Analyze with AI

Get AI-powered insights from this Mad Devs article:

The world as we know it is rapidly changing and becoming increasingly digital. This shift has touched almost every industry, and banking is no exception. Today, customers expect the same level of convenience and accessibility from financial services as they get from other online services. To meet these demands and stay competitive, banking institutions must embrace digital transformation and the innovations available to the finance industry.

Digital transformation for banks is about more than just updating technology. It's about reimagining how banking is done and creating a more customer-centric experience. One example is the concept of a "neobank," a financial institution that doesn't have physical branches and operates exclusively through mobile and online banking. Another innovation is the emerging use of AI that can review credit applications or predict spending on credit cards to allow banks to create personalized products for their consumers. By embracing digital transformation, banks can streamline operations, enhance security, and provide their customers with the services they need when and where they need them. It's an exciting time to be a part of this industry, and being one, we're happy to share information on the digital transformation in banking and its main trends.

What is digital transformation?

Digital transformation is changing the way businesses operate and interact with customers. Across various industries, companies are adopting new technologies to drive innovation and enhance the customer experience.

For instance, the retail sector has embraced online shopping and mobile commerce, integrating technologies such as AI, Big Data, and IoT to provide personalized shopping experiences and optimized supply chains. The healthcare industry has also undergone significant change, with the widespread use of electronic health records, telemedicine, and wearable devices, allowing healthcare providers to offer more accessible and personalized patient care. Meanwhile, the transportation industry has been disrupted by ride-sharing companies, and the rise of electric vehicles has introduced new business models and technologies like battery-swapping and vehicle-to-grid integration.

So digital transformation enables businesses to create more and more new opportunities, increase efficiency, and improve the customer experience. As technology evolves and customer expectations change, we can see further digital transformation across other industries, such as financial ones.

Digital transformation in financial services

The financial industry is also experiencing a profound transformation because of digitization. New technologies such as blockchain, smart contracts, and more have paved the way for advanced financial solutions shaking up the status quo. These innovative solutions offer a level of efficiency, security, and convenience that is unmatched by traditional banking systems.

So the transformation of the financial industry began with the rise of alternative financial solutions, such as centralized and decentralized crypto exchanges, NFT marketplaces, and many more. Then, traditional financial institutions have seen the full potential and high demand of these new technologies and got the necessary to implement them to stay competitive. This digital transformation is bringing the financial industry to the forefront of a technological revolution and evolving even the most conservative players.

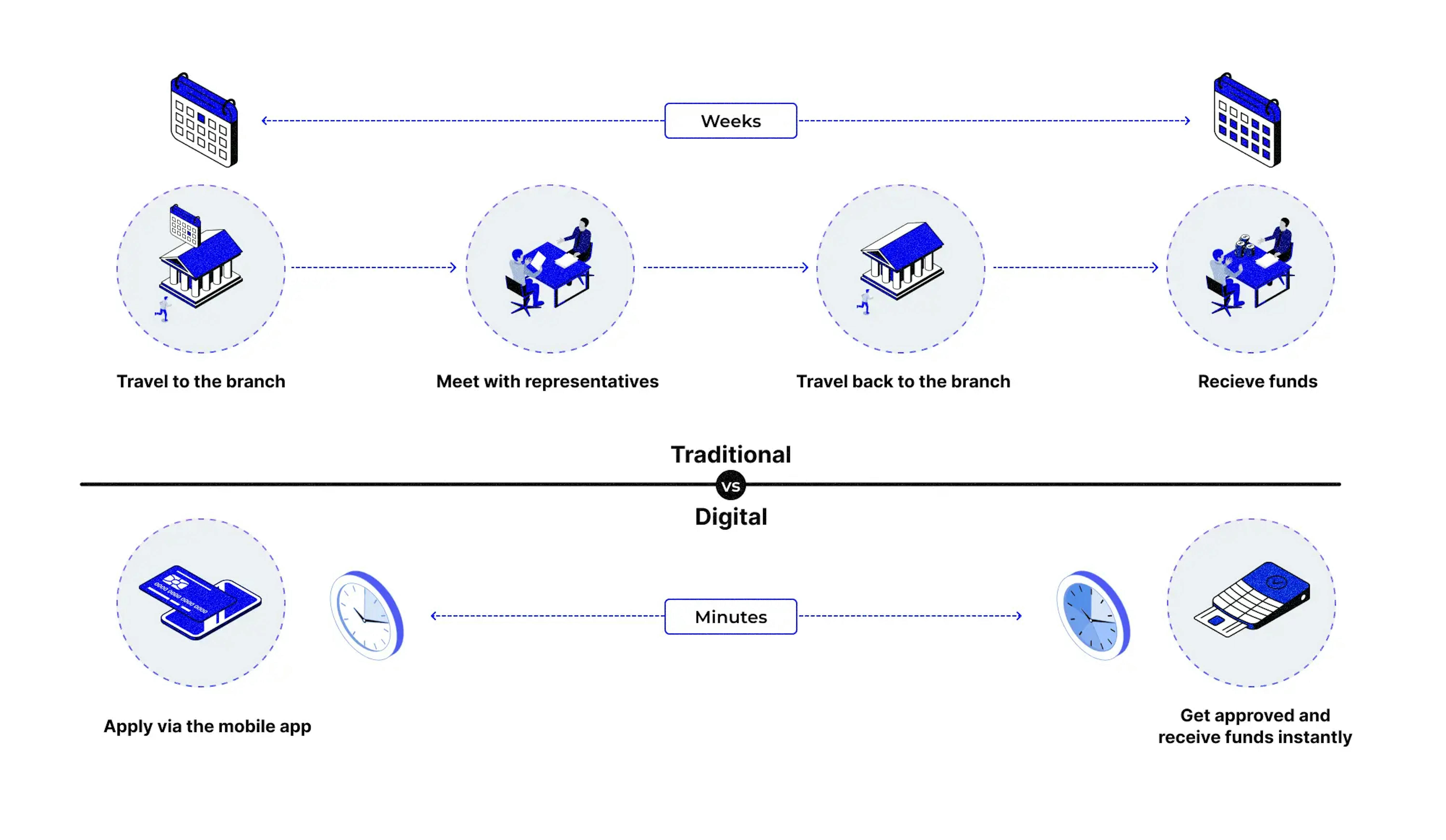

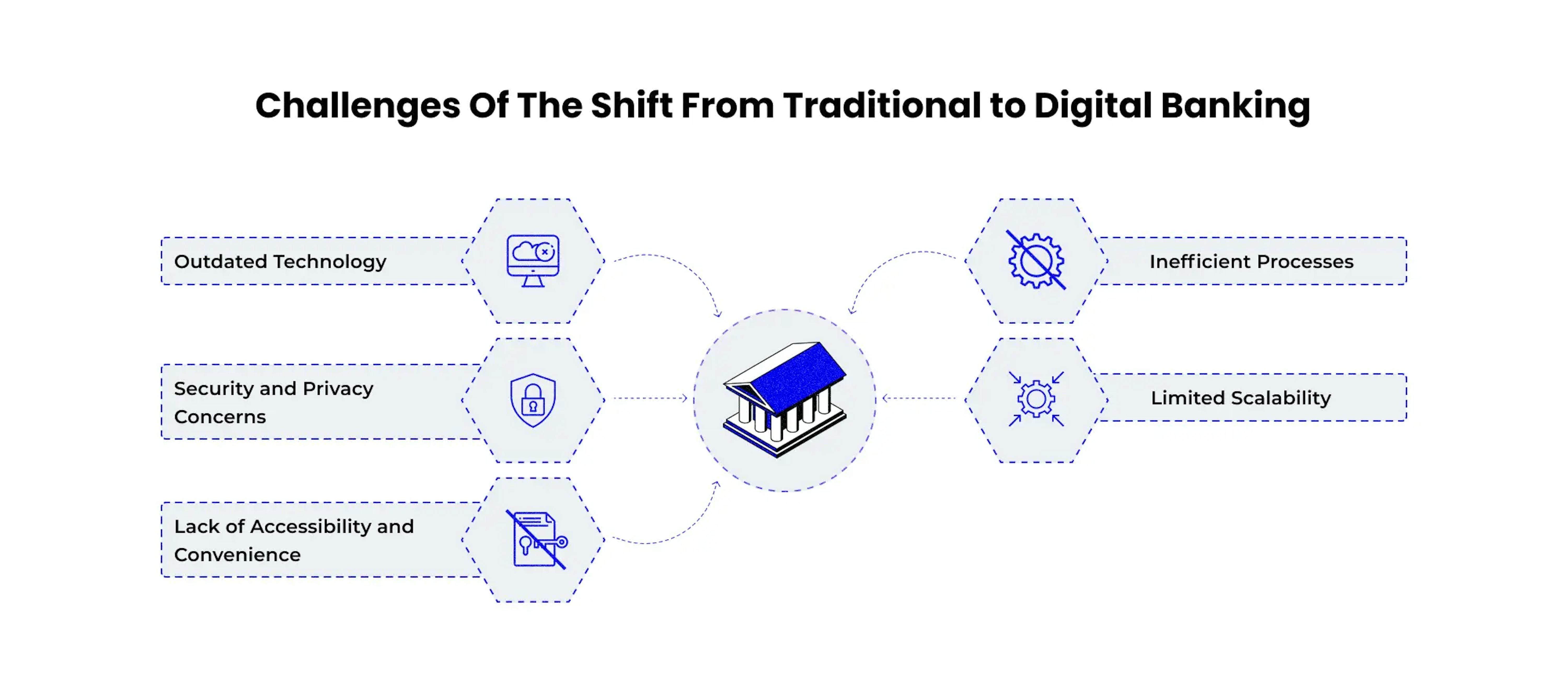

Challenges of the shift from traditional to digital banking

In today's rapidly evolving digital landscape, traditional financial institutions must improve their systems to keep up with customers' demands and remain competitive. Despite the tremendous opportunities, implementing new technology for banks can be challenging. Such challenges include:

- Outdated technology. The technology used by traditional banking systems often needs to be updated and able to keep pace with the innovations of the financial industry. This can lead to a lack of integration with new services, slow development of new features, and limited use of different assets.

- Security and privacy concerns. The security and privacy of customers' financial information and transactions are paramount. However, traditional banking systems can often be vulnerable to cyber-attacks and data breaches, compromising the security of sensitive information.

- Lack of accessibility and convenience. Traditional banking systems are often hindered by their limited accessibility. Many customers need help accessing their accounts and financial information from remote locations. Additionally, the processes involved in accessing financial services can be time-consuming and inconvenient, leading to frustrated customers.

- Inefficient processes. Traditional banking systems are often bogged down by inefficient processes, including long wait times, manual procedures, and a lack of transparency. This can lead to a negative customer experience and increase operational costs for financial institutions.

- Limited scalability. Traditional banking systems often need help to scale operations effectively, leading to increased costs and reduced efficiency. This can also hinder their ability to expand into new markets and offer new services to customers.

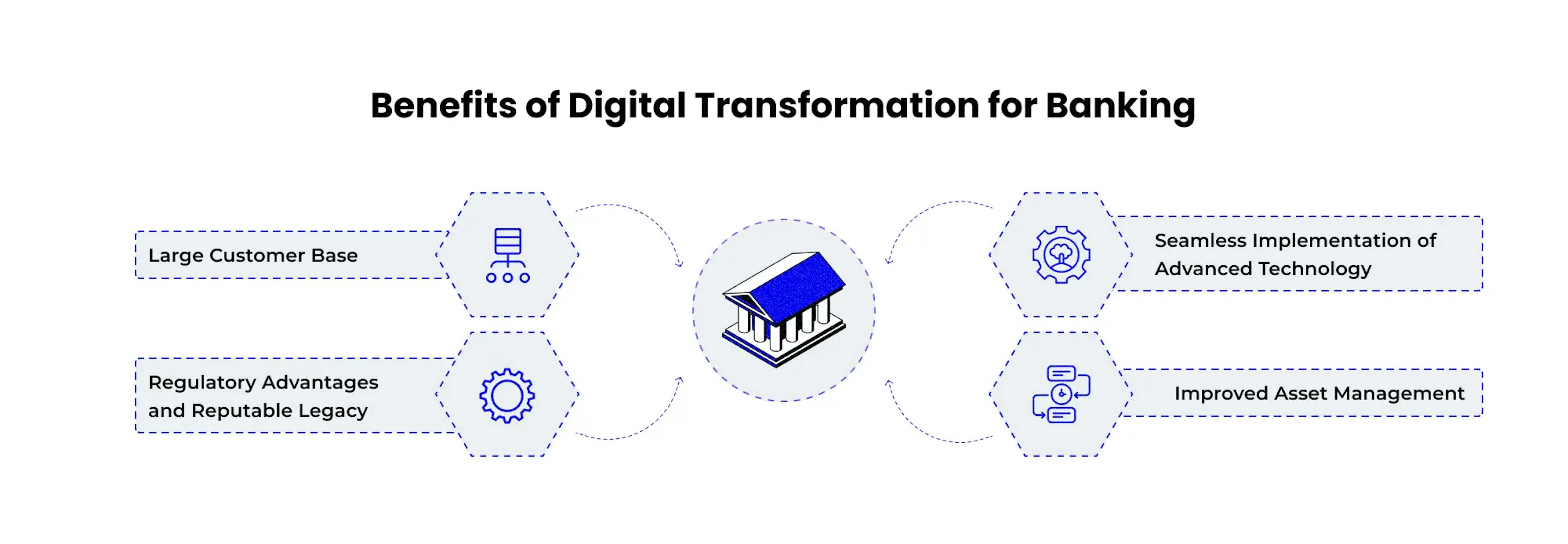

Benefits of digital transformation for banking

But, traditional banks still hold certain advantages when facing the challenges of more advanced digital financial solutions, which, if used properly, can give them many more benefits. One of the main advantages is their long history and established reputation, which follows the next:

- Large customer base. Traditional banks already have a huge user base, a costly and lengthy collection they can afford to avoid. This initially gives them access to a huge amount of data, including extremely sensitive data such as passport information, driver's licenses, insurance, etc. All of this puts traditional banks many steps ahead.

- Regulatory advantages and reputable legacy. Their operations have long been regulated, and their customer base is substantial. Additionally, they have fewer limitations on collecting and processing user data. This provides them with a solid foundation to embrace digital transformation.

- Seamless implementation of advanced technology. Traditional banks have more resources to hire the world's best experts to modernize their infrastructure and architecture and implement new technologies the most efficiently and seamlessly. It allows them to integrate their operations with government and third-party services, ensuring a smooth and regulated process.

- Improved asset management. The digital transformation of traditional banking allows for offering both traditional and many other asset management with a higher degree of security and flexibility. This improved asset management also enables banks to provide better rates, lower fees, and guaranteed payouts, enhancing the overall customer experience.

Digital transformation trends in banking

To succeed in the rapidly evolving digital landscape, banks must rethink their value proposition to enhance the customer experience and leverage data to create value. This requires banks to prioritize multiple businesses depending on their resources and competitive strengths and build digital platforms that support the entire customer journey from search to management.

For daily banking, the platform should simplify transactions by integrating them into the customer journey and offering fast and convenient access to various retailers and service providers.

For home and life events, the platform should offer a comprehensive solution by partnering with various businesses to support the entire journey from search to financing and ongoing management.

Finally, for wealth and protection services, the platform should differentiate itself through customer data to deliver highly personalized advisory services, empowering investors to make informed decisions about growing and preserving their wealth over the long term.

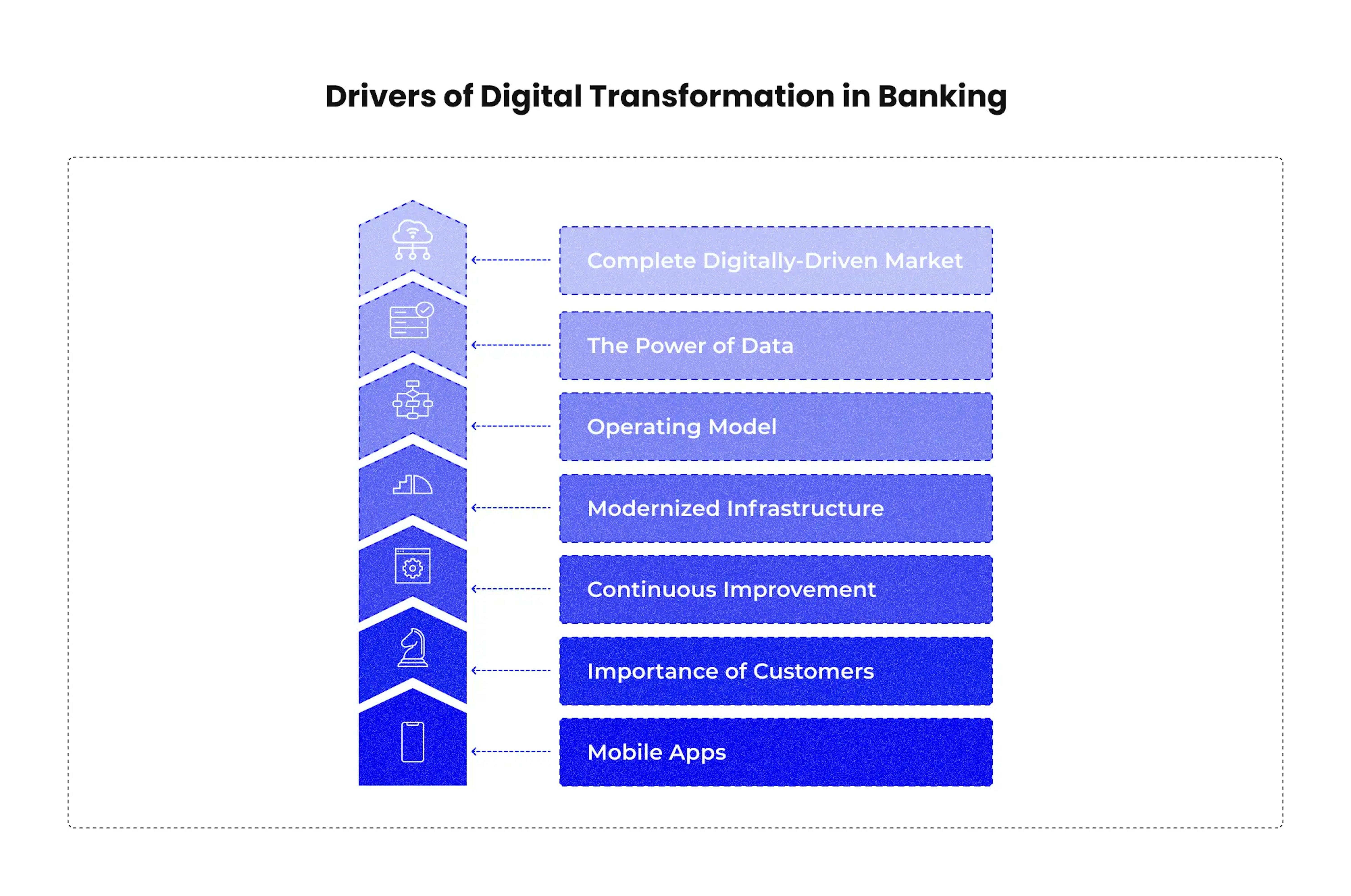

Drivers of digital transformation in banking

The banking industry is undergoing a major transformation due to technological advancements and changing customer preferences. Banks must embrace digitalization and leverage new technologies to provide a better customer experience and create value through data in this new digital environment. The following are some of the key drivers of this transformation:

Mobile apps

Mobile banking is one of the main drivers of digital transformation in the banking industry. With the widespread use of smartphones, customers have easier and faster access to information and the tools to make financial decisions. Mobile banking provides a high-quality data collection experience, immediate access to solutions, and a user-friendly experience. Additionally, the emergence of "super applications" has further emphasized the importance of mobile banking in the financial services sector.Importance of customers

Banks must prioritize putting their customers at the center of their digital transformation efforts. By understanding and addressing their customers' needs and preferences, they can ensure that they are providing relevant and valuable services. This includes gathering and analyzing customer data to deliver personalized and targeted services and provide a seamless customer experience across all channels.Continuous improvement

Digital transformation in banking is an ongoing journey of improvement. Banks must be willing to adapt and change as new technologies and customer preferences emerge to remain competitive. This includes regularly reassessing their digital strategy and making necessary changes to their technology stack and operating model.Modernized Infrastructure

Banks must invest in modernizing their infrastructure to support digital transformation. This includes upgrading hardware, software, and networks to support digital operations and provide a seamless customer experience. It also involves implementing robust security measures to protect customer data and ensure the integrity of digital transactions.Operating model

Digital transformation in the banking industry requires a shift in the traditional operating model. This may involve streamlining processes, integrating new systems, and changing the organizational structure to align with the bank's digital strategy. Banks must also ensure that their employees are equipped with the necessary skills to succeed in a digital environment.The power of data

Data is a critical driver of digital transformation in the banking industry. By leveraging customer data, banks can gain valuable insights into customer behavior and preferences, improve their decision-making processes and deliver more personalized and relevant services. This includes data analytics to identify trends and patterns and artificial intelligence and machine learning to automate processes and deliver targeted services to customers.Complete digitally-driven market

The banking industry is being transformed by the emergence of a completely digitally-driven market, where customers expect immediate access to financial services and solutions from their own devices. Banks must embrace digital transformation to remain competitive and meet the evolving needs of their customers. This includes offering a wide range of digital services and solutions and providing a seamless, secure, and convenient digital experience.

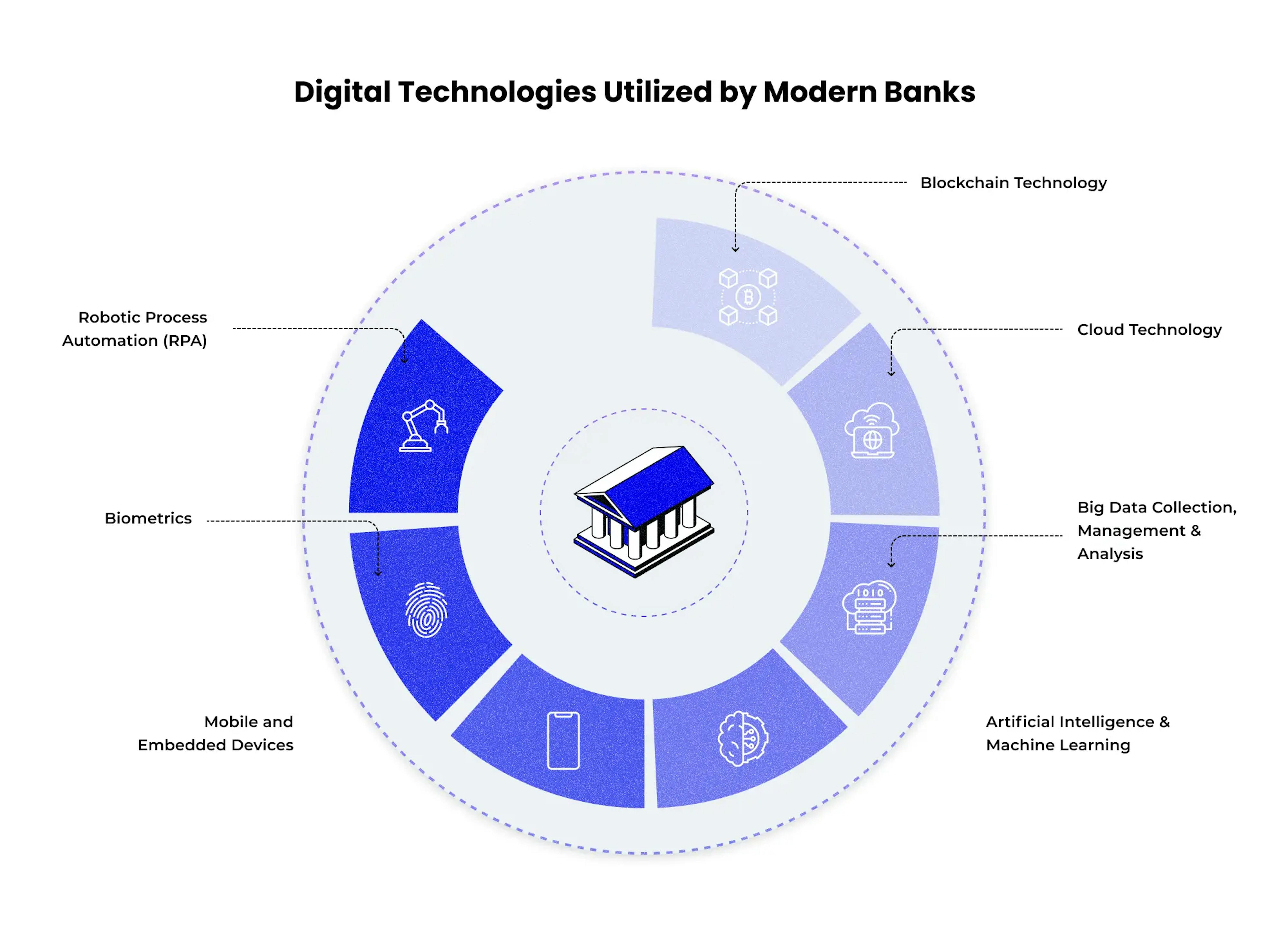

Digital technologies utilized by modern banks

To elaborate on the impact of drivers, modern banks are looking at innovative technologies not just as a means to improve their operations and services but also to fundamentally change the way they conduct their business. Look at how each of the following technologies is being used in the banking industry:

Robotic process automation (RPA)

RPA is used by banks to automate routine and repetitive tasks, freeing employees to focus on more value-adding activities. Banks are using RPA to automate processes such as data entry, account reconciliation, and customer service. This technology is improving the efficiency and accuracy of processes, reducing costs, and improving customer experiences. For example, BNP Paribas is using RPA to automate its back-office operations, leading to faster and more accurate processing of customer transactions.

Biometrics

Biometric technologies, such as facial recognition and fingerprint scanning, are being used by banks to improve the security and convenience of their services. Banks use biometrics to identify customers, reduce the risk of fraud, and streamline processes. For example, JPMorgan Chase is using biometrics to allow customers to access their accounts using their fingerprints or facial recognition, providing a more secure and convenient experience.

Mobile and embedded devices

Mobile devices and embedded technologies have revolutionized the way customers interact with their banks. Banks are utilizing these technologies to provide customers with convenient, accessible, and secure banking services through mobile apps, digital wallets, and smart devices. By leveraging these technologies, banks can enhance customer experience, improve operational efficiency, and increase customer engagement. Additionally, mobile and embedded devices enable new business models and revenue streams, such as mobile payments and P2P transfers. Through their integration with existing bank solutions, these technologies enhance their capabilities and provide customers with an even more comprehensive banking experience.

Artificial intelligence & machine learning

These technologies are being used by banks to analyze large amounts of data, automate processes, and provide personalized services to customers. It helps to improve the accuracy and speed of fraud detection, credit scoring, and customer service. Banks are also using these technologies to personalize services, such as providing customized investment recommendations to clients. For example, Citigroup has developed an AI-powered virtual financial advisor that provides personalized investment advice to customers.

💸 AI-first products enable solutions impossible with traditional systems. Unlock these competitive advantages for your business with our new article "How AI-First Financial Products Are Reshaping the Industry."

Big data collection, management & analysis

Big data is playing an increasingly important role in the banking industry, helping banks to make informed decisions, improve customer experiences, and stay ahead of the competition. Banks are using big data to collect, store, and analyze data from various sources, including customer transactions, social media, and other sources. This technology helps to identify patterns and trends in customer behavior, target marketing efforts, and prevent fraud. For example, HSBC is using big data to improve its customer segmentation and targeting, leading to better customer engagement and higher sales.

Cloud technology

The cloud enables banks to move away from outdated and inflexible infrastructure to a more agile and scalable platform. Banks use cloud technology to store and manage data, run applications, and host services. This technology has allowed banks to become more agile, respond to changing customer needs more quickly, and reduce operational costs. For example, Goldman Sachs has adopted cloud technology to modernize its IT infrastructure, improve security, and streamline processes.

Blockchain technology

This decentralized ledger technology is revolutionizing the way transactions are conducted, ensuring that they are secure, transparent, and tamper-proof. It eliminates intermediaries, reduces costs, and streamlines processes, making it a game-changer for the banking industry. Banks are using blockchain to create new products, such as digital currencies, and improve cross-border transactions' speed and efficiency. For example, JPMorgan Chase uses blockchain technology to create a settlement platform for its clients.

Banking digital transformation solutions

Many banks have already created a number of solutions based on implementing those new technologies that have already transformed their operations. And they continue to successfully invest in it, now gaining more and more benefits. The following companies are prime examples of digital transformation.

The Commonwealth Bank of Australia (CBA) has been at the forefront of digital transformation in the banking industry, utilizing innovative technologies such as artificial intelligence and blockchain to improve customer experiences and streamline operations. One of the key initiatives that CBA has undertaken is the implementation of AI-powered virtual assistants to provide 24/7 customer support and automate routine tasks. Additionally, CBA has leveraged blockchain technology to simplify and secure cross-border payments and supply chain management.

NatWest has taken significant strides towards digitization in recent years, leveraging cutting-edge technologies such as mobile and embedded devices and biometrics to enhance customer experiences and streamline operations. One of the major initiatives that NatWest has undertaken is the implementation of biometric authentication through facial recognition and fingerprint scanning to provide customers with a secure and convenient way to access their accounts. Additionally, NatWest has developed a robust mobile banking app that allows customers to access their accounts and perform transactions on the go.

Santander UK has proactively embraced digital transformation, leveraging advanced technologies such as cloud computing and artificial intelligence to drive innovation and improve customer experiences. One of the key initiatives Santander UK has undertaken is the implementation of cloud-based infrastructure to enhance data security and improve scalability. Additionally, Santander UK has utilized AI-powered algorithms to automate routine tasks, such as fraud detection and customer service, freeing up staff to focus on more complex and value-adding activities.

The 4 future trends for digital transformation in banking

Physical and digital banks have begun to implement various solutions to improve the experience of their customers and offer more personalized products and services. The drivers of the digital transformation in banking that we mentioned above will continue to motivate financial institutions to embrace new innovations. As technology advances and the world changes, certain trends will frame how banks adapt to the future.

1. Flexibility

Customers are looking for flexibility in their banking solutions and want businesses to adapt to their needs. Whether traveling, individuals working in different countries or for foreign employers, or performing work with more than one company, consumer desires are more varied than before, and that will continue to change. Open banking, easy cross-border payments, and embedded financial services will become expectations to help customers easily manage their finances.

2. Responsibility

People worldwide have long embraced responsibility in their consumer trends and place increasing value on ensuring the companies they use comply with environmental, social, and governmental (ESG) norms or regulations. Banks must continue demonstrating ESG compliance to retain current customers and attract new users through increased digital services, certification, and public commitments.

3. Personability

While customers enjoy the flexibility and ease of use of digital banking, the need for personal interaction is still relevant. Customers want to feel that their banks are invested in providing tailored products and solutions. They want to know that their problems can be resolved. Generative AI can help banks build customer relationships and mitigate issues that don't require human involvement. Banks can continue offering users AI-powered recommendations and financial management to create an environment of a local bank branch with people customers can trust. Furthermore, banks can increase interactions with their customers by allowing them to send messages and respond to notifications.

4. Security

It's no secret that consumers are becoming more security-conscious. As they consent to sharing their data to increase flexibility, customers expect their banks and other services to provide robust security to protect their finances and personal information. Banks can use AI to boost their cybersecurity with 24-hour scanning and threat detection, as well as to identify fraud attempts. It's also important for banks to openly demonstrate their security infrastructure to their users to gain their trust.

These trends will remain strong motivators for banks and financial institutions to adjust their approaches and create their own innovative solutions to provide customers with an enhanced experience.

Summary

The banking industry, long known for conservatism, is undergoing a significant transformation driven by digital technologies. With the increasing demand for improved customer experience, efficiency, and security, banks are leveraging innovative technologies such as blockchain, cloud, AI and machine learning, big data, biometrics, RPA, and mobile and embedded devices to enhance their operations and services. Each technology plays a unique role in improving the capabilities of existing bank solutions and offers new unique opportunities.

The sheer scale of resources and expertise available to the banking industry positions it well to fully realize the potential of these technologies and drive the next wave of innovation in financial services. This trend toward digital transformation in the banking industry is only set to continue, and businesses that don't keep pace risk being left behind.

FAQ

What is digital transformation in banking and financial services?

Digital transformation in the banking and financial services industry refers to the integration of advanced technologies and processes aimed at improving the efficiency, accessibility, and overall customer experience of banking services.

What are the main new technologies for banks?

Key new technologies for banks include artificial intelligence, blockchain, cloud computing, mobile and embedded devices, and biometrics.

Why are banks slow to embrace computing?

Banks may be slow to embrace computing due to the significant investments required to adopt and integrate new technology, regulatory and compliance concerns, and cultural resistance to change.

Why should banks consider digital transformation?

Banks should consider digital transformation to remain competitive, meet changing customer demands, increase efficiency and reduce costs, and improve the overall customer experience.

What are the benefits of digital transformation in banking and financial services?

The benefits of digital transformation in the banking and financial services industry include increased operational efficiency, enhanced customer experience, improved risk management, and reduced costs.

How can digital transformation help banks reduce costs?

Digital transformation can help banks reduce costs by automating manual processes, reducing the need for physical infrastructure, and streamlining operations using advanced technologies.

How can digital transformation improve the customer experience in banking?

Digital transformation can improve the customer experience in banking by offering increased accessibility and convenience, personalized services, and faster and more efficient service delivery.

How can banks ensure a successful digital transformation?

For a successful digital transformation, banks should prioritize customer needs and invest in advanced technologies. A clear and well-communicated digital strategy and a culture of innovation and change are key elements for success.

What should banks consider when developing a digital transformation strategy?

Ensuring a successful digital transformation in banking also involves engaging all stakeholders, selecting the right contractors and partners, and continually adapting to industry advancements. Banks should take a holistic approach, considering all aspects of the digital transformation process.