It's no secret that credit cards have been around for a very long time now, so what makes Buy Now, Pay Later (BNPL) so unique? What makes it a new solution to an unresolved issue?

According to its name, BNPL is a fintech solution that allows consumers to purchase items now without having to pay instantly. BNPL for businesses exemplifies a highly flexible payment option that has grown significantly in recent years. It particularly resonates with a diverse customer demographic, including younger audiences.

While BNPL for businesses presents numerous benefits, it also entails specific risks and challenges for both consumers and merchants. This article delves into the advantages and disadvantages of BNPL to assist you in evaluating whether this financial solution aligns with the needs of your customer base and technological infrastructure.

BNLP in nutshell

The surge in online payments results in increased consumer engagement in online shopping. BNPL has seen a notable rise in the past few years, positioning itself as a favored alternative for credit. Notably, this payment method has become a favored choice among Generation Z and Millennials.

| BNPL Market Size (2023) | $309.2 billion |

| BNPL Market Size (2026) | $565.8 billion |

| AGE | PERCENTAGE OF BNLP USERS |

|---|---|

| 18-24 | 42% |

| 25-34 | 50% |

| 35-44 | 50% |

| 45-54 | 33% |

| 55+ | 19% |

BNLP services can be broadly categorized into two main types:

Invoicing

- In this option, shoppers complete the checkout process without making any immediate payment.

- Instead, they are given a specified period, typically 14 to 30 days, to pay in full.

- This is often a zero-interest option, which is particularly popular in Europe.

Installments

- With installment-based BNPL services, shoppers can divide the total cost of their purchase into smaller, more manageable payments.

- These payments are usually due bi-weekly or monthly, depending on the terms.

- Some BNPL providers may also require a deposit or down payment at the time of purchase.

- This installment-based model is commonly favored in North America.

Why is BNPL an attractive payment option for consumers

BNPL provides financial flexibility by allowing consumers to customize payment terms to suit their needs, from the initial down payment to the installment period.

| REASONS FOR USING A BNPL | PERCENTAGE OF PEOPLE WHO USE IT FOR THIS REASON |

|---|---|

| Easier to make payments | 45% |

| More flexibility | 44% |

| Lower interest rates | 36% |

| Easy approval process | 33% |

| Credit cards are maxed out | 33% |

| No interest | 22% |

| Low credit card limit | 22% |

BNPL is a practical solution for those who seek to split large purchases into manageable monthly payments, offering a cost-effective alternative to credit cards with high-interest rates. According to a recent Bankrate survey, 10% of holiday shoppers plan to use BNPL for gift financing, with a quarter expressing concerns about holiday expenses.

Why consider BNPL for business owners

Overall, BNPL can be a good model for businesses; however, it's important to weigh the pros and cons before offering BNPL as a payment option.

Pros

Increased conversion rates and sales. BNPL offers an alternative payment option that can help businesses increase their conversion rates and sales. Customers for whom the upfront cost may have deterred can complete their purchases and pay for them over time.

Reduced shopping cart abandonment. BNPL offers flexible payment options that meet different needs and help businesses reduce cart abandonment rates.

Improved customer loyalty and satisfaction. Offering BNPL to customers as a payment option can increase customer loyalty and satisfaction by allowing customers more financial freedom and flexibility. Satisfied customers are more likely to return, which can increase sales growth and profits.

Ability to attract new customers and expand the customer base. Businesses can use BNPL as a competitive advantage and a marketing tool to attract new customers and expand their customer base. By providing customers with a unique and attractive payment option, businesses can expand their reach and attract a wider range of customers, ultimately leading to increased sales growth.

Cons

Higher merchant fees. Merchants are subject to elevated transaction fees, ranging from 2-8% of the sale cost, which can affect profit margins.

Integration and accreditation challenges. Implementing a BNPL payment method demands both resources and time for seamless integration and accreditation.

Complexity due to multiple providers. The presence of various BNPL providers in the market can lead to confusion for merchants, considering the diverse deals and terms offered. Selection of the most suitable partner becomes a time-consuming and challenging process.

Potential consumer debt. BNPL services can potentially contribute to consumer debt, particularly among financially vulnerable individuals. This debt burden may lead to payment defaults and ultimately impact a company's net income and brand reputation.

Here are some additional things to consider when deciding whether or not to offer BNPL:

- Your target market: Is your target audience likely to use BNPL? If not, it may not be worth offering BNPL as a payment option.

- Your products or services: Are your products or services well-suited for BNPL? For example, BNPL may not be a good option for businesses that sell low-priced items or have a short sales cycle.

- Your business model: Can your business afford the fees associated with BNPL? It's important to ensure that the benefits of offering BNPL outweigh the costs.

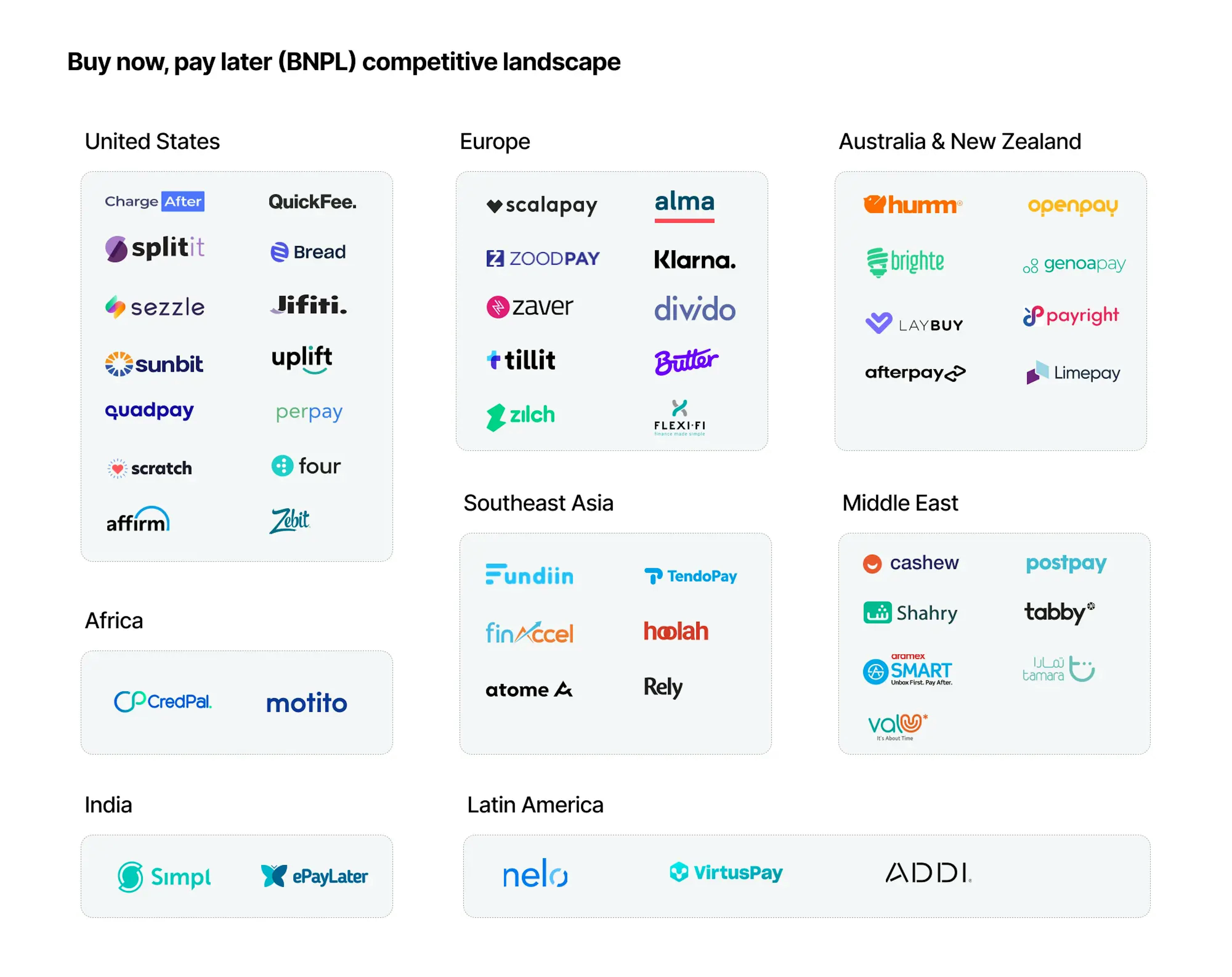

BNPL worldwide

The United States leads in the total number of BNPL companies, with Europe closely following. Additionally, BNPL companies are emerging across various regions worldwide, including Australia, New Zealand, Africa, Southeast Asia, the Middle East, and Latin America. This global expansion of BNPL services reflects this payment method's growing popularity and adoption. Below, you'll find a market map that identifies over 50 companies in each region actively developing and providing BNPL services.

We’ll delve into examples that are also considered BNLP unicorns by the regions since they have the most influence and future perspectives on the market.

North and South America

Sunbit

Sunbit, founded in 2016 in Los Angeles, CA, operates in the financial technology space and has raised a total of $447.67 million in funding. It competes with companies like Uplift and Lula in the same industry or market segment.

With Sunbit, you can pay over time for unexpected expenses, from auto repairs to veterinary care. The application process is used by thousands of customers and is designed to approve 90% of applicants. Currently, Sunbit is accepted by over 20,000 merchants. Sunbit has 17 investors, including Harel Insurance Investments and Financial Services and Zeev Ventures.

- APR: 0% to 35.99%

- Terms and Installments: 3 to 12 months

- Late fees: $10 if late by over ten days

| PROS | CONS |

|---|---|

|

|

Splitit

Splitit, founded in 2012 in New York, NY, has raised a total of $10 million in funding. It faces competition from companies like Velocity, Covalto, and Paystack in the same market segment.

Splitit connects card networks, merchants, and customers through "installments-as-a-service." With an approved credit card, customers can pay for their purchases over time without incurring additional interest charges. Splitit has $3 trillion of underwritten credit and has an average review of 4.1 out of 5 stars on Trustpilot. Splitit has 5 investors, including Goldman Sachs Bank USA.

- APR: 0% to 3%

- Terms and Installments: Configurable by the shop

- Late fees: No late fees

| PROS | CONS |

|---|---|

|

|

Creditas

Creditas, founded in 2012 and headquartered in São Paulo, Brazil, has secured a significant amount of funding totaling $1.1 billion. It competes with companies like Finja, Neat Capital, and Prospa. Creditas is known for its innovative financial services and lending solutions.

There are 27 investors in Creditas, including Andbank and QED Investors. The company announced that it had raised $260 million in Series F funding.

- APR: 21.99% to 29.99%

- Terms: 6, 9, 12, 18, and 24 months

- Installments: weekly, biweekly, and monthly

- Late feels: 5% of the past due amount, with a minimum of $15

Europe

Klarna

Klarna, founded in 2005 in Stockholm, Sweden, is a well-established fintech company with significant funding amounting to $4.5 billion. Competitors are Uplift, EBANX, and Recharge.

Klarna is a BNPL platform for eCommerce businesses. Whether paying in person or online, users can split their transactions into four installments. There are 936,000 reviews of the Klarna app on the App Store, with an average rating of 4.8 stars. Klarna closed its last funding round on Jul 11, 2022, from a Venture round. It has 70 investors, including the Canada Pension Plan Investment Board and Sequoia Capital.

- APR: 7.99% to 33.99%

- Terms: 6, 12, and 24 months.

- Installments: monthly payments.

- Late fees: up to $7.

- Overall ratings for the combined areas of safety, privacy, and transparency: 77

| PROS | CONS |

|---|---|

|

|

Zaver

Zaver, founded in 2016 in Stockholm, Sweden, has secured $8.3 million in funding. It operates in the fintech sector and competes with companies like EBANX, Bondora, and Credit Kudos.

Zaver offers two checkout solutions to merchants: Zaver Checkout and Zaver Cashout. Using Checkout, merchants can digitize physical sales and provide quick point-of-sale user experiences even for small cart purchases, reducing checkout friction. Zaver has 11 investors.

- APR: from 19.99% to 35.99%

- Terms: 6, 12, 18 and 24 months.

- Installments: weekly, biweekly, and monthly.

- Late fees: up to $10.

There is limited information available

Australia & New Zealand

Afterpay

Established in 2014 in Melbourne, Australia, Afterpay has secured substantial funding amounting to $448.7 million. This fintech company operates within the same market segment as competitors such as Sezzle, Affirm, and Splitit.

With Afterpay, customers can shop from thousands of online and in-store brands. More than 5.6 million people use Afterpay.

- APR: from 0% to 35.99%

- Terms: 6 or 12 months.

- Installments: pay-in-four payment plan and monthly plans.

- Late fees: up to $8.

- Overall ratings for the combined areas of safety, privacy, and transparency: 77

| PROS | CONS |

|---|---|

|

|

Zip

Founded in 2013 in Sydney, Australia, Zip has raised a significant amount of funding, totaling $893.6 million through post-IPO debt. The main competitors are Sezzle, Affirm, Klarna, and Afterpay.

With Zip, customers can pay in four installments over six weeks without affecting their credit score. With Zip, merchants can integrate the platform in 10 minutes anywhere Visa is accepted. Zip is currently used by over 11.4 million shoppers worldwide.

- APR: 0%

- Terms and Installments: pay-in-four model.

- Late fees: $5, $7 or $10.

- Overall ratings for the combined areas of safety, privacy, and transparency: 76

| PROS | CONS |

|---|---|

|

|

Africa

PayFlex

Payflex, a fintech startup founded in 2017 in Johannesburg, South Africa, has raised $500,000 in a Corporate Round. It faces competition from other companies like Bright.MD and Lacaisse.ma.

With an excellent rating from almost 25K customers on Trustpilot, merchants who use PayFlex have boosted their sales by 30%.

- APR: from 0% to 25%

- Terms: 6, 12, and 24 months.

- Installments: monthly.

- Late fees: $15.

There is limited information available

Southeast and East Asia

Hoolah

Hoolah, based in Singapore, has received funding amounting to $373,800. It competes in the fintech sector with alternatives and competitors like PayPal, PayPal Credit, Affirm, and Sezzle, providing flexible payment solutions.

Currently living in Singapore, Malaysia, and Hong Kong, customers can make online and in-person purchases. The company partners with retail companies, including Daniel Wellington and Zalora.

- APR: from 0% to 36%

- Terms: 3, 6, and 9 months.

- Installments: monthly.

- Late fees: $7 for the first late payment and $10 for each subsequent late payment.

There is limited information available

Du Xiaoman Financial

Du Xiaoman Financial was founded in 2015. It is a short-term loan and investment services provider. Investors of Du Xiaoman Financial include the Bank of Tianjin, Bank of Nanjing, ABC International, Baidu, The Carlyle Group, and 4 more. It is also known as Baidu Financial Services Group (FSG)and operates as its fintech arm.

- Personal loan: up to CNY 200,000 (approximately $29,000) over 12 to 36 months

- Installment payment: over 3 to 24 months

There is limited information available about this unicorn because it is primarily focused on the Chinese market

Paidy

Paidy, founded in 2008 in Minato, Japan, has secured $397.9 million in funding. It operates in the fintech industry and competes with alternatives and competitors such as Afterpay, Affirm, and Klarna, offering innovative payment solutions.

Paidy, allows customers to shop online without a credit card or pre-registration. The customer enters their email address and phone number, receives a verification code via SMS, and completes the transaction.

- APR: from 15.0% to 29.99%

- Terms: 3 and 6 months.

- Installments: monthly.

- Late fees: 5%

There is limited information available

What is the future of BNPL

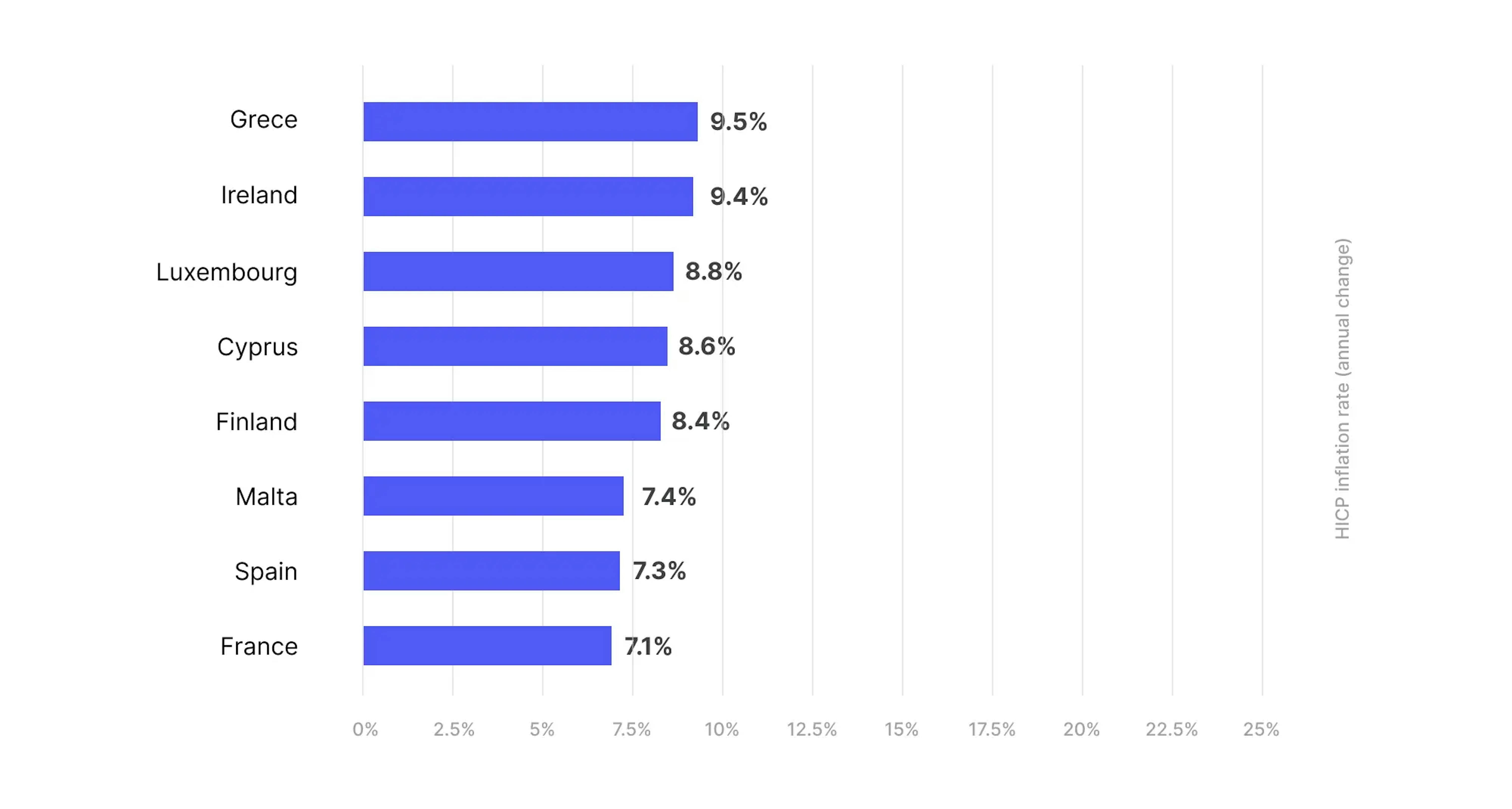

According to the latest estimates, inflation in the U.S. is currently around 9.1%, similar to the numbers seen at the start of the 1980 recession. As a result of fears of a market downturn, consumers are less likely to use their own money for purchases, instead saving it for a "rainy day".

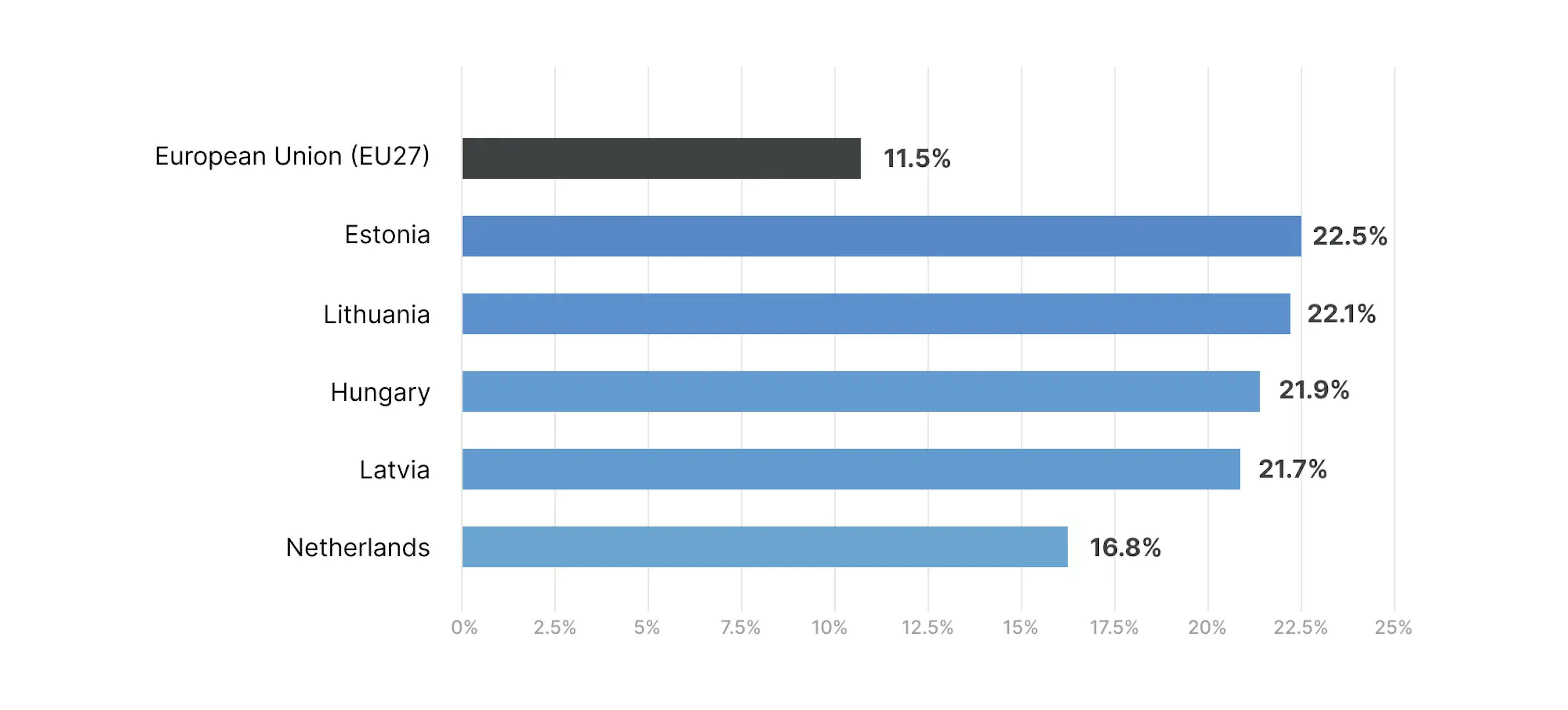

The Harmonised Index of Consumer Prices (HICP) rates across EU countries tell a similar picture. With an overall average of 9.8% inflation for the EU, Estonia, Latvia, and Lithuania are experiencing significant inflation, with rates as high as 23.2%, 21.3% and 20.9%, respectively. Ireland, Denmark, and Austria fare better, coming closer to the average at around 9.6%. Meanwhile, Malta, France, and Finland are at the lower end of the scale, with rates between 6.8% and 8%, making the U.S. far from the exception.

HICP inflation rate (annual change)

One reason for the growth of BNPL is the numbers on the chart and related panic, but what is causing the market to react in this manner? Is there any hope for the future?

- Challenges with oil and gas sourcing.

- Increases in food costs worldwide and fears about shortages.

- Rises in rent and buying prices for homes, leaving many cut out of the market.

- Jumps in the cost of materials, such as microchips, among others.

- Ongoing effects of the Covid-19 pandemic and resulting downturn.

In addition to that. All these factors are currently contributing to the so-called cost of living crisis. A situation like this has left the consumer market shaken and uncertain about whether to spend or save. Consequently, many are forced to take out BNPL loans as a short-term solution.

Soon, it is projected that BNPL lending could surpass the $600 billion mark on a global scale by 2025. Many banks are actively exploring entry into this sector to stay relevant in the consumer lending arena. Though the BNPL industry is poised for lasting prominence, it's important to note that not all participants in this market will endure.

According to the Insider Intelligence report, the BNPL industry is moving into “BNPL 2.0,” we can expect two main changes:

- Leading BNPL providers are working on creating super apps that offer more than just BNPL services. They want to include things like rewards, physical payment cards, other payment options, and price tracking. By becoming a one-stop shop for shopping and managing finances, they hope to keep customers engaged and make more money.

- Some providers might team up and collaborate with others. This can help them reach more people and offer a wider range of services. For example, companies like Affirm and Splitit are looking to buy new technology. Struggling companies might also sell themselves to bigger companies to stay afloat.

The Bottom Line

With BNPL, consumers can get the things they need immediately while also getting more time to pay. But the future of BNPL companies is still in the early innings.

Among our list of top BNPL companies, zero fees and interest payment installments are a major trend. Any company that charges additional fees for using a BNPL service would likely have a negative impact on customers.

Pricing transparency is also a priority for many companies. To reduce customer friction, many feature language about hidden fees or additional charges on their homepage.

The BNPL business model is likely to flourish since these companies offer customers payment flexibility and enable them to make large purchases without paying full price upfront.

If you are interested in integration, which requires a robust billing system, contact us now for a free consultation.