance, insurance, and personal identity security, among hundreds of other fields. No less than IBM has invested more than $200 million in research into the technology. In addition, more than 90% of European and US banks are researching the technology. We've rounded up four successful blockchains popular among soaring startups powered by Ethereum, Cardano, Polkadot, and Solana.

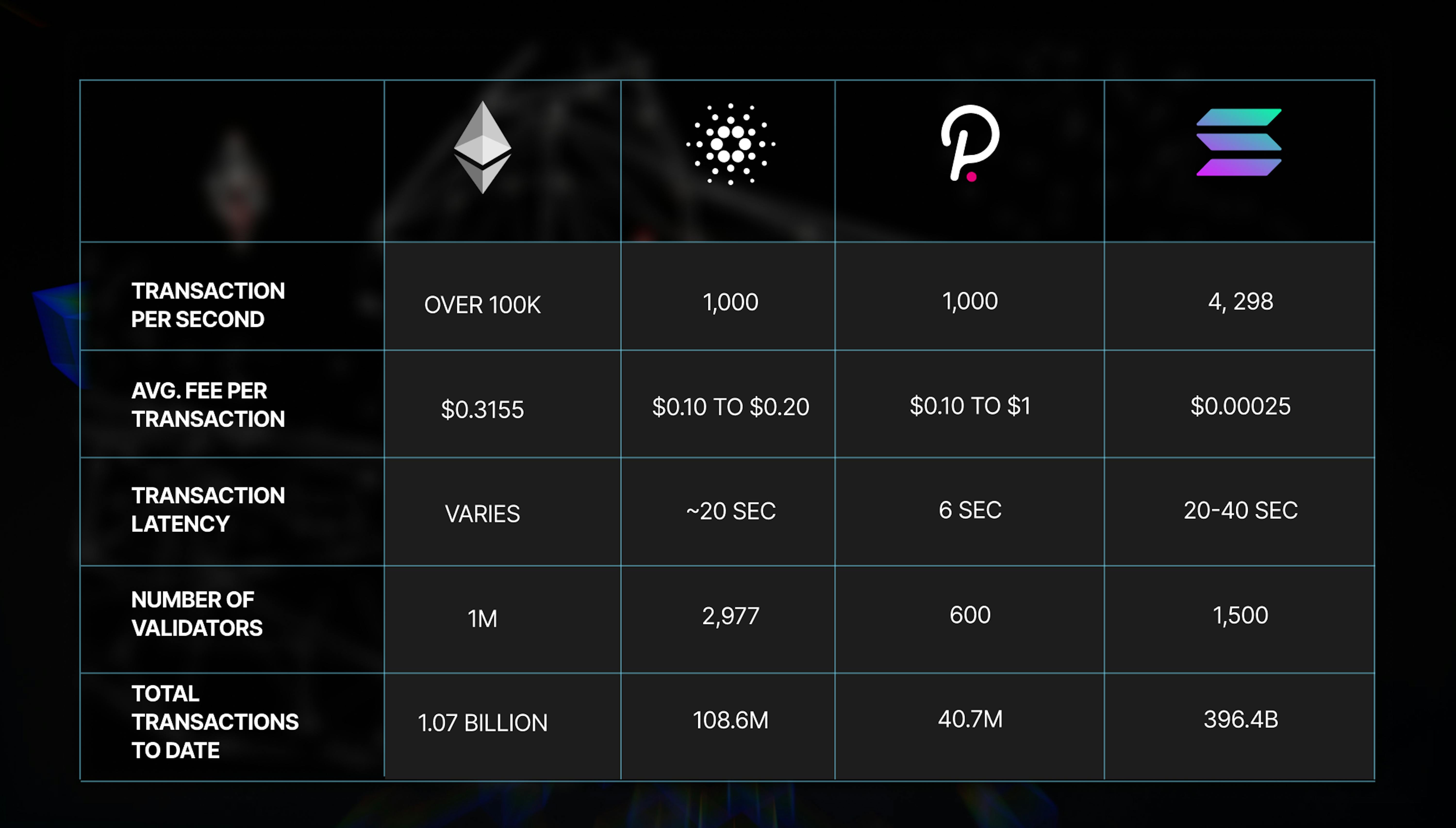

Ethereum vs Cardano vs Polkadot vs Solana: a feature-by-feature comparison

Blockchain, though new, has already seen three generations. However, that does not mean that each succeeding generation has been less successful than the previous one. The three blockchain generations are:

- First-generation – Bitcoin

- Second generation – Ethereum

- Third generation – Cardano, Polkadot, Solana

The crypto community has generally called cryptocurrencies with a native third-generation blockchain "Ethereum Killers." These cryptocurrencies are decentralized, secure, enabling smart contracts, offering a digital application platform (dApp), scalability for fast, low-cost transactions, and integration with other blockchains.

Solana, Cardano, and Polkadot are the top ten cryptocurrencies in market capitalization. And all three of them are seen as challengers or "Ethereum Killers."

Finding the best blockchain can be difficult, considering they all have differences. Ethereum, Solana, Cardano, and Polkadot are the most well-known blockchains, so let’s differentiate them from one another.

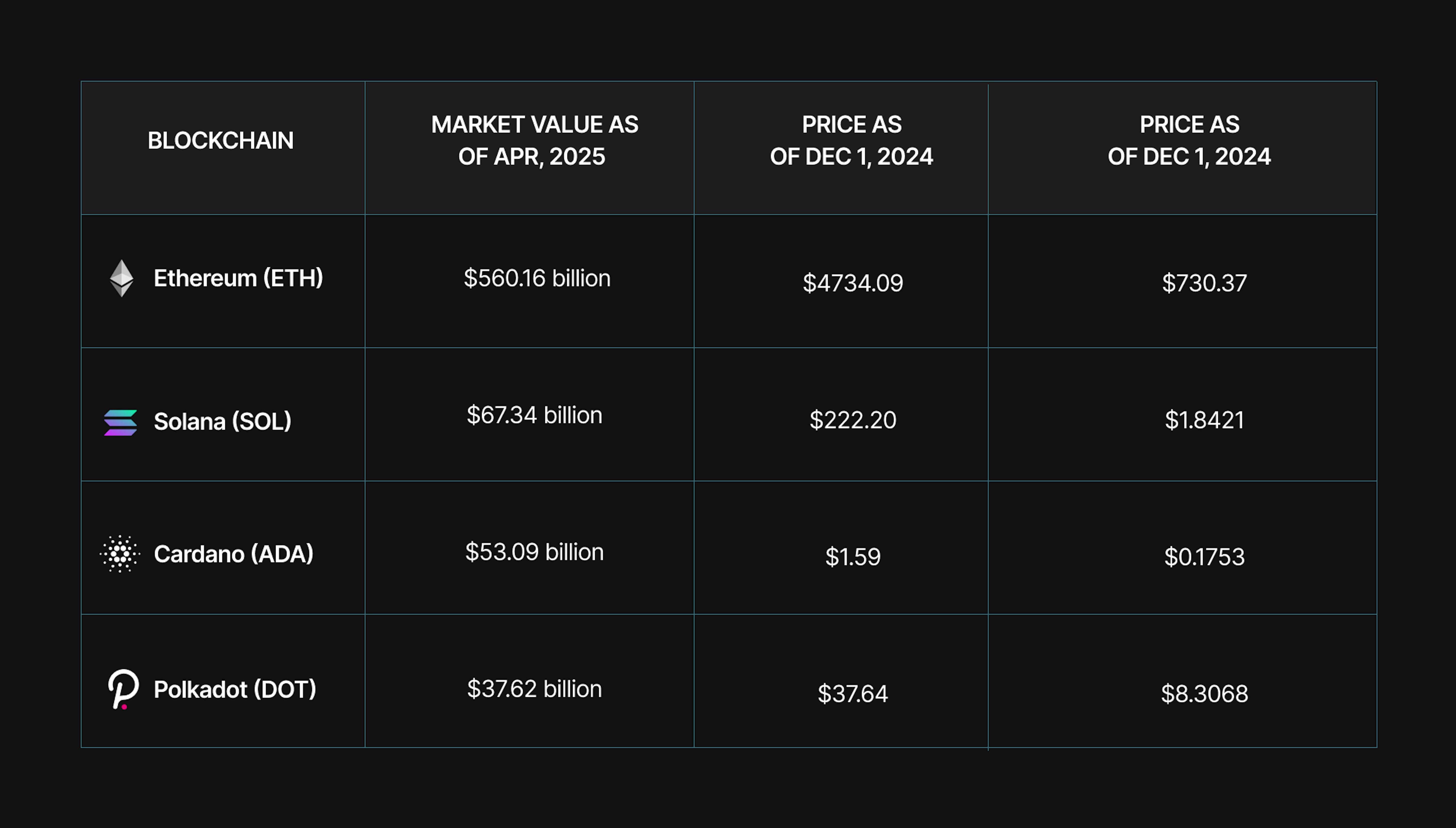

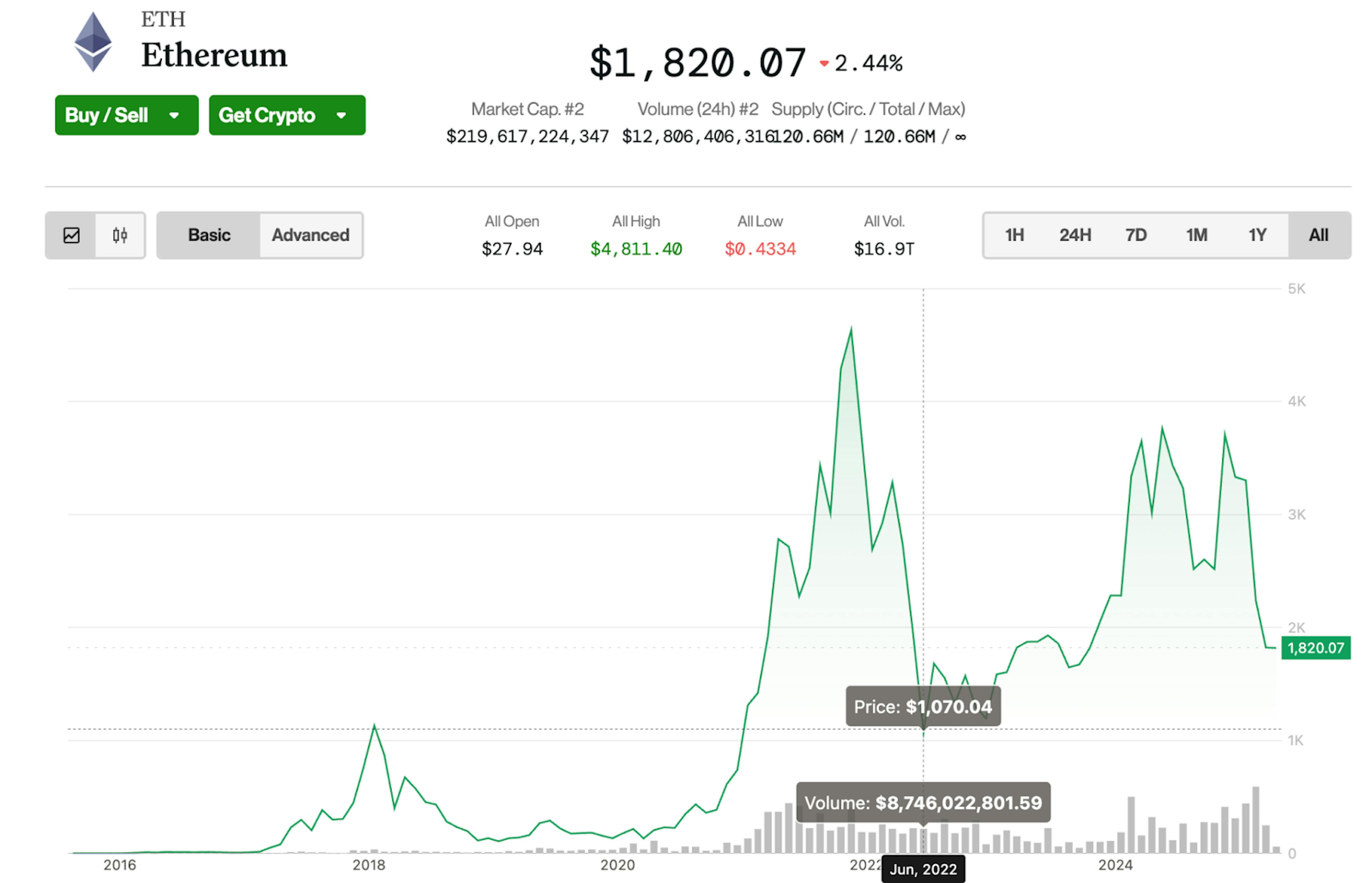

Ethereum – ETH (since 2015)

- Coin: ETH

- Market Cap: $197.03 billion

- TVL: $46.4 billion

Ethereum was launched in 2015 by computer programmer Vitalik Buterin. It has gained significant institutional support with over 800 members of the Enterprise Ethereum Alliance as of 2024, including tech giants like Intel, JPMorgan, and Microsoft. The price of Ether (ETH), Ethereum's native cryptocurrency, has seen remarkable growth from its initial value of $0.311 at launch to an all-time high of approximately $4,800 in late 2021. In 2024, Ethereum experienced significant price appreciation, with ETH reaching new heights after the approval of spot Ethereum ETFs in the United States and the continued development of its ecosystem.

Working

Ethereum is the first decentralized blockchain platform that establishes a peer-to-peer network for securely executing and verifying application code, known as smart contracts. These smart contracts allow participants to transact directly without requiring a trusted central authority. The platform enables developers to build decentralized applications (dApps) using the native Solidity scripting language and the Ethereum Virtual Machine (EVM).

The maturity of the Ethereum ecosystem extends to the quality of user experience for average users of Ethereum applications. Its architecture supports enterprise-level applications while maintaining its cryptocurrency, Ether (ETH), as a core component of the network.

Scalability

The Merge and Proof-of-Stake Transition

In September 2022, Ethereum completed "The Merge," successfully transitioning from Proof-of-Work to Proof-of-Stake consensus. This historic upgrade reduced Ethereum's energy consumption by approximately 99.95%, addressing one of the platform's most significant criticisms.

Layer 2 Solutions

By 2024, Ethereum's scalability has significantly improved through the widespread adoption of Layer 2 scaling solutions:

- Optimistic rollups — Solutions like Optimism and Arbitrum have gained substantial traction, processing thousands of transactions per second with significantly lower fees.

- ZK-Rollups — Zero-knowledge rollups such as zkSync and StarkNet have matured, offering near-instant finality with strong security guarantees.

- Ecosystem growth — Total value locked in Layer 2 solutions exceeded $51 billion by November 2024, demonstrating strong market adoption.

The Dencun upgrade

In March 2024, Ethereum implemented the Dencun upgrade, which introduced proto-danksharding (EIP-4844) to significantly reduce costs for Layer 2 solutions. This upgrade has decreased rollup costs by approximately 90%, making Ethereum applications much more accessible to average users.

Governance

Ethereum operates on a decentralized governance model where development decisions are made through community consensus. The Ethereum Foundation plays a significant role in coordinating development efforts, but the platform itself remains open-source, allowing for community-driven improvements and upgrades.

Key governance features include:

- Open-source configurations

- Community-driven development

- Decentralized decision-making process

- Multiple client implementations

Environmental impact

Ethereum's environmental profile has dramatically improved since its transition to Proof-of-Stake. Before September 2022, Ethereum consumed approximately 87.29 Terawatt-hours of electricity annually, comparable to Finland's national consumption. After The Merge, Ethereum's energy usage dropped by 99.95%, making it one of the most environmentally friendly major blockchain networks.

Current estimates in 2024 place Ethereum's annual energy consumption at less than 0.01% of its previous level, using roughly the same amount of electricity as a small town rather than an entire country. As of 2024, the Ethereum Foundation has funded carbon removal projects that more than offset the network's minimal remaining carbon footprint, effectively making Ethereum carbon-negative.

Cardano - ADA (since 2017)

- Coin: ADA

- Market Cap: $22.57 billion

- TVL: $309.25m

Cardano (ADA) is a public blockchain platform and the eighth-most valuable cryptocurrency launched in September 2017 by Charles Hoskinson, the inventor of Ethereum. It is known as the "academic blockchain" that is still being tested. But it is the first large blockchain platform based on the proof-of-stake model as an alternative to proof-of-work (PoW). Blockchain is designed to serve as a flexible, sustainable, scalable platform for running smart contracts, allowing the development of decentralized finance apps and more.

Working

Cardano's architecture is built on a unique two-layer foundation that separates accounting and computational processes:

Cardano Settlement Layer (CSL)

The CSL functions as the first layer of Cardano's architecture, handling peer-to-peer transactions like token transfers between users. It is responsible for the chain's security, serves as a foundation for smart contracts, and provides a regulatory compliance framework for various jurisdictions. This layer utilizes specific scripting languages, Plutus and Marlowe, to move value and enhance compatibility for the overlay network protocol. The CSL implements the Ouroboros consensus mechanism, differentiating it from earlier blockchain generations.

Cardano Computation Layer (CCL)

The CCL helps Cardano replicate functionalities similar to the Rootstock smart contract platform from the Bitcoin ecosystem. This layer was implemented for its ability to help scale specific protocols over time, including the potential addition of hardware security modules (HSM) to the existing protocol stack. The CCL supports Solidity, the programming language that powers Ethereum Smart Contracts, for applications requiring lower security on the platform. The separation between CCL and CSL allows smart contracts to execute independently without interference from transaction verification processes, enabling users to establish different conditions for transaction assessment.

KMZ Side Chains

The KMZ sidechain protocol facilitates bridging between Cardano and other cryptocurrencies or similar blockchains. This protocol allows ledgers to interact with the CSL in compliance with specific regulatory standards without sharing sensitive data. The research-based framework supporting Cardano's development phases combines peer-reviewed concepts with evidence-based methodologies, establishing a solid platform for the blockchain network and the ADA token. The KMZ protocol enables secure fund transfers from the CSL to any CCL or blockchain that implements this protocol.

Scalability

Cardano's scalability grows proportionally with the number of validators connected to the network. The platform utilizes an Epochs system designed by Hoskinson, which divides the network into blocks and assigns slot leaders to each. These slot leaders are responsible for mining, validating, and directing transactions to their appropriate blocks.

In its initial implementation, Cardano could process approximately 257 transactions per second. With the introduction of Hydra, Cardano's layer-two solution, Hoskinson claims the network can achieve a transaction rate of 1,000 per minute. Hydra also enables the creation and access of smart contracts, decentralized applications (DApps), and other applications that operate on top of the existing Cardano blockchain. The primary goal of the Hydra layer is to increase market exposure while reducing expenses and storage inefficiencies.

Beyond enhancing transaction throughput, the Hydra scalability solution offers additional advantages that appeal to large-scale users. Layer 2 addresses concerns beyond other networks, including payments, denial-of-service attack prevention, identity management, and storage solutions. Theoretical projections suggest that with full implementation of Ouroboros Hydra, Cardano could potentially achieve throughput of up to 1 million transactions per second.

Governance

Cardano employs an off-chain governance mechanism similar to Ethereum's. The Cardano Foundation and IOHK (Input Output Hong Kong) serve as the governing bodies of the Cardano network. IOHK, led by CEO Charles Hoskinson, is a research and development company dedicated to leveraging blockchain's peer-to-peer innovations to create accessible financial services for all.

Treasury system

Cardano maintains a treasury where funds collected from transaction fees accumulate. These resources are allocated for effective marketing, customer services, and network maintenance. The ADA token is designed to be deflationary, with a fixed supply cap of 45 billion coins.

Environmental impact

One of Cardano's primary goals is to be the most environmentally sustainable blockchain platform. It achieves this through its unique proof-of-stake consensus mechanism called Ouroboros, which eliminates the energy-intensive mining activities associated with proof-of-work systems. The fact that Cardano cannot be mined makes it an "environmentally friendly" cryptocurrency, as it avoids the high energy consumption typical of mining operations. This design choice also contributes to faster transaction processing compared to Ethereum's original proof-of-work implementation.

Polkadot – DOT (since 2017)

- Coin: DOT

- Market Cap: $6.09 billion

Polkadot's developers include Ethereum co-creator Gavin Wood. It was founded in 2016 and launched on May 26, 2020, by Web3 Foundation. The nonprofit Web3 Foundation is the primary research organization maintaining Polkadot's open-source code. The primary goal of the Web3 Foundation is to facilitate the creation of a fully functional decentralized web that will be controlled entirely by users to maintain the privacy of users' data.

Working

Polkadot's architecture consists of a unique system that combines a network of heterogeneous blockchains called parachains and parathreads. These components work together to create a flexible, scalable ecosystem:

Relay Chain

The Relay Chain functions as Polkadot's central chain and serves as the platform's backbone. All Polkadot validators are staked on the Relay Chain and validate for it. The Relay Chain supports a limited number of transaction types, primarily focused on system-level operations such as governance processes, parachain auctions, and other essential functions.

Validators play a crucial role by checking block candidates from parachains and parathreads, adding new blocks to the Relay Chain and connected chains. This validator system is fundamental to Polkadot's network security and enables secure cross-chain communication.

Parachains and Parathreads

Parachains are application-specific data structures that run parallel to the Relay Chain. They derive their name from these "parallelized" chains that operate alongside the main chain. Due to their parallel nature, they enable simultaneous transaction processing, achieving scalability for the entire Polkadot system.

Parathreads are more flexible chains that can participate in Polkadot's shared security framework without requiring a full chain slot. They provide a way for blockchains to temporarily join Polkadot's security model, making the ecosystem more accessible to a broader range of projects.

Bridges

Bridges represent another significant component of Polkadot's architecture. These mechanisms allow parachains and parathreads to connect and communicate with external networks like Bitcoin. Bridges come in various forms, from centralized and trusted to decentralized and trustless, with Polkadot preferring the latter design for its ecosystem. Bridge connections can be implemented through Bridge pallets, smart contracts, or higher-order protocols.

Scalability

Polkadot's parachain structure enables it to process up to 166 transactions per second, approximately ten times faster than Ethereum's original implementation. By connecting multiple blockchains, Polkadot establishes a foundation for substantial future network growth.

The platform achieves its performance through the cooperation of parachains and the Relay Chain, which provide consensus across the entire network via multiple validators. Parachain slots are auctioned and leased for significant amounts, creating an ecosystem where specialized blockchains can function in parallel, each designed for specific purposes. For example, a Polkadot DeFi Parachain can host DeFi projects, while an NFT Parachain can contain games, digital assets, and related applications.

Parathreads address the limited availability of parachain slots by offering a more economically feasible alternative. They have a fixed registration price that is substantially lower than acquiring a parachain slot but must compete for inclusion in each block through cost-effective methods, similar to Ethereum's gas fee model.

As more parachains are added to the network, Polkadot's processing capacity is expected to increase dramatically, with theoretical speeds approaching one million transactions per second.

Governance

Polkadot implements an on-chain governance mechanism based on two distinct groups: the Technical Committee and the Council. These bodies oversee protocol updates, corrections, and other significant changes. Stakeholders actively participate in governance by voting on initiatives and proposals that shape the platform's future.

Substrate

Polkadot was built from the ground up to simplify the fundamental programming tasks in decentralized application development. The platform was constructed using Substrate, a framework for creating cryptocurrencies and decentralized systems. Substrate allows any developer, company, or individual to maintain their custom parachain, enhancing accessibility to Polkadot's ecosystem.

Kusama

Polkadot's development is supported by a "canary network" called Kusama. Kusama's primary function is to identify vulnerabilities or flaws in Polkadot's code base before they affect the main network. Developed by Parity Technologies, the same company that created Polkadot, Kusama operates independently with no central controlling entity. The network is governed by a decentralized network of Kusama token holders who vote on decisions.

Treasury

To ensure teams developing on Polkadot have access to necessary resources, the platform maintains the Polkadot Treasury, which supports various initiatives within the ecosystem. The treasury plays a critical role in promoting organic development and community growth, providing funding alternatives for projects building on the platform.

Solana - SOL (since 2020)

- Coin: SOL

- Market Cap: $71.23 billion

- TVL: $7.336 billion

Solana is a high-performance smart contract platform designed specifically to host decentralized applications (dApps). Launched in 2020 by former Qualcomm software engineer Anatoly Yakovenko, Solana has rapidly gained traction in the blockchain space by offering significantly faster transaction processing and lower fees compared to competitors like Ethereum and Cardano. Solana's native cryptocurrency, SOL, experienced remarkable growth in its early years, rising from approximately $3 per coin at the beginning of 2021 to a peak of over $250 per coin by September of the same year.

The platform has attracted significant investment from prominent venture capital firms in the cryptocurrency space, including Alameda Research, Andreessen Horowitz, and Polychain. Many analysts view Solana as being in the early stages of its growth cycle, with predictions that it could eventually rival or surpass Ethereum in terms of market value and adoption.

Working

Solana's primary innovation lies in its consensus mechanism, which combines two distinct approaches:

Proof-of-Stake and Proof-of-History

Solana implements a unique hybrid consensus model that combines a Proof-of-Stake (PoS) system with a novel approach called Proof-of-History (PoH). While PoS provides the security and validator incentive structure, PoH serves as a cryptographic clock that creates a verifiable sequence of transactions without requiring nodes to communicate about time.

The Proof-of-History mechanism timestamps incoming transactions, creating a verifiable order of events that significantly reduces the overhead needed for network consensus. This timestamping allows validators to process transactions without having to coordinate extensively with each other about the order of events, resulting in dramatically improved throughput.

Transaction processing

By leveraging this hybrid consensus mechanism, Solana's blockchain achieves remarkable performance metrics:

- Transaction capacity of up to 50,000 transactions per second (TPS), compared to Ethereum 1.0's approximately 30 TPS

- Average transaction costs of a fraction of a cent, substantially lower than Cardano's $0.44 and Ethereum's $20+ during peak periods

- Sub-second finality for transaction confirmation

This performance has made Solana particularly attractive for applications requiring high throughput and low latency, such as decentralized exchanges, trading platforms, and gaming applications.

Scalability

Solana's architecture was designed from the ground up with scalability as a primary consideration. Rather than implementing layer-2 solutions or sharding, Solana achieves its high throughput on the base layer through several technical innovations:

- Proof-of-History — Creates a historical record of transactions that verifies passage of time between events

- Tower BFT — A PoH-optimized version of Practical Byzantine Fault Tolerance

- Turbine — A block propagation protocol that breaks data down into smaller packets

- Gulf Stream — A mempool-less transaction forwarding protocol

- Sealevel — Parallel transaction processing on a single state machine

- Pipelining — A transaction processing unit for validation optimization

- Cloudbreak — A horizontally-scaled accounts database

- Archivers — Distributed ledger storage

These combined innovations enable Solana to achieve throughput that scales with network bandwidth, positioning it as one of the most scalable public blockchains currently in operation.

Governance

Solana's governance model is currently more centralized than some other blockchain projects, with the Solana Foundation and Solana Labs playing significant roles in direction and development. The Solana Foundation is a non-profit organization based in Switzerland that supports the growth and development of the Solana network.

As the ecosystem matures, there is an expectation that governance will gradually transition toward a more decentralized model, potentially incorporating on-chain voting mechanisms for holders of the SOL token. However, at present, major protocol decisions and upgrades are primarily directed by the core development team and foundation.

Environmental impact

Solana is positioned as an environmentally friendly cryptocurrency due to its energy-efficient consensus mechanism. Unlike proof-of-work blockchains like Bitcoin, Solana's proof-of-stake system requires minimal computational resources to validate transactions.

According to the Solana Foundation, a single Solana transaction uses approximately the same energy as a few Google searches. Despite this already low energy footprint, the Solana Foundation has committed to making the network carbon-neutral and continues to work on further reducing its environmental impact.

Is Solana better than Cardano?

When comparing Solana and Cardano, it's clear that both platforms offer compelling alternatives to Ethereum, but they approach blockchain innovation in very different ways.

Cardano is known for its methodical, research-first approach. It emphasizes decentralization, formal verification, and academic peer review. Its Proof-of-Stake consensus protocol, Ouroboros, is widely regarded as one of the most energy-efficient and secure. However, Cardano has often been criticized for slow development timelines and a smaller ecosystem of dApps compared to its competitors.

Solana, by contrast, is a performance-focused blockchain, prioritizing speed and low fees. It can process thousands of transactions per second at a fraction of a cent, making it attractive for high-throughput use cases like DeFi and NFTs. However, Solana has faced criticism for its centralization concerns and network reliability, having experienced multiple outages since its launch.

It's unlikely that Cardano can overtake Solana in the near term. While Cardano and Solana have been long-time rivals, current market dynamics favor Solana for better investment.

However, it's important to note some inaccuracies in the claim:

- Cardano does support smart contracts through the Plutus platform (launched in 2021).

- Security is subjective. Cardano uses a formally verified proof-of-stake protocol (Ouroboros), which is academically peer-reviewed.

- Transaction costs on Cardano are higher than Solana's but still relatively low compared to Ethereum.

Is Polkadot better than Solana?

Scalability and developer flexibility are critical features of Solana. Polkadot aims to facilitate interoperability between blockchains by letting developers send data seamlessly between networks securely.

These two projects are so different that it is impossible to say which is better. Polkadot tries to solve the scalability and interoperability problems in blockchain technology. Solana is a blockchain that aims to provide low fees and high speed. Improving the way crypto is used is the main aim for Polkadot and Solana. They may become the backbones of the blockchain ecosystem if they achieve these goals and provide unique usability.

It is impossible to predict how well these projects will do or how much their respective tokens will rise in value. However, both Solana and Polkadot offer developers a more flexible and open development environment. As a result, both projects can look forward to bright futures.

Is Polkadot better than Cardano?

As mentioned above, Cardano is a blockchain platform of the third generation that focuses on Dapp development. Unlike other cryptocurrencies, it has been 100% decentralized, making it safer and more reliable. ADA is one of the most popular tokens in the market. The Cardano system is based on a PoS model, which cannot be mined.

Polkadot is a decentralized ecosystem of blockchains. The network was built to facilitate cross-chain interoperability and power next-generation Dapp development. Polkadot currency provides scalability and interoperability due to its ability to parachain its tokens. Polkadot is one of the most funded blockchain projects of all time.

Both projects originated from Ethereum team members, and both aim to eliminate some of the limitations of that platform. A closer look reveals that Cardano is designed to provide an upgraded network for Dapp development. To achieve greater functionality, Polkadot allows developers to integrate other networks. You should hold a little of each of these projects in your portfolio due to these reasons.

Is Cardano, Polkadot, and Solana better than Ethereum?

Not necessarily. Polkadot is focused on multi-chain security so that different blockchains can communicate with each other. Cardano's goal is to be the most environmentally sustainable blockchain platform. The main goal of Cardano is to become a more environmentally sustainable blockchain platform than others. While keeping costs low, Solana aims to scale throughput.

Solana, Cardano, and Polkadot are only three of the hundreds of crypto coins that promise to do just what Ethereum does, only better. It means that these cryptocurrencies have a chance to learn from Ethereum's mistakes. In contrast, the Ethereum ecosystem is much more developed and stable.

| PARAMETERS OF COMPARION | CARDANO | POLKADOT | SOLANO | ETHEREUM |

|---|---|---|---|---|

| Year of origin | 2017 | 2017 | 2020 | 2015 |

| Developed by | Charles Hoskinson | Gavin Wood | Anatoly Yakovenko | Vitalik Buterin |

| Type of token | $ADA | $DOT | $SOL | $ETH |

| Speed | Approximately 1,000 TPS | Approximately 1,000 TPS | Up to 4,298 TPS | Over 100,000 TPS |

| Consensus mechanism | Ouroboros (Proof-of-Stake) | Nominated Proof-of-Stake (NPoS) | Proof-of-History + Proof-of-Stake | Proof-of-Stake (since 2022, post-Merge) |

| Decentralization | High (3,000+ stake pools) | High (independent validators) | Medium (fewer validators, higher control) | Medium–High (multiple client implementations) |

| Smart contracts support | Yes | Yes | Yes | Yes |

| Scalability (L2) | Hydra (in development) | Parachains | High throughput built into base layer | Layer 2 rollups |

| Primary focus/Niche | Research-driven, identity & finance | Interoperability, Web3, multichain | High-speed DeFi & NFT apps | General-purpose smart contract platform |

Can Ethereum be killed?

According to Solana co-founder Raj Gokal, "Ethereum cannot be killed; it's impossible." Despite this, Ethereum continues to face stiff competition from platforms often labeled as "Ethereum Killers," including Solana, Cardano, and Polkadot. These platforms offer high throughput, low transaction fees, and innovative consensus mechanisms—capturing significant market share and ranking within the top ten cryptocurrencies.

Ethereum's ongoing evolution, particularly the transition to Ethereum 2.0, aims to address its key limitations: scalability, speed, and energy efficiency. With upgrades like The Merge (completed in 2022), and more recently the Dencun upgrade (March 2024), Ethereum is moving toward a long-term goal of achieving 100,000 transactions per second (TPS), as stated by Ethereum co-founder Vitalik Buterin. These advancements are designed to future-proof the platform against rising competition and increase its ability to support mainstream adoption.

While competitors may offer superior performance today in specific areas (Solana's sub-second finality or Cardano's formal verification), Ethereum's massive ecosystem, developer community, and continued innovation make it incredibly resilient, if not unstoppable, in the long run.

Soaring blockchain companies and startups

It appears from the above blockchains and cryptocurrencies are becoming legitimized and welcomed in myriad industries. In the United States alone, there are 726 blockchain companies, according to IPlytics research, and this number is still increasing. We've rounded up eight interesting examples of companies using blockchain.

Raydium (Solana)

Using the Solana blockchain, Raydium is an automated market maker (AMM) and liquidity provider. Raydium enables permissionless trading of digital assets, such as cryptocurrencies, through liquidity pools, which have emerged as an essential tool of Decentralized Finance. Pools of liquidity rely on individuals, known as liquidity providers, who lock their assets in a smart contract. As an additional source of liquidity for Solana, Raydium combines the flexibility of an AMM with the reliability of Serum's more traditional order book mechanism.

With a recent market capitalization of $700 million, the protocol has attracted plenty of interest for Total Value Locked (TVL). In addition, Raydium launched Fusion Pools, a project that offers dual-yield rewards to liquidity providers and stakeholders.

Raydium has a market cap of over $83.40M. The protocol has a maximum supply of 555 million RAY tokens from its main net launch in February 2021. The circulating supply is at 131,305,777 RAY tokens. The price of RAY is $0.63 per token at the time of writing (August 2022).

Price Prediction does predict a gradual rise for the token. Its RAY crypto price prediction suggests it will climb from $0.63 in 2022 to $11.49 in 2025. The prediction is that the DeFi token will reach a new all-time high in 2027 of $24.02. The Raydium price prediction for 2030 is even higher, forecasting an average price of $75.87.

Single.Earth (Solana)

After a comprehensive investigation of other blockchain technologies' capabilities and energy usage, Estonian startup Single.Earth chose Solana to protect transactions on the platform.

Single.Earth simulates nature's capacity for carbon and biodiversity. It has created a digital clone of planet Earth using satellite images, big data analysis, and machine learning. Tokens are issued to landowners for carbon dioxide gathered in biodiverse areas.

Single.Earth secured one of the biggest seed investments in Estonia to date: $7.9 million led by EQT Ventures and Icebreaker.vc founders. To finance its 'nature-backed' financial system, Single.Earth will use MERIT tokens. As the market for carbon credits is estimated to reach $50 billion by 2030, and crypto's market cap exceeded $2 trillion in 2021, their plan might just work.

The current circulating supply of Merit Circle is 276.69 Million tokens, and the maximum supply of Merit Circle is 899.74 Million. According to market data for August 2022, the current price of MERIT is $0.7054 per token.

Cryowar (Solana)

Cryowar is a real-time multiplayer PVP arena NFT game launched in Q1 2022, with the first live World Championships in Q2 2022. Players fight for resources, territory, and global dominance in a massive in-game environment. The project's main feature is that the game combines traditional gaming with blockchain best practices, such as DAO voting, NFT, and decentralized financing (DEFI). RPG stakers can also improve their skill and experience levels in-game and achieve higher rewards through the game's deflationary gaming environment that integrates staking with gameplay.

The current CWAR token price is $0.028. Days after listing on the exchange, it returned over 200x ROI and reached an all-time high of $4.75 in November 2021. As a result of the market crash, the price action has deteriorated. As a result, the token trades between $0.25 – $0.40. The price action and the fundaments are weak at the moment. If the bulls are back, it’s possible to hit the previous high and target a value area of around $7.

Uniswap (Ethereum)

Uniswap is the largest decentralized exchange (DEX) operating on the Ethereum blockchain. Users can trade crypto without an intermediary from anywhere in the world. Launched in November 2018, Uniswap was one of the first DeFi applications to gain traction on Ethereum.

Since then, Uniswap has been the most popular by a significant margin. Uniswap processed a weekly trading volume of over $10 billion as of April 2021.

According to Zycrypto, Uniswap's decentralized exchange contains USD 5.19b, making it the second-largest DEX in the crypto industry. Uniswap's TVL-backed UNI coin is now ranked 7th as a trending crypto coin. There has been a good surge in sales for Uni coin holders.

There are 700k UNI coins, meaning that exchanges went around 7.5 million USD in UNI trades and swaps. In the future, this will significantly impact the direction of the UNI coin.

PricePrediction.net predicts a moderate uptrend in the short term, reaching $6.09 by 2022 and $9.02 by 2023. According to the site, the coin will surpass $40 in 2028 and continue to grow.

According to DigitalCoinPrice, the UNI coin price will be $7.20 in 2022. In one year, the coin will reach a maximum of $8.62; in five years, it will average $12.54. In 2025, UNI coin prices will average $10.57.

Some of the potential advantages of decentralized exchanges like Uniswap include:

- Funds are never transferred to any third party or are generally subject to counterparty risk.

- Participation is open to anyone with a smartphone and an internet connection.

- Users don't have to register or provide personal information.

Aave (Ethereum)

Aave is a decentralized lending protocol that was first launched in 2017, powered by Ethereum. Anyone with access to the internet can use Aave as a high-yield savings account for cryptocurrencies and stablecoins. You can take out loans without credit approval. Aave uses cryptocurrency as collateral instead of credit to guarantee loans will be repaid. Crypto will be sold if a user defaults on their loan. The uniqueness of Aave is that its interest rates are determined by the utilization rate of the liquidity pool.

Aave currently has over $10 billion of total value locked, making it the largest DeFi program with the most value locked.

As of March 16, 2022, Aave's TVL (Total Value Locked) is worth 11.6 billion dollars. Aave's bullish price movement in 2021 demonstrated its crypto potential. Aave reached its all-time high of 666.86 USD per token in May 2021. The actual price stayed around 81.28 USD per token for the rest of the year.

Tamadoge (Ethereum)

Tamadoge is a play-to-earn (P2E) game meme crypto that offers real-world utility, Metaverse gaming experiences, and NFT technology, all in one ecosystem. Gamers can earn TAMA tokens by breeding, training, caring for, and fighting Tamadoge pets in this game.

The current Dogecoin value is around $0.13. Based on well research analysts, it is expected by 2023, the price will double for the Doge token and be worth at least $0.23. By the end of 2025, the coin should be worth at least $0.54. However, it isn't very easy to predict the future of Dogecoin. Also, Dogecoin is no longer the only meme coin out there. Tamadoge could provide a viable alternative.

Tamadoge's native token, TAMA, is going through a presale phase, during which enthusiasts can purchase one TAMA for $0.01. Projected that the highest profit will be more than 10 times when judged based on the common fact that the value of a fellow meme coin, Dogecoin, increased by 12,000% between January 2021 and May 2021. Moreover, those who have TAMA tokens in their portfolios by the end of the presale will have a chance to win $100,000 in the project’s official giveaway.

Ardana (Cardano)

Ardana is on Cardano running an all-in-one DeFi project that will build products around its stablecoin dUSD. AMM DEX and DUSD lending services are the two main products offered by the platform. Ardana's mission is to facilitate foreign exchange on the Cardano blockchain.

Ardana's DANA token allows its holders to receive a proportional share of the platform's fees. Additionally, they can participate in the Ardana governance to vote on parameter changes.

Remarkably, the Ardana team comprises technical talent from reputable companies and blockchain projects such as Apple, Microsoft, Barclays, the Central Bank of Jordan, Jane Street, Mina Protocol, Cardano, the Plutus Pioneers Program, and Emurgo Academy.

Meld (Cardano)

MELD is a decentralized, trustless lending protocol based on the Cardano Blockchain and governed by smart contracts. With this project, anyone can get instant cash loans using their crypto assets, while investors can leverage their fiat investments for better returns. Further, MELD offers a range of products, such as MELD debit cards, which can be used to open a line of credit against crypto investments.

Meld is a DeFi protocol similar to Aave on Ethereum, making it possible to lend and borrow tokens on Cardano.

Currently, the project has a total of 4,000,000,000 tokens. And the actual price is over $0.026 per MELD.

According to PricePrediction algorithmic procedure followed by technical analysis and prediction, in 2022, Meland.ai's minimum expected price will be $0.000388, while the average price will fall around $0.000485. In 2023 this cryptocurrency will achieve a price of $0.000906. The Meland.ai price prediction for 2030 states that Meland.ai will start another decade at a maximum price of $0.003171, while the minimum price would be around $0.002977. The average price for the cryptocurrency is $0.003074.

Kusama (Polkadot)

The Kusama network describes itself as scalable and multichain for radical innovation. In 2019, Kusama Network (KSM) started as a “canary network” or testing polygon for the Polkadot projects, testing new features before releasing them on Polkadot. It offers developers cost-efficiency, speedy iterations, and access to next-generation technology.

KSM is a PoS cryptocurrency. KSM tokens are distributed in exchange for validating transactions via the staking process. To stand a chance of being chosen to validate a new block, staking involves depositing a certain amount of KSM into a smart contract. KSM is an inflationary asset with an inflation rate of 10% per year.

There are currently 8.47 million KSM in circulation, priced at $45.52, giving a market capitalization of almost $390.78M. KSM ranks at number 76 on the crypto charts. The KSM price prediction target given by DigitalCoinPrice is $63.92 for December. The site forecasts a yearly average of $79.83 for 2023, $84.62 for 2024, and $106.46 for 2025.

Moonbeam (Polkadot)

Moonbeam was another project the blockchain community looked forward to testing and exploring in 2021. This project offers compatibility between the Ethereum network and Polkadot, thus advancing scalability and cross-chain integration. With the Substrate-based API integration, the solution simplifies dApp deployments and offers various tools that Ethereum users use. In this way, Moonbeam provides a bridge between two blockchain solutions and combines Polkadot's robust performance with Ethereum's user-friendliness.

Moonbeam became the first fully operational parachain on Polkadot, with more than 80 deployed projects in the Moonbeam ecosystem.

GLMR has a strong zone at $9.65. If it can move up because most interoperability projects are moving up right now, it can stay above this resistance and flip it to support, we could start seeing a move towards $11.47, $13.08, and $15.96.

The token was first traded on 11 January 2022, when the price was $11.00. It spiked dramatically and freakishly, shooting up nearly 4,000% to hit $437.07. According to CryptoPredictions.com, next year, tokens will trade from $1.06 to $1.80. By 2026, it should reach around $2.75 after closing at under $2.53 in 2025.

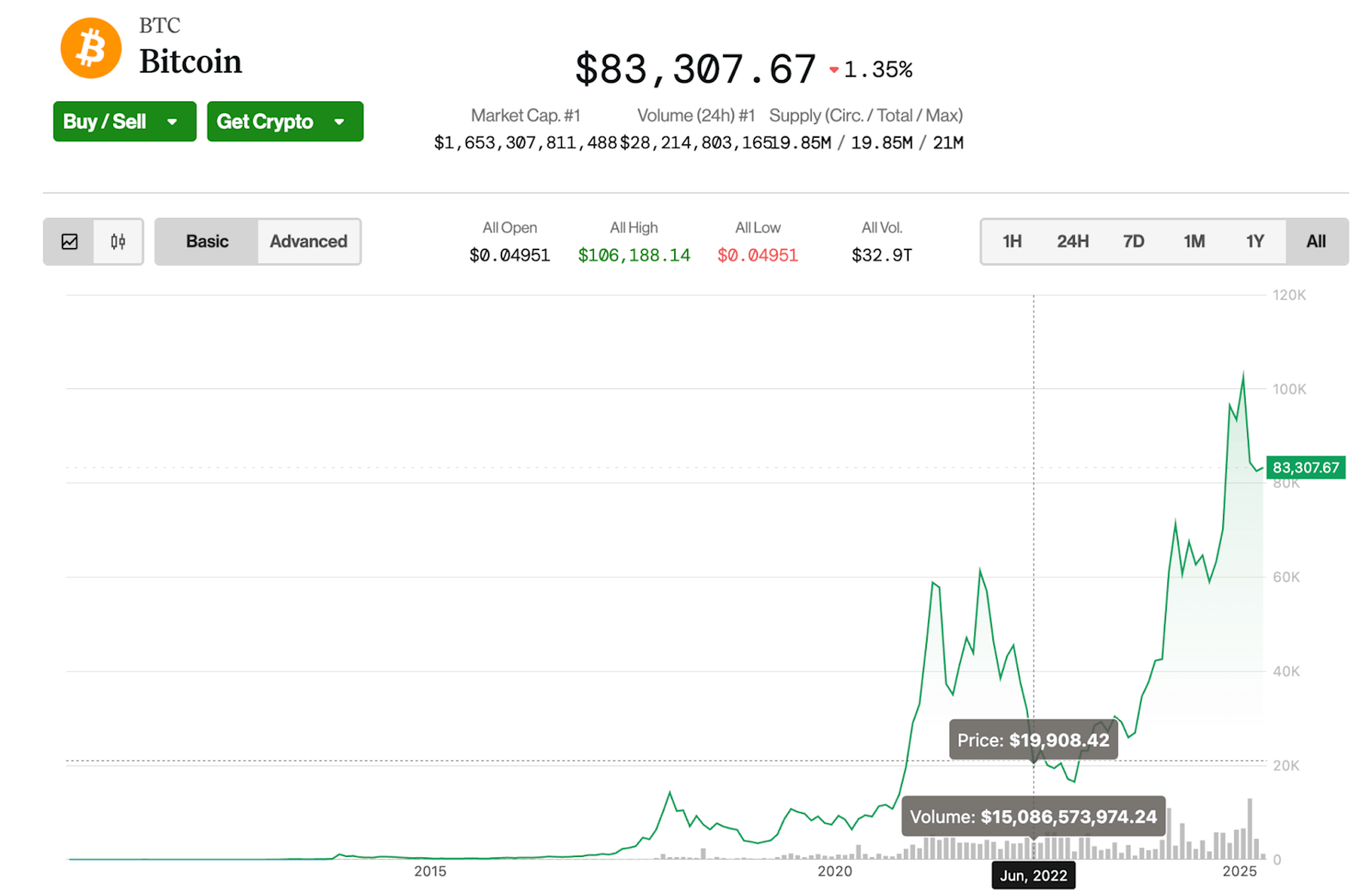

Crypto winter explained: How the crypto industry is rebuilding post-winter

Crypto winter is a term used to describe prolonged downturns in the digital asset market, characterized by low investor confidence, falling prices, and reduced activity across the ecosystem. While the term has no strict definition, it is widely used to describe bearish cycles in the cryptocurrency industry.

There have been several crypto winters in the past. Between late 2017 and December 2020, crypto prices fell and hovered far below their prior peaks. In December 2020, however, prices exploded to record highs due to a significant crypto bull market.

The most recent and notable example is the 2022–2023 crypto winter, which lasted around 18 months and was deeper and more complex than previous cycles. Unlike earlier downturns, it was shaped by both external macroeconomic factors and internal failures within the crypto ecosystem.

The 2022-2023 crypto winter had more comprehensive causes than previous downturns:

- Industry collapses — Major failures of crypto institutions like FTX, Celsius, and Terra/Luna caused cascading effects throughout the ecosystem.

- Regulatory scrutiny — Increased regulatory focus from global authorities, with more defined frameworks emerging in many jurisdictions.

- Institutional involvement — Unlike previous cycles, many institutions maintained positions despite the downturn, providing some market stability.

- Macroeconomic pressures — High inflation, interest rate hikes by central banks, and recession fears affected all financial markets, not just crypto.

- Increased correlation — Crypto showed higher correlation with traditional equity markets than in previous cycles, reflecting greater institutional participation

As of March 2025, Bitcoin is trading at approximately $62,000, while Ethereum is around $3,200. This represents a significant recovery from the depths of the 2022-2023 crypto winter, when Bitcoin fell below $16,000 in late 2022. While still below their all-time highs of $69,044 for Bitcoin (November 2021) and $4,878 for Ethereum, the market has substantially rebounded.

The recovery phase

The recovery of the cryptocurrency market has been driven by several pivotal developments, each contributing to renewed investor confidence and broader adoption across industries:

Bitcoin ETF approvals

One of the most significant milestones was the approval of spot Bitcoin Exchange-Traded Funds (ETFs) in early 2024. These approvals marked a turning point by allowing institutional investors easier and more regulated access to Bitcoin through traditional financial markets. As a result, substantial institutional capital began flowing into the crypto space, reinforcing Bitcoin's legitimacy as a long-term investment asset and fueling renewed interest across the entire digital asset ecosystem.

Technical advancements

Despite the challenges of the bear market, development within the crypto ecosystem—especially on Ethereum—continued to push forward. The implementation and adoption of layer-2 scaling solutions, such as rollups, significantly improved network throughput and reduced transaction costs. Additionally, ongoing progress on Ethereum's roadmap toward greater decentralization, scalability, and sustainability signaled a maturing infrastructure ready to support mainstream use cases.

Mainstream integration

Major financial institutions, technology companies, and even governments maintained their commitment to building blockchain-based infrastructure. Initiatives ranging from tokenized assets and digital identity systems to payment networks and supply chain solutions demonstrated a growing belief in the long-term value of decentralized technologies. This persistent development during the downturn laid the foundation for a more robust and interconnected Web3 ecosystem.

Regulatory clarity

A clearer regulatory landscape also played a crucial role in stabilizing the market. Key jurisdictions—including the U.S., the EU, and parts of Asia—began to define more transparent and structured regulatory frameworks for digital assets. These developments reduced uncertainty and risk for investors, startups, and institutions alike, creating a more secure environment for innovation and capital deployment.

Summary

So here, we compared the four largest cryptocurrencies in the market – Ethereum vs. Solana vs. Cardano vs. Polkadot. Where Ethereum is by far the second-largest cryptocurrency in the market, and the other three are "Ethereum killers." All of them have pros and cons that users and developers have been complaining about. But all of them are different from each other and respond to various investor inquiries.

Analysts generally believe that Ethereum will succeed after a new update, but it should be taken into account that its rivalries will slowly occupy its market shares. Hundreds of blockchain projects out there claim to outperform Ethereum, and Solana, Cardano, and Polkadot are only some of them.

If you are interested in this sphere, don't miss the opportunity. As you see in startups' examples – you can release all ideas. There might not be a better time to act than now if you have an idea for a software product. Because blockchain technology moves rapidly with emerging new platforms, new features, and new releases, ambitious enterprises strive to take advantage of its disruptive potential.

You can check our blockchain development services and contact us if you want to develop your own blockchain startup.