The rise of blockchain technology and cryptocurrency has pushed the boundaries of the industry of finance, creating an alternative to the traditional financial markets. In addition to the long-established securities, such as stocks and bonds, people can now trade crypto and perform other transactions using smart contracts.

The venue for such transactions is a decentralized platform. These platforms give users control over their crypto wallets and the freedom to lend, borrow, or trade their assets as they desire.

Just like any other service, decentralized platforms need promotion. In this post, we’ll consider a way to popularize them by using the example of a real-life project. But first, let’s delve into blockchain, decentralized finance, and other relevant topics.

Blockchain, smart contracts, crypto: sorting things out

First things first, so before we turn to the main subject of the article, we suggest looking at the basic notions that decentralized platforms deal with. Here they are:

Blockchain

Blockchain is a general term for a technology aimed at organizing, managing, and storing data. In a blockchain, data is kept in blocks connected one by one chronologically. Each block has a specific storage capacity and contains information about the previous block, such as transaction details and a hash—a unique cryptographic code that allows for tracking any changes made to the block.

Blockchain is a decentralized technology that enables users to access, manage, and share information from anywhere in the world. So it’s also referred to as Distributed Ledger Technology (DLT). The blocks in the chain are arranged as nodes in a peer-to-peer network that have equal capabilities and do not depend on a central server. The main advantages of blockchain technology include the following:

Smart contract

Just like a printed contract, a smart contract is used to fix the terms of a transaction between the participants. But unlike a written agreement, a smart contract is a software program, so all the processes here are automated. The participants don’t need to control the execution of the contract, track the transactions, and involve third-party experts.

Smart contracts, also called transaction protocols, can be concluded between anonymous parties and can stipulate all the conditions, requirements, and workflows necessary to complete the transaction. Blockchain-based smart contracts are decentralized applications, so the information about the transaction is stored in each node of the network. Once the contract is deployed on a blockchain, it cannot be amended or annulled. Smart contracts offer the following benefits to the users:

Cryptocurrency

Simply put, cryptocurrency is digital money that you can use to perform transactions online. The security of these transactions is ensured by encryption algorithms, and the history of transactions is kept in a digital ledger. Being powered by blockchain technology, cryptocurrency allows for decentralized transactions based on the peer-to-peer model. That means the transactions are possible between any crypto holders.

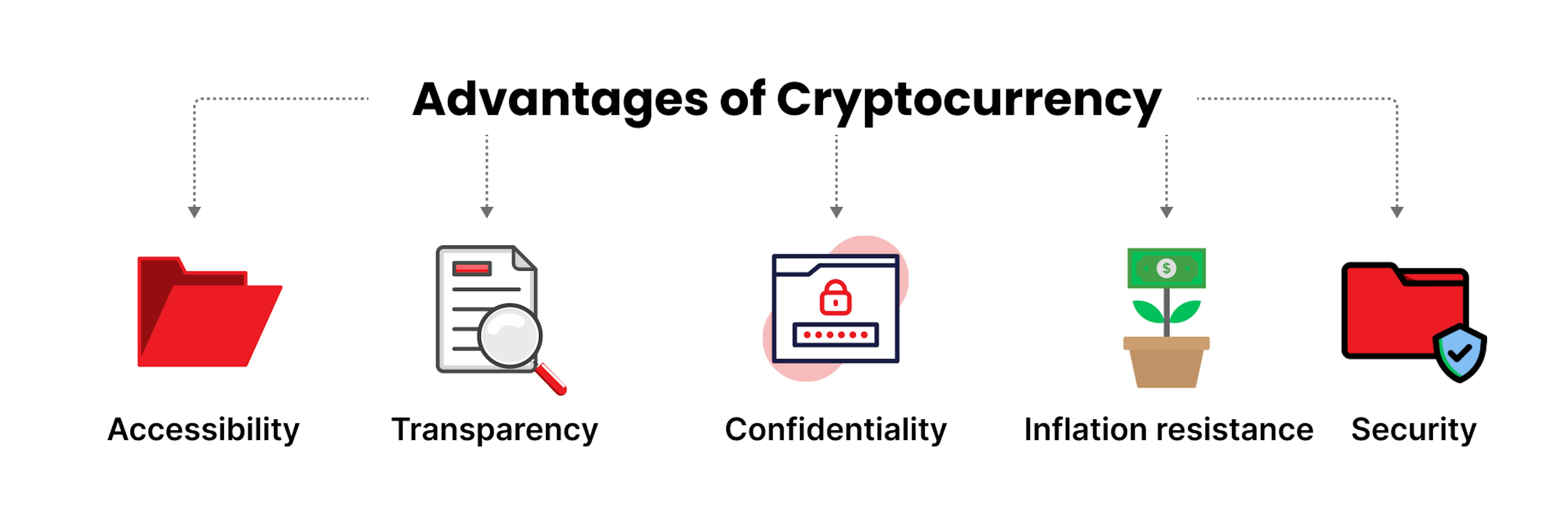

Each crypto holder has a wallet with public and private keys. The keys give access to the cryptocurrency stored on the blockchain and enable their owners to perform transactions using the currency. Crypto coins are generated during the so-called mining process, which involves the solution of complicated computational tasks. Among the most well-known cryptocurrencies are Bitcoin, Ethereum, Binance Coin, Dogecoin, and Tether. Crypto’s strengths comprise:

What is DeFi?

Decentralized finance or DeFi is an ecosystem of applications, platforms, and technologies enabling financial operations with no intermediaries involved. In other words, DeFi is an autonomous system that is independent of banks, exchanges, and other financial institutions. The key features of DeFi include:

- Blockchain. The technology makes the system decentralized and allows users to interact with each other directly and anonymously.

- Smart contract. Agreements fixed in smart contracts help users conduct transactions automatically and securely.

- Cryptocurrency. Crypto serves as a medium of exchange intended to perform financial operations.

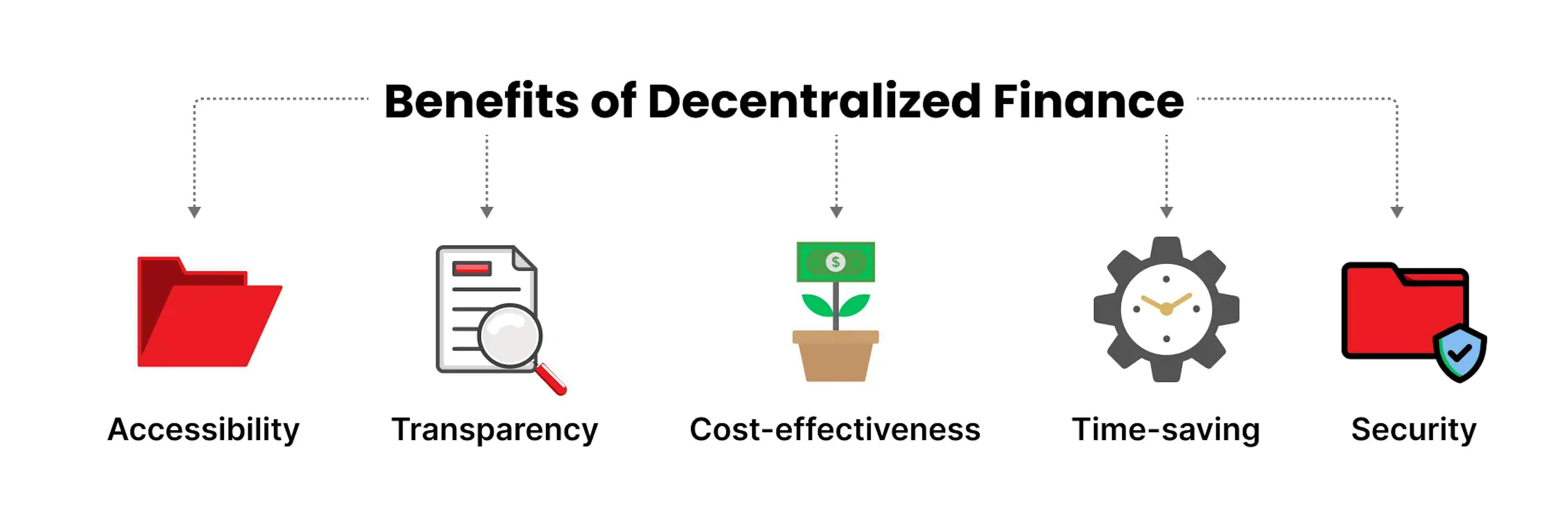

In October 2021, the value of assets used in decentralized finance reached $100 billion. The following advantages make DeFi a viable alternative to the traditional financial system:

What DeFi platforms offer?

Decentralized platforms set the stage for DeFi transactions. Here, people can perform a variety of operations with digital funds, among which are:

- Lending and borrowing

- Exchanging

- Trading

- Earning interest

- Insuring

Decentralized platforms rely on blockchain networks, such as Ethereum—an open-source technology with its own smart contracts and crypto called ether (ETH), which lays the ground for DeFi transactions. For example, users of Ethereum-based decentralized exchanges (DEXs) can buy, sell, and trade crypto assets without any intermediaries.

DeFi has a set of rules regulating activities that take place on the blockchain. These rules are specified in protocols created by developers and other blockchain contributors. The same protocols can be used across different networks. DeFi platforms and applications tap into blockchain protocols to establish their workflows. For example, lending platforms utilize lending protocols so that users could earn interest while DEXs can apply aggregation protocols to optimize trades. With the help of liquidity protocols, DeFi exchanges can incentivize users to receive extra rewards by staking their tokens.

DeFi platforms provide for transactions with different types of cryptocurrencies, such as a coin, for example, Bitcoin, and a stablecoin, as Tether. The latter is non-volatile as its value is tied to an external asset.

A token is another kind of crypto asset used in decentralized finance to meet the purposes of a particular project or ecosystem. Thus, each DeFi platform or blockchain network can issue its own tokens to perform operations within the ecosystem. There can be:

- Utility tokens (grant access to the platform or network, making its products and services available to the user)

- Security tokens (represent the ownership of the token holder and can be used as investments)

- Governance tokens (enable users to manage the project and make core decisions about the blockchain protocol by voting)

About the DeFi platform types

Lending and borrowing

DeFi platforms that facilitate lending and borrowing allow users to lend and borrow digital assets, such as cryptocurrencies, to and from one another. These platforms use smart contracts to automate the process and enforce the terms of the loans. The loans may be for a fixed term or may be more flexible and open-ended.

Exchanging

DeFi exchange platforms enable users to trade cryptocurrencies and other digital assets. These platforms use smart contracts to facilitate the exchange process and ensure the security and transparency of the trades. DeFi exchanges may offer a wide range of trading pairs or may focus on a specific asset or market. Some DeFi exchanges also offer additional features, such as margin trading, which allows users to trade with leverage.

Trading

DeFi trading platforms allow users to buy and sell various financial instruments, including cryptocurrencies, futures, options, and other derivatives. These platforms use smart contracts to facilitate the trading process and ensure the security and transparency of the trades. DeFi trading platforms may offer advanced features such as margin trading and tools and resources to help users make informed trading decisions.

Earning Interest

DeFi platforms that enable users to earn interest on their digital assets typically do so by pooling the assets of multiple users and investing them in various financial instruments. These platforms use smart contracts to facilitate the investment process and ensure the security and transparency of the investments. Some DeFi platforms that allow users to earn interest also offer additional features such as staking, which rewards users for holding certain cryptocurrencies.

Insuring

DeFi insurance platforms allow users to purchase insurance coverage for their digital assets. These platforms use smart contracts to facilitate the insurance process and ensure the security and transparency of the coverage. DeFi insurance platforms may offer coverage for a wide range of risks or focus on specific assets or risks. They can help users protect their assets against losses due to various risks, such as theft, fraud, or market volatility.

Choosing a DeFi platform

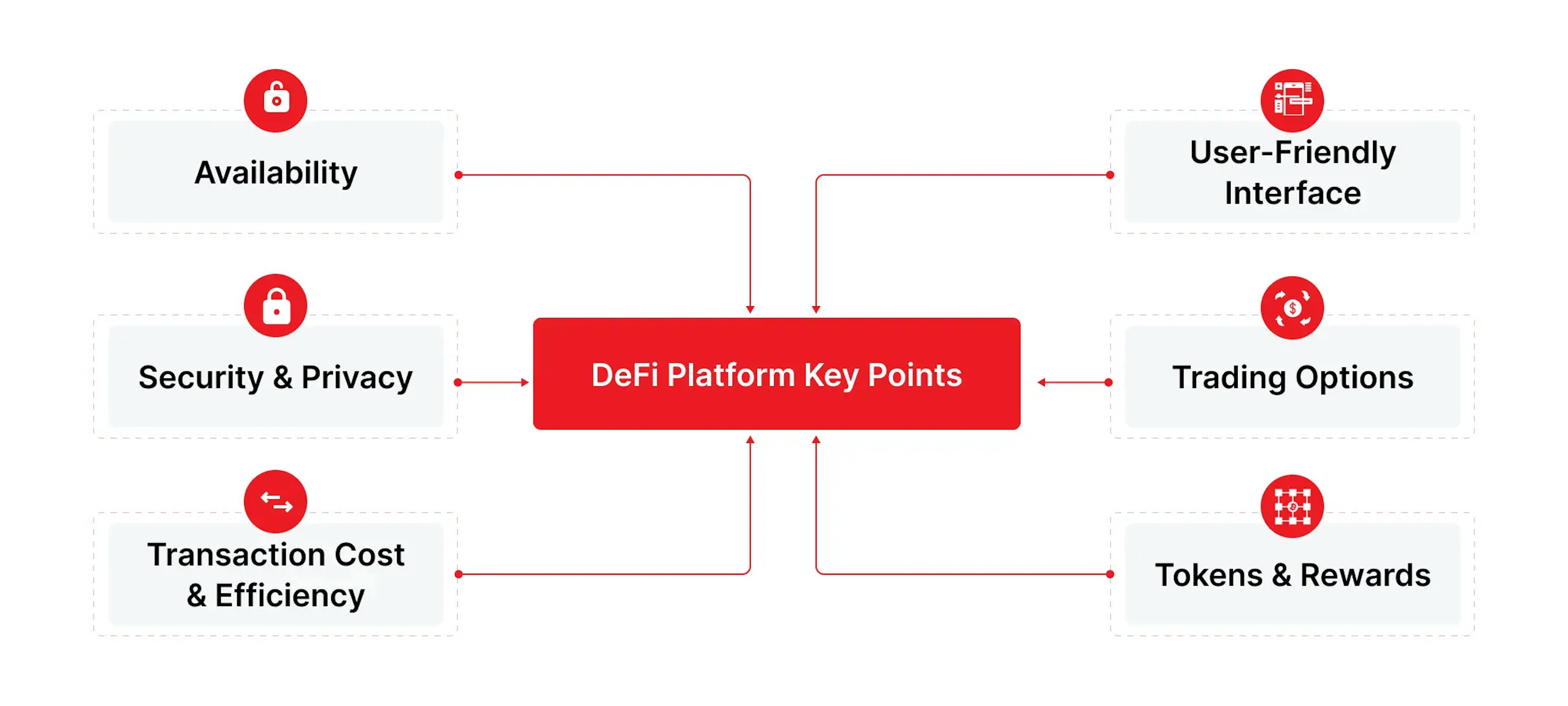

When choosing a decentralized finance platform, paying attention to several key points is essential to ensure that you are making an informed and well-informed decision. Some of the key things to consider when choosing a DeFi platform include the following:

- Regulations: It is important to ensure that the DeFi platform adheres to relevant regulatory requirements, as this can impact the security and reliability of the platform. This is especially important for decentralized finance startups, as they often operate in a legal grey area. Look for platforms that have taken steps to comply with relevant regulations, such as obtaining necessary licenses or permits.

- Security & Privacy: DeFi platforms should prioritize security and privacy as they handle sensitive financial information and transactions. Look for platforms with strong security measures, such as secure infrastructure, advanced encryption techniques, and robust authentication protocols. It is also important to consider the platform's privacy policies, as some DeFi platforms may collect and share user data without proper consent.

- Transaction Cost & Efficiency: DeFi platforms should offer low transaction costs and high efficiency to ensure that users can easily and cheaply access the platform's services. This is especially important for the young decentralized exchange platforms, as high transaction costs can discourage users from using the platform. Look for platforms that have optimized their infrastructure to minimize transaction costs and reduce latency.

- User-Friendly Interface: A user-friendly interface is essential for DeFi platforms, as it allows users to navigate and use the platform's finance features easily. This is especially important for decentralized web applications, as they often have complex functionality that can be difficult for non-technical users to understand. Look for platforms with intuitive interfaces and helpful resources, such as tutorials or user guides.

- Trading Options: DeFi platforms should offer a wide range of trading options, such as trading multiple cryptocurrencies and other assets. This can be especially important for decentralized exchange app development, as users will expect to be able to trade a variety of assets on one platform. Look for platforms that offer a wide range of trading pairs and allow users to access liquidity easily.

- Tokens & Rewards: Many DeFi platforms offer tokens or rewards to incentivize users to use their services. It is important to consider the value and potential of these tokens or rewards when choosing a DeFi platform. Look for platforms that offer tokens or rewards that have real value and can be traded or used on the platform.

In addition to these points, it is also important to consider factors such as the track record and reputation of the DeFi platform, as well as the team behind it. It may also be helpful to consider decentralized exchange software development services or decentralized app development services if you are looking to create your own DeFi platform or decentralized application.

We at Mad Devs have extensive development experience in the DeFi industry, which we are always happy to share. For example, we have a great in-depth article dedicated to Building Your Own DeFi Company: List of the Best 9 Analytics Tools. We highly recommend you get it!

DeFi platforms to look for at 2023

The cryptocurrency market has been badly shaken, some decentralized platforms have been found unscrupulous, and the imperfection of technology has become evident. Therefore, trust in the entire DeFi industry has been damaged, and shares of all companies, even the top ones with strong technological solutions and reputational positions, have plummeted. However, decentralized technology remains a necessary step toward a better future, even if we stumble along the way. The serious players keep improving their solutions, and they will rehabilitate their positions sooner or later.

You can read more about top decentralized platforms, which have captured huge market share and provide extensive functionality, in our article White Label Cryptocurrency Exchange Software.

This time we decided to pay attention to something else, conducting in-depth research, considering a lot of user ratings and reviews from various sources to compile a list of decentralized platforms that, even in such a market situation, have potential and inspire trust. After all, it is up to the new players to re-inspire new users, investors, and developers.

Nexo

Nexo is a decentralized finance (DeFi) platform that allows users to earn interest on their cryptocurrency by depositing it into a Nexo account. It is built on top of the Ethereum blockchain and utilizes smart contracts to facilitate the lending and borrowing of cryptocurrency.

Some of the key features of Nexo:

- Earn interest on cryptocurrency: Users can earn interest on their cryptocurrency by depositing it into a Nexo account. The interest rates offered by Nexo are competitive and are often higher than those offered by traditional financial institutions.

- Instant access to credit: Users can borrow against their deposited cryptocurrency using Nexo's instant credit line feature. This allows users to access credit without having to sell their cryptocurrency.

- Multiple currencies accepted: Nexo supports many cryptocurrencies, including Bitcoin, Ethereum, Binance Coin, and more.

- Multiple borrowing options: Nexo offers multiple borrowing options, including fixed-term loans and credit lines.

- Mobile app: Nexo has a mobile app that allows users to manage their accounts and access credit on the go.

Some pros of using Nexo:

- High-interest rates: Nexo offers competitive interest rates on deposited cryptocurrency, making it an attractive option for users looking to earn interest.

- Multiple borrowing options: Nexo offers multiple borrowing options, including fixed-term loans and credit lines, which allows users to choose the option that best fits their needs.

- Mobile app: Nexo has a mobile app that allows users to manage their accounts and access credit on the go.

Some cons of using Nexo:

- Limited privacy: Nexo requires users to provide personal information and undergo a KYC (Know Your Customer) process, which may not be appealing to users who value privacy.

- Risk of loss: As with any investment, there is a risk of loss even when using Nexo. Users should be aware of this risk and carefully consider their investment decisions.

Nexo has a strong reputation in the DeFi space and is widely used to earn cryptocurrency interest. Some of its biggest competitors include Compound, Celsius, and BlockFi.

DeFi Swap

DeFi Swap is a decentralized exchange (DEX) that allows users to exchange cryptocurrency and other digital assets securely and transparently. It is built on top of the Ethereum blockchain and utilizes smart contracts to facilitate the trading of assets.

Some of the key features of DeFi Swap include:

- Multiple asset support: DeFi Swap supports a wide range of assets, including cryptocurrency, stablecoins, and non-fungible tokens (NFTs).

- Low fees: DeFi Swap charges low fees for trades, which makes it an attractive option for users looking to minimize trading costs.

- Easy to use: DeFi Swap has a user-friendly interface that makes it easy for users to trade assets.

Some pros of using DeFi Swap:

- Decentralized trading: DeFi Swap's decentralized nature makes it more secure and transparent than centralized exchanges.

- Multiple asset support: DeFi Swap supports a wide range of assets, which makes it a versatile platform for traders.

- Low fees: DeFi Swap charges low fees for trades, which makes it an attractive option for users looking to minimize trading costs.

Some cons of using DeFi Swap:

- Limited liquidity: As a relatively new platform, DeFi Swap may have lower liquidity than established exchanges, making it more difficult to trade certain assets.

- Lack of regulation: As a decentralized exchange, DeFi Swap is not subject to the same regulatory oversight as centralized exchanges. This can make it more vulnerable to scams and fraud.

- Limited customer support: As a decentralized exchange, DeFi Swap may have limited customer support compared to centralized exchanges. This could make it more difficult for users to get help with issues or resolve disputes.

DeFi Swap has a growing reputation in the DeFi space and is widely used for trading cryptocurrency and other digital assets. Some of its biggest competitors include Uniswap, Kyber Network, and 0x.

BitGo

BitGo is a digital asset financial services company that offers a range of products and services, including a DeFi insurance platform. The BitGo DeFi insurance platform is designed to cover smart contract risks in the DeFi space.

Some of the key features of the BitGo:

- Smart contract coverage: The BitGo DeFi insurance platform provides coverage for smart contract risks, including loss or theft of assets, security vulnerabilities, and more.

- Multiple coverage options: The BitGo DeFi insurance platform offers multiple coverage options, including per-asset coverage and aggregated coverage.

- Customized policies: The BitGo DeFi insurance platform offers customized insurance policies tailored to the policyholder's specific needs.

- Experienced team: The BitGo DeFi insurance platform is backed by an experienced team with a track record in the insurance and DeFi industries.

Some pros of using the BitGo:

- Coverage for smart contract risks: The BitGo DeFi insurance platform provides coverage for a wide range of smart contract risks, which can give users peace of mind when participating in DeFi projects.

- Multiple coverage options: The BitGo DeFi insurance platform offers multiple coverage options, which allows users to choose the option that best fits their needs.

- Customized policies: The BitGo DeFi insurance platform offers customized insurance policies that are tailored to the specific needs of the policyholder.

Some cons of using the BitGo:

- Limited coverage: As a relatively new platform, the BitGo DeFi insurance platform may not yet offer coverage for all types of risks in the DeFi space.

- Risk of loss: As with any insurance policy, there is a risk of loss when using the BitGo DeFi insurance platform. Users should be aware of this risk and carefully consider their insurance decisions.

- Dependence on third parties: The BitGo DeFi insurance platform relies on third-party risk assessors to evaluate risks and determine coverage. This could introduce additional risk into the process.

Its DeFi insurance platform is still relatively new, and its market position may be less established compared to more established DeFi insurance platforms like Nexus Mutual and Etherisc.

DeFi's capabilities help to create more and more exciting solutions. One unusual but exciting project for you could be CryptoMarry. Unlike decentralized platforms and organizations that focus on improving the individual asset ownership experience, CryptoMarry focuses on close people, offering many features for more transparent budgeting and joint decision-making using crypto assets. We highly recommend you read more about it.

How to build your own DeFi platform?

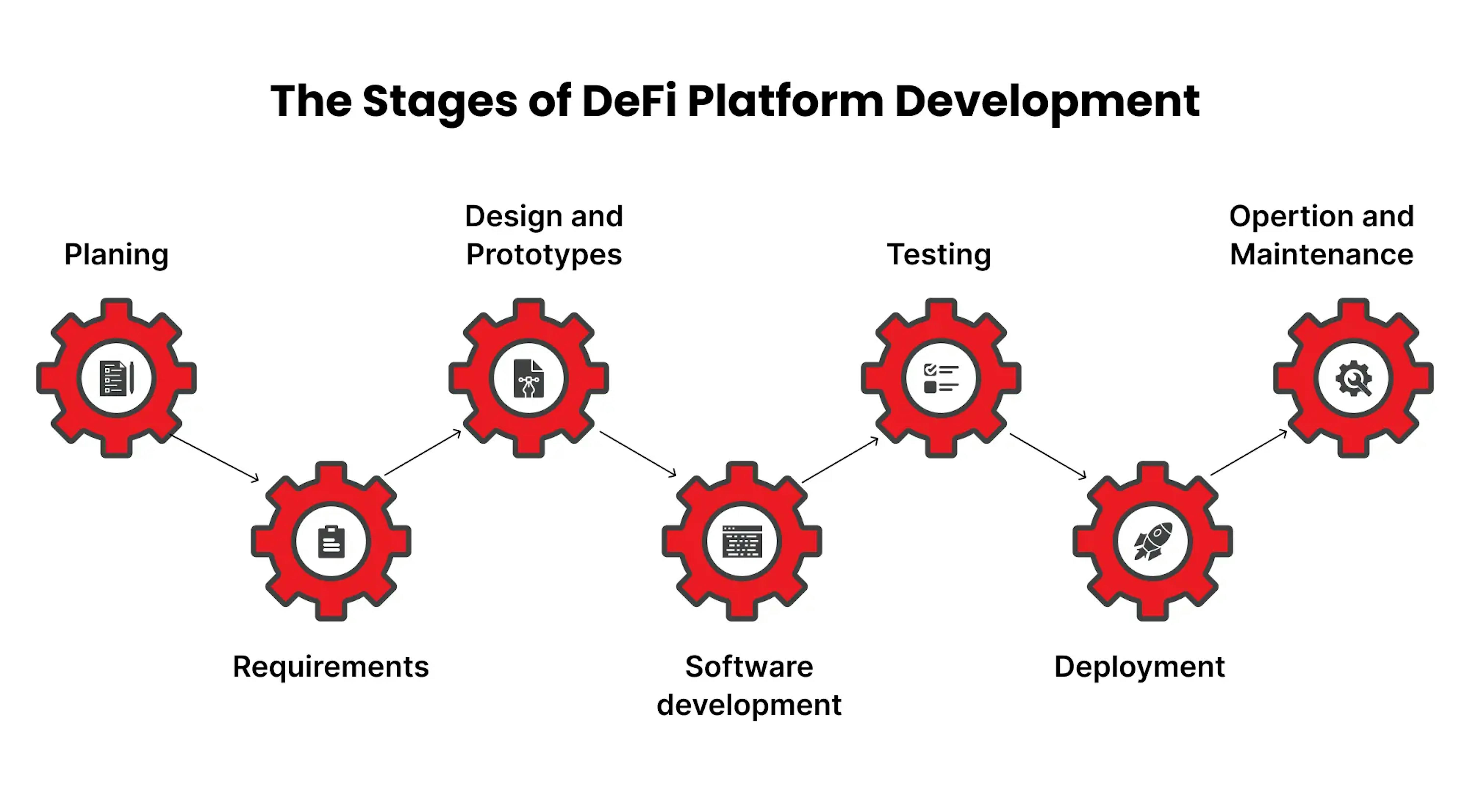

Product discovery

In this phase of the DeFi development process, you will conduct market research to identify trends and opportunities for new features and improvements in the decentralized finance space. You will also need to choose the blockchain technology that aligns with your business goals and objectives. Some popular blockchain options for DeFi include Ethereum, EOS, Cardano, and TRON, and you should consider whether open-source libraries are available for your chosen platform.

Architecture and infrastructure planning

This phase involves designing the technical architecture and infrastructure of your DeFi application. This includes selecting the technology stack, such as the programming languages and frameworks to be used, and determining which components will be included and how they will work together. It also involves setting up servers and databases to store and process the data required by your app. For example, you may need to choose between a relational database like MySQL and a non-relational database like MongoDB based on the needs of your application.

Backend active development

During this stage, you will focus on building the back end of your DeFi app, including implementing core functionality and integrating with external APIs and services like the possibility of connecting to other platforms, wallets, etc. This involves writing smart contracts, implementing algorithms and logic to handle complex processes such as trade execution, and integrating with external APIs to retrieve real-time data or facilitate fund transfers.

Frontend development

This phase involves creating the user interface for your DeFi app, including developing HTML, CSS, and JavaScript code to present information and functionality to users. This may involve using frameworks like React or Angular to create a responsive and interactive user interface and optimize performance and accessibility.

Mobile app development

A mobile version of your DeFi application is essential for user adoption. This phase involves developing the app for iOS and Android devices, including creating a responsive design that adjusts to different screen sizes and resolutions and optimizing the app for performance and security. You may use frameworks like Flutter to create a cross-platform app that can be deployed on multiple platforms with minimal changes.

Quality assurance (QA)

This phase involves testing the DeFi app to ensure it meets requirements, has no bugs or errors, and performs well under different conditions. This can include functional testing, which tests features and functionality to ensure they work as intended, and non-functional testing, which tests performance, security, and reliability. Testing can be done manually or with automated testing tools and frameworks like Jest or Selenium.

Maintenance

After launching your DeFi application, you will need to keep it up-to-date and fix any issues that arise. This will ensure that users can get the most out of their experience with your product. Maintenance tasks may include patching security vulnerabilities, adding new features or functionality, updating the app to work with new versions of the blockchain or other technologies it relies on, monitoring performance, and optimizing as needed. To streamline and automate these tasks, you need to implement a continuous integration/continuous delivery (CI/CD) pipeline using tools like Jenkins or GitLab to automatically build, test, and deploy code changes to the live version of the app, reducing the risk of errors and speeding up the development process.

Never underestimate the importance of testing and supporting your solution, especially in the financial industry. Here, mistakes can lead to the loss of large amounts of users' money and reputational damage that cannot be recovered. We have an article on the Cost of Failure in Smart-Contract Development, which we strongly recommend studying before starting development.

How much does it cost to develop a DeFi platform?

Developing a decentralized finance (DeFi) platform requires a multi-disciplinary team with a range of expertise. Here is a list of roles that you may need to consider when building a DeFi platform:

- Web and mobile developers

- DevOps

- Testers

- UI/UX designers

- Project managers

- Blockchain developers

Such a team, of course, initially requires more expenses than a couple of mobile developers, one tester, and one project manager in a young small startup. Also, any DeFi platform is always more than just an average mobile app, using more technologies for its implementation.

All this greatly expands the potential scope of work, increases requirements for specialists, and complicates a concrete answer regarding cost and deadlines. However, let's try to derive approximate numbers.

- A simple DeFi platform with basic features and functionality may cost between $50,000 and $100,000 and take several months to develop with a team of 3-4 specialists.

- A medium-complexity DeFi platform with more advanced features and functionality may cost between $100,000 and $500,000 and take several months to a year to develop with a team of 5-8 specialists.

- A highly complex DeFi platform with a wide range of advanced features and functionality may cost over $500,000 and take over a year to develop with a team of 10 or more specialists.

However, you can always contact us for a free consultation. We will attentively listen to you, suggest the best solutions regarding the choice of technology and specialists, and at the same time, be the most profitable for your business. There you can also get an accurate and transparent calculation of the necessary resources for the implementation of any project.

A promotion solution for a DEX platform

There has been pretty much hype around blockchain and crypto for quite a while. These topics regularly hit the headlines, just like this one about Dogecoin skyrocketing after Elon Musk said he would accept the cryptocurrency as payment for Tesla vehicles.

The mainstreaming of blockchain has given rise to the proliferation of decentralized finance that makes crypto an accessible medium of exchange and a solid investment for many people worldwide. DeFi platforms are always looking for new ways to advance their services and expand the business.

A decentralized exchange that turned to Mad Devs is one of the largest DeFi platforms with annual investments of $12 million. The DEX unites blockchain protocols to provide the most beneficial, time-saving, and secure DeFi transactions.

The company wanted to promote its products and services, such as a token, wallet, liquidity mining, etc. To achieve this, they were planning to develop a game and present it in a head-turning marketing campaign. One of the options was to embed the game into the digital wallet so that the user spent more time in the app. Also, the client had certain requirements for the game.

Project requirements:

- The game should be both entertaining and play-to-earn.

- It’s necessary to think through the play-to-earn mechanism.

- The game monetization should be implemented in compliance with all applicable laws.

- It’s crucial to prevent the user from registering multiple accounts and earning as a different user.

- The game should have a leaderboard with nicknames and addresses.

- Registration and authentication should be implemented in the app.

- The app should be developed for iOS.

- The web version could be created to use the app on different devices and authorize via the wallet.

But the most critical requirement for the project was the tight timeline—the game was supposed to be developed within just 1.5-2 months.

Mad Devs scrutinized the client’s needs and requirements and offered suggestions on how to implement the project meeting the deadline.

Mad Devs suggestions:

✔ For starters, it was important to set the main goal of the game: whether it should be short-term hype or a long-term play. The latter scenario could give an opportunity to get regular users who earn tokens and pay commissions.

✔ To save time and speed up the launch, it could be preferable to start with the game development, adding monetization later.

✔ As the game concept, we suggested using a 2D pixel art racing game in the style of the 16-bit classics from the ‘80s. This was an achievable task to complete within 1 month or even less, considering that we had an ample widget library.

To sum up

Backed by blockchain technology, smart contracts, and crypto assets, decentralized finance stands a good chance to edge out traditional financial systems and institutions. Direct communications between the parties, no need for intermediaries, and highly automated processes—are just several examples of how DeFi makes transactions easier, faster, and cheaper.

DeFi incorporates platforms and applications that enable people to lend, borrow, trade, and carry out other operations with crypto. Using software development teams' expertise, decentralized platforms can create promotion solutions to attract more users and grow their businesses. By leveraging our knowledge and experience, we at Mad Devs can help you advance your DeFi products and services.