Asia is experiencing a digitalization boom in various areas, fundamentally changing how people live. The emergence of new digital products and services stimulates this market to grow even more. Given the population density in many Asian countries, this looks like an excellent opportunity for entrepreneurs and investors.

So get a deeper understanding of the reasons and prospects for such active digitalization in Vietnam. Here we will detail the digitalization of financial services, which payment methods are still popular or are actively gaining popularity right now. Also, we will talk about what top solutions are already built on this.

Reasons for the trend of digitalization of finance and payment

One of the fastest growing areas is everything related to finance, or more precisely, financial products and services. For example, SBV (State Bank of Vietnam) manager Nguyen Thi Hong says many local banks do 90% of their transactions on digital platforms, which exceeds the target of 70% set for 2025.

The government understands the importance of such a transformation and actively supports it. Vietnamese Prime Minister Pham Minh Chinh, also head of the National Committee on Digital Transformation, praised the banking sector for its digital transformation efforts through various products and services for people and businesses. All this shows that such initiatives are taken seriously and actively supported at the most fundamental levels.

According to the SEA 2022 report, the SEA digital economy could reach up to $1T GMV by 2030. However, it is worth giving credit to Vietnam for its awareness of the region's potential and for actively promoting its development. According to the same report, Vietnam is one of the frontrunners in this growth, and the capitalization of its digital economy could rise to $49B by 2025 and to $120 - 200B by 2030.

Let's take a closer look at what factors have caused this rapid digital development.

Distribution of mobile devices

The spread of mobile devices has given Internet access to a huge number of people. Even in 2021, Vietnam was among the top 10 countries in the world regarding the number of mobile devices in use, accounting for 61.3 million pieces. Unsurprisingly, this has had a major impact on people's lifestyles, quick access to various services anytime, anywhere, and therefore a greater need for them for various tasks. Of course, some of the first services needed are financial services because going to the bank and standing in line every time you need to make a simple transaction is unbearable.

The big younger generation

Many young people are already used to having mobile devices as indispensable tools for various tasks. Moreover, the young generation is as open as possible to many upcoming changes and the use of all new digital products and services. In Vietnam, more than 65% of the population is younger than 45, and the median age is only 33. This is a huge market of potential users, and they are a big bet for entrepreneurs and investors.

Pandemic

The Covid-19 pandemic has also played a role in driving the digitalization of finance and payments in Vietnam. In response to the pandemic, the Vietnamese government introduced many measures to promote cashless payments and discourage using cash. For example, it waived fees for online payments made through certain platforms and offered discounts on utility bills paid electronically.

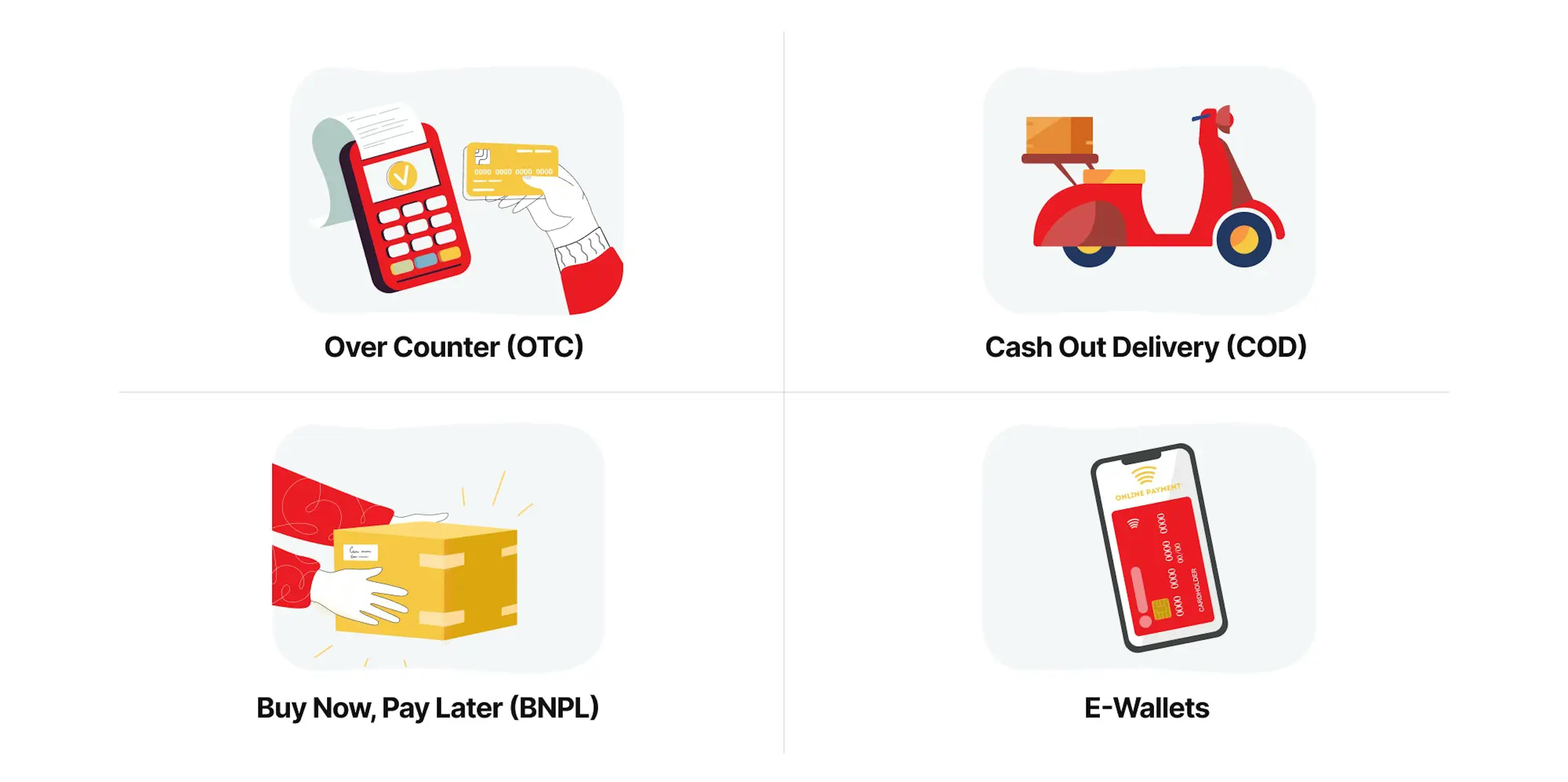

Top payment methods in Vietnam

All of the above has significantly popularized previously available digital payment methods and created completely new ones. Now we have payment methods for absolutely any portrait of the user, with any preferences, habits, and wealth. Let's see the place on the market of all these payment methods and what they offer.

Over the counter (OTC) payment

Vietnam's most popular payment method is Over the Counter (OTC) Payment. OTC involves paying for goods and services in person at a physical location, such as a store or restaurant. This type of payment is often used for small purchases, such as food or clothing. Many businesses in Vietnam accept OTC payments which makes it the most common form of payment used by consumers.

There are several advantages to using OTC payments:

- It is a convenient way to pay for goods and services.

- OTC payments do not require a bank account or credit card.

- OTC payments are often less expensive than other forms of payment, such as credit cards or PayPal.

- OTC payments are safe and secure; if you lose your cash, you can simply go to the business and ask for a refund.

However, there are some disadvantages to using OTC payments:

- You may have to wait in line to pay for your purchase.

- You may need to have the exact amount of cash required; businesses will not give change for large bills.

- You may need to show identification when making an OTC payment.

- If you misplace your cash, getting a refund from the business can be difficult.

Cash-on-delivery (COD)

Another popular payment method in Vietnam is cash-on-delivery (COD). COD involves paying for goods and services with cash when they are delivered to your home or office. This type of payment is often used for online purchases, such as food delivery or clothes from an online store. Many businesses in Vietnam offer COD as a payment option; however, it is important to check with the business before purchasing to ensure that they offer this service.

There are several advantages to using COD payments:

- It is a convenient way to pay for goods and services that are being delivered to your home or office.

- COD payments do not require a bank account or credit card; you can pay with cash when the goods are delivered.

- COD payments are safe and secure; if something goes wrong with your order, you can simply refuse delivery and get a refund from the business without having to worry about losing any money.

However, there are some disadvantages to using COD payments:

- You may have to wait longer for your purchase since businesses typically only deliver orders once daily or weekly.

- There is always the risk of something happening to your order before it arrives.

- Some businesses might charge an additional fee for COD orders; be sure to ask about any potential fees before placing your order.

- If you cancel your order after it has shipped, you might be responsible for paying shipping charges both ways.

Buy now, pay later (BNPL)

A new and popular payment method in Vietnam is buy now, pay later (BNPL). It allows customers to make purchases and then pay for them later, either in installments or in one lump sum. Several BNPL providers are operating in Vietnam, such as MoMo, ZaloPay, and Moca.

Let's figure out several advantages of using BNPL:

1. Shoppers can make purchases and defer the payments for some time period. It can help with budgeting and cash flow management.

2. BNPL offers a convenient way to make purchases, as shoppers do not need to pay upfront for items.

3. BNPL providers often offer flexible repayment options, such as interest-free periods or installments. It can make it easier for shoppers to repay their debt.

But there are also some disadvantages of using BNPL, including

1. If shoppers do not repay their debt on time, they may be charged late fees by the provider.

2. Some BNPL providers charge high-interest rates on outstanding balances, which can be expensive for shoppers if they are not able to repay their debt quickly.

3. Missed or late payments may negatively impact a shopper's credit score.

E-Wallets

E-Wallets are digital wallets that allow users to store, send, and receive money electronically. They can be used to make online payments, transfer funds to friends and family, or pay for goods and services. In Vietnam, E-Wallets are one of the most popular payment methods, with a wide range of providers offering different features and services.

There are many advantages to using E-Wallets in Vietnam:

- They are convenient, easy to use, and widely accepted by businesses.

- E-Wallets also offer users a degree of security as they can set up password protection and PIN codes to prevent unauthorized access to their accounts.

- Additionally, many E-Wallet providers offer promotional discounts and cashback rewards when users make payments with their wallets.

There are some disadvantages to using E-Wallets in Vietnam as well:

- If users lose their phones or have them stolen, their E-Wallet balance could be at risk.

- Some businesses may charge higher prices for goods and services when paid with an E-Wallet than other payment methods such as cash or credit cards.

- There is always the possibility that E-Wallet providers could experience technical problems which could temporarily disrupt service.

- Not all local E-Wallets support international cards.

Criteria to look out for payment gateways in Vietnam

Whether you are choosing solutions to use as a customer or as an entrepreneur to integrate into your product, you need to pay attention to some criteria when making your choice.

Especially if you are an entrepreneur and you are going to integrate a provider, you need to consider all the nuances. A good example is the Stripe integration, which we have successfully done many times before. Based on our experience, we wrote an excellent article about Stripe integration, which we highly recommend for reading.

Supported currencies

An important criterion to look for in a payment gateway is supported currencies. Since Vietnam is a rapidly growing economy, it's important to choose a provider that supports a variety of currencies so you can do business with customers from all over the world. Look for providers that support major currencies like USD, EUR, and GBP, as well as emerging markets like VND and CNY.

Payment options

When choosing a payment gateway, it's also important to consider the different payment options the provider supports. Does the provider support money transfers between individuals (P2P), transfer of funds between businesses (B2B), etc.? Make sure to choose a provider that offers payment methods that better cover all the customer's needs.

Market integrations

Another thing to look for in a payment gateway is market integrations. Does the provider offer integration with popular E-Commerce platforms like Shopify and WooCommerce? This will make it easier to set up and manage your online store. Additionally, some providers offer plugins or extensions for popular accounting software like QuickBooks and Xero, which can save you time and money on bookkeeping.

Security

Security is always a top priority when it comes to online payments. Make sure to choose a payment gateway that offers the highest level of security, including SSL encryption and fraud detection. Also, look for a provider that provides customer support in case of questions or concerns about using the service.

Top payment gateways in Vietnam

Now, let's look at popular gateways in Vietnam that are strong in one of the payment methods listed and may include several. Here you can discover the top gateways in Vietnam with detailed info about each to choose the most suitable one.

OnePay

OnePay provides a fairly wide range of financial transactions you can offer customers. It's not just about transferring funds here but also about setting up their automation for established addresses. OnePay also provides the ability to tokenize some assets. It works with cards like Visa, MasterCard, American Express (AMEX), JCB International, and UnionPay. It also works great with E-Wallets like MoMo, ZaloPay, Viettel money, and Moca.

|

| |

| Headquarters | Hanoi, NA - Vietnam, Vietnam |

| Founders | 2006 |

| Credit/Debit Cards | VISA, MasterCard, American Express, JCB, Union Pay, Diners Club. |

| Other Payment Methods | E-Wallets like MoMo, ZaloPay, Viettel money, and Moca |

| E-Commerce platform integrations | Available upon sing up |

| Supported currencies | Available upon sing up |

| Website | onepay.vn |

VNPay

VNPay is a local payment gateway in Vietnam that offers businesses a wide range of features. It provides integrated payment services to its parent company Sendo. It also provides QR payments and domestic and international card payments from its platform and offers payments through Senpay, MoMo, and Zalo wallets. Their main partners are Vietcom Bank, Vietin Bank, Argibank, Bidv, and others.

In fact, you should take a closer look at VNPay because they have created a fairly unique model. Instead of creating one super app, VNPay has created a set of super apps, one for each of their banking partners. And it continues to expand its set of services. For example, VNPay is testing insurance and credit products for small businesses and consumers, and that's just one initiative. Now the company provides electronic payment services for more than 40 banks, 5 telecommunications companies, and more than 20,000 businesses.

|

| |

| Headquarters | Hanoi, NA - Vietnam, Vietnam |

| Founded | 2007 |

| Funding | $250M |

| Credit/Debit Cards | BIDV, VietinBank, Agribank, Vietcombank, ABBANK, SCB, IVB, NCB, SHB, Maritime Bank, VID, Visa. MasterCard |

| Other Payment Methods | VnTopup Bank; SMS Banking, VnPayBill bill payment service, VnMart E-wallet |

| E-Commerce platform integrations | Available upon sing up |

| Supported currencies | Top world currencies like USD, EUR, etc.+ Cryptocurrency |

| Website | vnpay.vn |

In some projects, we enjoyed integrating VNPay and found features of this solution that Western counterparts could learn from. For example, to connect their API, you must pass several testing types. Only after that, it's possible to get the keys. Checking this is largely automated thanks to their SDK, making developers' lives easier and the solution much more reliable. You can read more about it in our MegaUni case study.

MoMo

MoMo, last but not least. It is a top-rated payment service and a separate mobile app that provides a wide range of functions for sending and receiving funds using Visa and MasterCard, recharging your wallet and paying for services such as more than 100 types of bills, settling personal loans and purchase services such as software, game cards, airline, movie tickets, etc.

|

| |

| Headquarters | Ho Chi Minh City, NA - Vietnam, Vietnam |

| Founders | 2007 |

| Funding | $449.8M |

| Credit/Debit Cards | 24 domestic banks and foreign payment networks, including JCB, MasterCard, and Visa |

| Other Payment Methods | MoMo eWallet funds, and MoMo eWallet postpaid |

| E-Commerce platform integrations | Available upon sing up |

| Supported currencies | Top world currencies like USD, EUR, etc. |

| Website | momo.vn |

We had to deal with many local solutions because when we were developing GoDee and were about to integrate Stripe, which we had already done many times in various projects, we found it not so handy in Vietnam. Anyway, we integrated Stripe properly and also got excellent experience integrating MoMo, VNPay, VinID, and OnePay. You can read more about it in our GoDee study case.

Atome

Atome is the leading payment system at the moment, focusing mainly on the BNPL method, which is gaining popularity in Vietnam. Of course, it is even more popular in its home country of Singapore, but Vietnam is very actively starting to use it. Their partners are many stores and brands like Samsung, Marks & Spencer, Zara, Pandora, and others. Atome also provides its super app with many online shopping features at various stores.

|

| |

| Headquarters | Singapore, Central Region, Singapore |

| Founders | Chun Dong Chau, Dong Shou, and Jefferson Chen, 2019 |

| Funding | $465M |

| Credit/Debit Cards | Available upon sing up |

| Other Payment Methods | Apple Pay |

| E-Commerce platform integrations | Easy Store, Magento 1 & 2, Opencart, Salesforce SFRA and Site Genesis, Shopify, Wix, and WooCommerce |

| Supported currencies | Top world currencies like USD, EUR, and +33 other currencies. |

| Website | atome.sg |

VitaPay

VitaPay is a U.S.-based payment gateway with a big reach in eCommerce Vietnam. It provides fast settlement by managing sales data and analysis based on transaction data from online markets. Key partners SK m&service, KB Kookmin Bank, Acuon Capital, Hana Capital, Suhyup Bank, etc. It is used by companies like Tmon, Kurley Market, Coupang, Auction, etc.

|

| |

| Headquarters | Astoria, New York, United States |

| Credit/Debit Cards | VISA, MasterCard, American Express, JCB, Union Pay |

| Other Payment Methods | Available upon sing up |

| E-Commerce platform integrations | Readily integrates with retail businesses, F&B businesses, service-based businesses, digital businesses |

| Supported currencies | Top world currencies like USD, EUR, etc. |

| Website | vitapay.com |

2C2P

2C2P is one of the leading payment service providers in Southeast Asia, offering omnichannel payment solutions that enable merchants to accept local and international payments through credit and debit cards, banking channels like ATMs, iBanking, and mBanking, and cash acceptance through payroll offices. Large companies such as IKEA, Lazada, Changi Airport Group, Lenovo, MSIG, Thai Airways, AirAsia, Anantara, Yotel, and Aviva use the solution.

|

| |

| Headquarters | Singapore, Central Region, Singapore |

| Founders | 2003 |

| Funding | $48M |

| Credit/Debit Cards | Domestic banks and foreign payment networks, including JCB, MasterCard, and Visa |

| Other Payment Methods | - |

| E-Commerce platform integrations | Merchants can connect to financial institutions like Lotus, Big C, Family mart, Bangkok Bank, Krungsri Bank, Kasikorn Bank, Siam Commercial Bank, and Government Savings Bank. It is also easily customizable and integrates into a wide variety of mobile applications. |

| Supported currencies | Top world currencies like USD, EUR, etc. |

| Website | 2c2p.com |

AsiaPay

AsiaPay is a leading international payment gateway that offers its services to businesses in Vietnam. It supports multiple currencies, allows businesses to accept payments from major credit and debit cards, and offers fraud protection measures. AsiaPay also has a mobile app that allows customers to make payments on the go.

|

| |

| Headquarters | Hong Kong |

| Founders | 2003 |

| Funding | $48M |

| Credit/Debit Cards | RuPay, MasterCard, JCB, Discover, Diners Club International, Amex, UnionPay, Visa |

| Other Payment Methods | Bank accounts, net banking, digital wallets, and other commonly accepted payment platforms. |

| E-Commerce platform integrations | Oracle, Xero, Acces, Drupal, Magento, Shopify, nonComerce, opencart. 3dcart and many others. |

| Supported currencies | +144 currencies |

| Website | asiapay.com |

Skrill

Skrill hardly needs an introduction, being a trendy payment method in Europe, which is easily integrated into solutions of various levels and has its own E-Wallet for transactions. Since Skrill was launched in the UK, it has been most popular in Europe, but it has also begun to gain popularity in Vietnam, competing with PayPal.

|

| |

| Headquarters | London, UK |

| Founders | 2001 |

| Funding | $331M |

| Credit/Debit Cards | Accepts most credit/debit cards issued by a financial institution. |

| Other Payment Methods | BankPlus, Neteller, debit card, Paysafecash, Bank transfer via Sofort/Klarna |

| E-Commerce platform integrations | Available upon sing up |

| Supported currencies | Top world currencies like USD, EUR, etc. |

| Website | skrill.com/en |

PayPal

PayPal also does not need an excessive introduction. Paypal is one of the most popular payment methods worldwide and is available in Vietnam. It offers a fast, convenient and safe way to send and receive money online. Paypal also offers the buyer ways of protection for items purchased using the service and good customer support.

|

| |

| Headquarters | US |

| Founders | 1998 |

| Funding | $4B |

| Credit/Debit Cards | MasterCard, JCB, Discover, Diners Club International, Amex, UnionPay, Visa |

| Other Payment Methods | PayPal balance, PayPal credit, and rewards balance |

| E-Commerce platform integrations | A wide list of the most popular integrations and plugins is fully available. |

| Supported currencies | Top world currencies like USD, EUR, etc. |

| Website | paypal.com |

Summary

The above-mentioned payment methods and gateways are the top ones that you can use for your business in Vietnam. Each one of them has its own advantages and disadvantages, so choose the one that best suits your needs. If you have any questions or need help choosing the right payment gateway for your business, feel free to contact us, and we will be happy to assist you.