Analyze with AI

Get AI-powered insights from this Mad Devs article:

Modern biotechnology began in the late 19th century with discoveries like Louis Pasteur's identification of organisms involved in fermentation and Joseph Lister's antiseptic surgery system. In the 20th century, the structure of DNA was discovered, leading to a greater understanding of organisms and the human body. Biotech drugs have been used to treat diseases such as cancer and Hepatitis B since the 1980s.

Today biotech is a booming industry where Amgen, Biogen, Gilead Sciences, Vertex Pharmaceuticals, and Regeneron Pharmaceuticals are some of the largest players. The market is expected to grow to $775.2 billion by 2024, according to Global Market Insights. Biotech startups are also joining the industry to tackle various issues, from toxic laundry detergents to gene editing.

This article will look at the leading biotechnology startups in different industries and provide information about their financials. In addition, we will determine the criteria for the success of biotech startups and the reason why biotech startups fail.

What is biotech, and what types of companies exist?

Biotechnology, or biotech, uses living organisms and biological systems to create products and services with diverse applications. It intersects biological, engineering, and computer science and is utilized in industries like vaccine and drug production and even beer brewing.

The biotech industry played a crucial role in developing COVID-19 vaccines using messenger RNA (mRNA) by modifying nucleosides to ensure safety. Biotech also has a significant impact on the food industry, ranging from creating substitutes for meat to cultivating lab-grown meat and easy-to-cultivate crops. Moreover, biotech is utilized in growing tissue by isolating animal cells to produce cultured meat, while gene-edited crops may be used in alternative meat products.

Now, let's talk about biotech startups. They are companies that focus on developing innovative technologies, products, or therapies in the field of biotechnology. These companies often leverage cutting-edge research to develop new disease treatments, improve diagnostic tools, or create sustainable food and energy sources. Biotech startups often require large investments to fund research and development efforts and may face significant regulatory hurdles when bringing products to market. Despite these challenges, successful biotech startups have the potential to transform healthcare and generate high returns for investors.

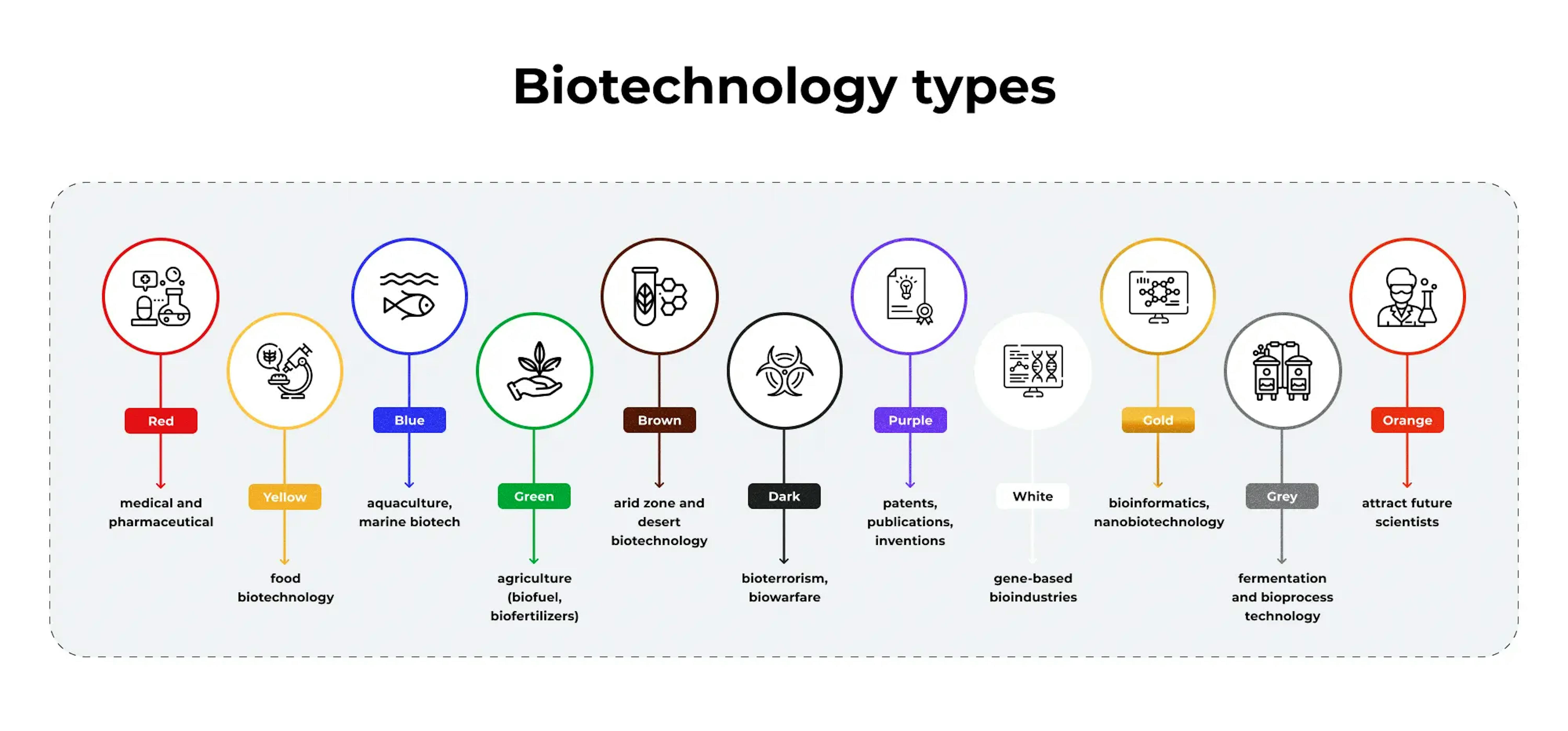

Types of biotechnology industries

Biotech solves challenges throughout many industries, from medicine to food and fuel production. To define the needs, capabilities, and ethics involved in each application, biotech companies can be broken down into various categories based on the solutions they seek to create.

- Red biotechnology. Also known as medical biotechnology. According to the Biotechnology Innovation Organization (BIO), this branch is responsible for developing over 250 vaccines and medications, including antibiotics, regenerative therapies, and producing artificial organs. It falls within the realm of health.

- Yellow biotechnology. This division is dedicated to food production and conducts research to lower the levels of saturated fats in cooking oils. Its primary objective is to genetically enhance products to increase the quantity or quality of food.

- Blue biotechnology. This practice uses marine resources to obtain aquaculture, cosmetics, and healthcare products. Moreover, it is the most commonly utilized field for obtaining biofuels from specific microalgae. The goal at the environmental level is to preserve marine species and ecosystems.

- Green biotechnology. Used for processes in the agricultural industry to provide nutrients to crops, safeguard them from severe weather conditions, and control pests.

- Brown biotechnology. This type focuses on treating arid and desert soils by studying species highly resistant to saline and dry conditions.

- Dark (black) biotechnology. Research is being conducted on virulent microorganisms that could potentially be used as biological weapons, as well as those that could counteract their harmful effects on bioterrorism and biological warfare.

- Purple biotechnology. Analyses all legal facets pertaining to biotechnology, including safety regulations, data privacy, patent laws, and more.

- White biotechnology. It is connected to the industrial field and focuses on researching biofuel production and advancement techniques to make the industry more environmentally friendly and productive.

- Gold biotechnology. Bioinformatics is important in analyzing data related to biological processes, such as DNA sequences and amino acids.

- Grey biotechnology. The purpose of these organizations is to preserve and restore natural ecosystems that have been impacted by pollutants.

- Orange biotechnology. The purpose is to disseminate interesting information about biotechnology to attract future scientists.

What are the measures of success for biotech startups?

Suppose you have decided to invest in a biotech startup. After selecting the industry, you must choose a project that has the potential to succeed by paying attention to the indicators of success.

Measures of success for biotech startups can vary depending on the specific company and its goals. However, some common measures of success in the biotech industry include:

- Development and commercialization of innovative products or services;

- Secure funding and investment from venture capitalists;

- Achieve regulatory approvals for products;

- Make strategic partnerships with larger companies or organizations;

- Publication of research results in peer-reviewed journals;

- Clinical trials;

- Patent filings or approvals;

- Market share;

- Revenue growth;

- Profit.

Ultimately, success in the biotech industry is complex and multifaceted and can be measured in various ways depending on the goals and objectives of the company.

Who funds biotech startups?

Various funding sources are available for biotech startups, including government grants, corporate grants, research organizations, venture capital firms, angel investors, and unconventional funding sources.

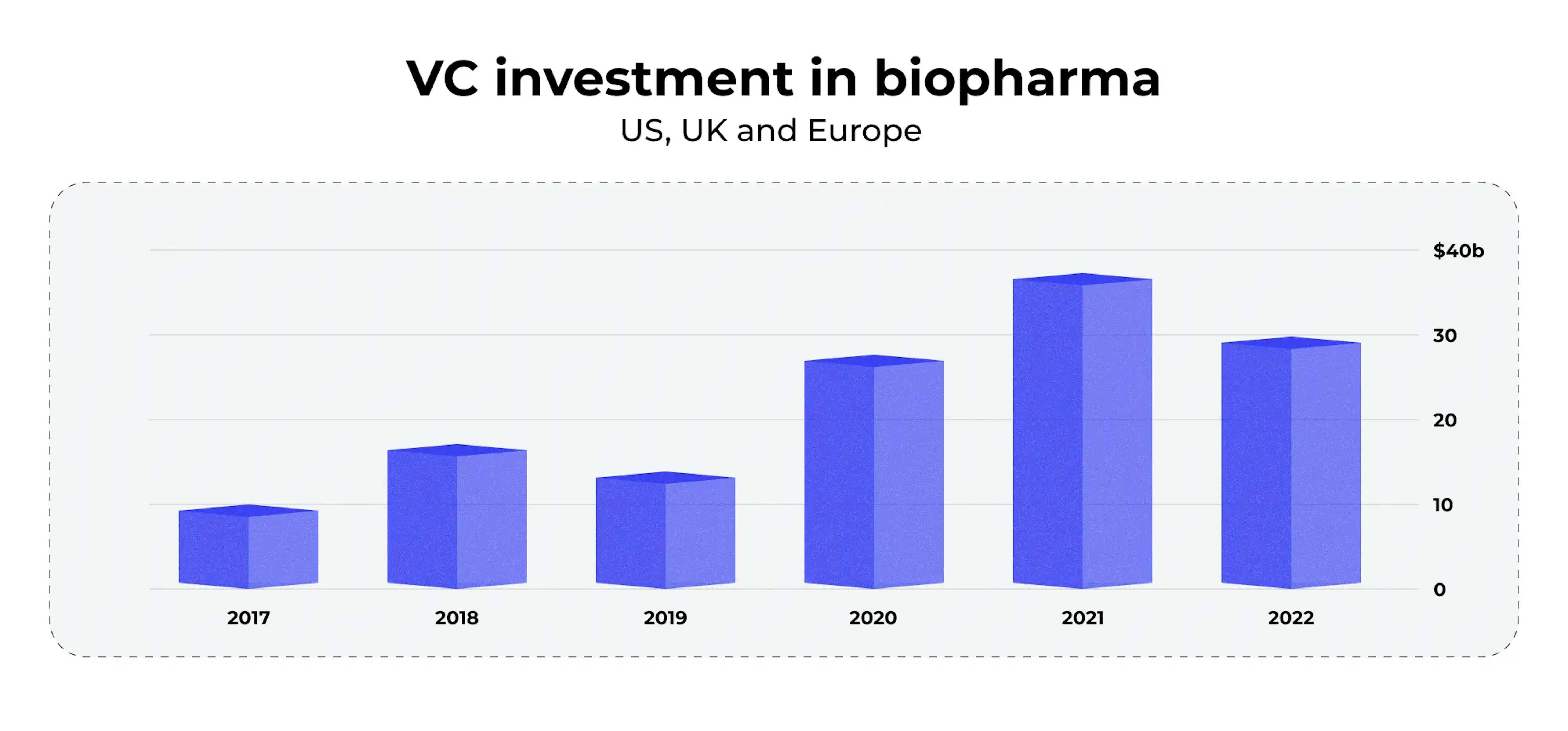

Recent research shows venture capital (VC) firms poured a record $36.6 billion into biopharma companies in the US, UK, and Europe in 2021, marking a 281% increase from 2017. However, private investment in biotech startups in 2022 dropped by 19% from the previous year to $29.5 billion. This dip suggests that investors are growing increasingly cautious about the near-term outlook for the biotech sector. Despite this setback, some VC firms remain optimistic, continuing to invest in promising startups in the hope of discovering the next big breakthrough.

Overall, the main sponsors of this direction are:

- Government grants & public funding: These grants may be available at various levels of government, from local to national. They may be oriented towards supporting research or development efforts related to particular diseases or patient populations. Some examples of government grants and public funding for biotech startups include grants from the National Institutes of Health (NIH).

- Non-governmental grants: These grants may be more disease-specific and less competitive than government grants and may be oriented toward supporting research or development efforts related to particular diseases or patient populations. Some examples of non-governmental grants for biotech startups include grants from patient advocacy groups, family foundations, and major corporations.

- Private investment: This type of investment is a major source of funding for biotech startups, especially in the initial stages of development, and involves investments that range from seed funding to venture capital and beyond.

- Venture capital: It refers to investments made by venture capital firms to support the development, research, and commercialization of biotech products or services. VC funding typically involves larger amounts of capital than other forms of financing, and the investments are made in exchange for an ownership stake in the company. VC firms may provide funding at various stages of a biotech startup's development, from seed funding to later-stage rounds. Such investors are typically looking for promising startups with high growth potential and are willing to take on higher risks in exchange for the potential for larger returns.

- Partnerships: These partnerships may involve a transfer of technology or knowledge from the startup to the established company in return for funding or support. This type of funding can benefit biotech startups as it can provide access to resources and expertise that may be otherwise difficult to obtain and can help startups advance their research and development efforts.

- Other options: Academic Funding, Loans, Crowdfunding & Peer-to-Peer Financing, and Incubators & Accelerators.

Each source necessitates a distinct strategy. Startups should consider these possibilities with federal grants and venture capitalists to optimize their access to funding.

Top biotech startups to watch in 2026

As we dive into 2023, the biotech industry continues to attract significant attention from investors and entrepreneurs alike. From advancements in gene editing to developing new drug therapies, the potential for transformative breakthroughs in biotech is immense. In this part of the article, we'll look closely at some of the top biotech startups to watch in 2024. We will also provide analytical insights into these startups' funding landscape and growth potential, giving you a comprehensive overview of the exciting developments in this space.

Please note that this is not an exhaustive list; many other biotech companies are working in this field.

Fermentation

Fermentation is a process that has been used for centuries to create some of the most beloved foods and beverages in the world, from cheese to beer. And in recent years, fermentation has become a hotbed of innovation and entrepreneurship, as startups worldwide are using fermentation's power to create new products and solve pressing issues like food waste and climate change. Here we will provide an overview of some of the most exciting fermentation startups and explore how they are changing the way we think about food and drinks.

| Startups | Ginkgo Bioworks | Bolt Threads | RootWave |

|---|---|---|---|

| Investors | Primarily financed through VC, with investors including Viking Global, Cascade Investment (Bill Gates' investment firm), General Atlantic, and Baillie Gifford. Also received funding from government agencies like DARPA and the Department of Energy. | Various types of financing, including Series A, Series B, Series C, Series D, and Series E funding rounds. Additionally, the company has announced various partnerships, collaborations, and grants throughout its history. Received funding from a number of investors, including Formation 8, Founders Fund, Innovation Endeavors, Baillie Gifford, and Foundation Capital, among others. | Has received a grant as it's the only known type of financing. The grant was provided in a single funding round referred to as Grant-IV. |

| Funds raised | $800.4 million | $334.1 million | $7.89 million |

| Fundraising rounds | 13 | 7 | 1 |

| Certification | CLIA, ISO 9001:2015, ISO 13485:2016 | ISO 9001 and ISO 14001 | ISO 14001 |

Ginkgo Bioworks

- Headquarters location: Boston, Massachusetts, United States

- Last funding type: Series B

- Total funding amount: $800.4 million

Ginkgo Bioworks is a biotech company founded in 2008 by five MIT scientists led by Jason Kelly. They use genetic engineering and fermentation technology to design and manufacture new organisms for various industries, including food, health, and energy. Their cell programming platform uses synthetic biology to engineer microbes for specific genetic capabilities to produce valuable compounds and materials. Ginkgo Bioworks has partnerships with major companies such as Bayer and Novartis and has received funding from investors, including Bill Gates and Viking Global Investors. The company is committed to sustainability and uses its technology to create environmentally friendly products, researching alternative proteins, dairy products, biofuels, and sustainable chemicals.

Bolt Threads

- Headquarters location: Emeryville, California, United States

- Last funding type: Series E

- Total funding amount: $334.1 million

Bolt Threads is a US-based biotech company specializing in sustainable materials inspired by spider silk. They engineer silk proteins with yeast and spin them into strong, stretchy, and biodegradable fibers. Bolt Threads' materials are used in apparel, consumer goods, and industrial products. Investors such as Foundation Capital and Formation 8 and partnerships with Patagonia and Stella McCartney fueled the company, which launched a necktie made of spider silk in 2017 that quickly sold out. Bolt Threads emphasizes sustainability and contributing to a greener future.

RootWave

- Headquarters location: Kineton, Warwickshire, United Kingdom

- Last funding type: Series A

- Total funding amount: $9.7 million

RootWave, a UK-based startup, is developing an organic and sustainable alternative to chemical herbicides using high-voltage electricity at the root level, demonstrating a beneficial solution for weed control. RootWave seeks to reduce harmful chemicals in agriculture, horticulture, and other industries. They've received investment from the EU's Horizon 2020 program and have won awards for their innovative technology, aiming to broaden their reach and impact on ecosystem management and agriculture.

Tissue engineering and regeneration

Tissue engineering and regeneration are among the fastest-growing fields in the healthcare industry, potentially revolutionizing medical treatments and procedures. Regenerative medicine aims to restore or replace damaged tissue, cells, or organs with a patient's cells or cells from a donor source. This approach has shown great promise in treating numerous diseases and injuries, including spinal cord injuries, diabetes, and heart disease.

In recent years, several startups have emerged, leveraging innovative technologies and research to develop new treatments and therapies for patients. Here we will provide an overview of the top tissue engineering and regeneration startup companies leading this exciting field.

| Startups | Avery Therapeutics | Lattice Medical | Prellis Biologics |

|---|---|---|---|

| Investors | VC investments, grants from government organizations or foundations, and partnerships with other companies. | EIC Accelerator grant and co-investment funding. | Received funding from a variety of sources, including seed funding, venture capital, and other forms of investment. |

| Funds raised | Over $700,000 in prior financing events. | $12.7 million, including a June 2022 EIC Accelerator grant of €2.5 million ($2.8 million USD) and €5 million ($5.5 million USD) in co-investments funding. | $64.9 million |

| Fundraising rounds | 1 | No data | 9 |

| Certification | Not disclosed. | ISO 9001, IATF 16949, and ISO 14001 | ISO 13485 |

Avery Therapeutics

- Headquarters location: Tucson, Arizona, United States

- Last funding type: No data

- Total funding amount: $500K

Avery Therapeutics is a startup that develops tissue-engineered therapeutics for heart failure. Their MyCardia product is designed to treat muscle disease and injury. The company was founded in 2018 and had funding from sources like NIH, BioInspire, and the Arizona Commerce Authority. The team comprises experts in stem cell biology, tissue engineering, and regenerative medicine, and their work strives to bring treatments to those without options and advance regenerative medicine.

Lattice Medical

- Headquarters location: Loos, Nord-Pas-de-Calais, France

- Last funding type: Series A

- Total funding amount: €12.7 million

Lattice Medical founded in 2013 specializes in biodegradable reconstructive surgical devices. Its Lattice scaffold supports cell regeneration, gradually breaking down and being absorbed by the body. The company focuses on innovative solutions, dedicating research to advancing regenerative medicine. Grants supporting research include the French Tech ticket program and European Union's Horizon 2020 research and innovation program. Lattice Medical aims to expand from breast reconstruction to orthopedic and cardiovascular surgery.

Prellis Biologics

- Headquarters location: Loos, Nord-Pas-de-Calais, France

- Last funding type: Series A

- Total funding amount: $64.9 million

Prellis Biologics company focuses on bioprinting and tissue engineering. They use holographic technology and human antibody discovery, providing potentially more effective solutions than traditional antibody or bioprinting methods. They aim to revolutionize transplant and donation by developing artificial tissues and organs. The company hopes to advance antibody treatments by predicting clinical results. They provide job opportunities on their website and investment possibilities, with pre-IPO options available.

Polymerase chain reaction technology

Polymerase chain reaction (PCR) technology is a widely used technique in molecular biology that can amplify specific DNA sequences from small amounts of starting material. This block will provide you with a comprehensive overview of PCR startups. Here are some biotech companies working in PCR technology.

| Startups | Karius | MedGenome |

|---|---|---|

| Investors | SoftBank, General Catalyst, and HBM Healthcare Investments | LeapFrog |

| Funds raised | $254 million | $185.5million |

| Fundraising rounds | Series B | Series Unknown |

| Certification | GMP, GLP, CLIA, CAP, and GDPR | ISO 15189, ISO 9001, ISO 27001, CLIA, CAP |

Karius

- Headquarters location: San Francisco Bay Area, California, USA

- Last funding type: Series B

- Total funding amount: $254 million

Karius is a biotech company that specializes in genomic sequencing-based diagnostic tests with over 1000 known pathogen identification possible from a single blood draw. Their testing service uses proprietary machine learning algorithms with shotgun metagenomic sequencing technology to identify and quantify pathogens to diagnose infectious diseases more efficiently. Karius's flagship product is the Karius Test, marketed to hospitals, labs, and physicians, and it detects viruses, bacteria, fungi, and parasites. They also provide testing for COVID-19 and Lyme disease. They received major funding from VC firms, presently used in US health centers.

MedGenome

- Headquarters location: County of New Castle, USA

- Last funding type: No data

- Total funding amount: $185.5 million

MedGenome is a genomics research and diagnostics company with offices in San Francisco and Singapore. Their genome-based solutions personalize healthcare, covering genetic testing, genomics research, drug discovery, and precision medicine. Their 1300+ tests, backed by cutting-edge testing technologies, can provide insights into disease and drug response for complex genetic disorders, cancers, and reproductive and infectious diseases.

This company provides research services to academic institutions, pharma, and other partners seeking to identify therapeutic targets or biomarkers. NGS services, single-cell sequencing, liquid biopsy, and more are available research solutions. They have funding from partners Sequoia Capital, Sofina, and HDFC Life; work with academic institutions and research centers; and plan to globally enhance disease prevention, diagnosis, prognosis, and treatment through genetic information decoding.

Nanobiotechnology

This industry refers to the application of nanotechnology in the field of biology and medicine. It aims to design and develop novel technologies and devices for disease diagnosis, drug delivery systems, and targeted therapies. In recent years, numerous startups have emerged that are working on innovative solutions in the field of nanobiotechnology. We will provide an overview of some of the startups that are making a significant impact and contributing to the growth and development of the field.

| Startups | Cellino | Nanovis |

|---|---|---|

| Investors | Leaps by Bayer | SBIR-funded projects |

| Funds raised | $100 million | $16.8 million |

| Fundraising rounds | 5 | No data |

| Certification | Not disclosed; FDA-compliant | Not disclosed; FDA-compliant |

Cellino

- Headquarters location: Boston, Massachusetts, USA

- Last funding type: Series A

- Total funding amount: $100 million

Cellino is a biotech startup democratizing stem cell-based therapies for eligible patients. Founded in 2017 by three Harvard University alums, Cellino automates and scales high-quality, genetically identical stem cell line production using CRISPR gene editing. They aim to expedite stem cell therapy development and delivery for various diseases and conditions. The company has won significant awards and funding from the NIH and presented at TechCrunch Disrupt 2021's Startup Battlefield. Cellino has the potential to transform regenerative medicine, with growing interest and investment in stem cell therapy development and delivery.

Nanovis

- Headquarters location: Columbia City, Indiana, United States

- Last funding type: Series A

- Total funding amount: $16.8 million

Nanovis is a biomedical startup that aims to enhance orthopedic and spinal implants through nanotechnology-based solutions for reducing infection rates, increasing implant lifespan, and improving osseointegration. The company employs proprietary nanotube surface technology named "nanoVIS Ti," which accelerates and improves bone tissue adhesion and proliferation. Nanovis also provides implants such as lumbar cages, cervical cages, and titanium plates designed to rectify spinal implant failure caused by alignment issues and poor osseointegration. Nanovis's commitment to clinical needs and research and development makes it an exciting company in nanobiotechnology.

Cell-based assays

The use of cell-based assays has become a crucial aspect of drug development and testing, providing highly relevant data for understanding the interactions between compounds and biological systems. With the increasing demand for assays accurately representing human biology, numerous startups have emerged, offering innovative solutions to improve and accelerate drug discovery processes. So we will provide an overview of some of the most promising cell-based assay startups.

| Startups | Asimov | Indee Labs |

|---|---|---|

| Investors | Canada Pension Plan Investment Board (CPP Investments), Northpond Ventures, GV, Lux Capital, Andreessen Horowitz, and others. | SOSV, a venture capital and investment firm |

| Funds raised | $175 million | $5.1 million |

| Fundraising rounds | Series B | 2 |

| Certification | Not disclosed; FDA-compliant | ISO 13485 |

Asimov

- Headquarters location: Boston, Massachusetts, United States

- Last funding type: Series B

- Total funding amount: $205 million

Asimov is a biotech company that specializes in the research and development of gene therapies, synthetic biology, and biologics. The company is to develop industrial-scale, full-stack genetic design with the ultimate goal of transforming healthcare. The company uses a combination of advanced biophysical models, software, machine learning, and genomic technologies to accelerate the discovery, design, and development of new therapeutics. Asimov is known for its multidisciplinary team, which includes experts in synthetic biology, computer-aided design, machine learning, and bioinformatics. The company has several partnerships with leading biotech firms and academic institutions, including the University of California, Berkeley. Recently, Asimov has received significant investment from leading venture capital firms, including Andreessen Horowitz and Fidelity Investments.

Indee Labs

- Headquarters location: San Francisco, California, United States

- Last funding type: No data

- Total funding amount: $5.1 million

Indee Labs is a biotech company based in Berkeley, California, that develops gene delivery technologies for personalized medicine. Their microfluidic platform delivers genetic material to cells with precision, which is important for developing cell and gene therapies. Indee Labs has partnerships with various firms and academic institutions and is backed by venture capital firms like Founders Fund and Y Combinator. The company aims to boost the adoption of gene and cell therapies in clinical practice.

DNA sequencing

The field of DNA sequencing has been revolutionized by technological advancements in the past decade. The sequencing of the human genome was a major milestone, and since then, there has been an explosion of startup companies focusing on DNA sequencing services. These companies offer a range of services, from whole-genome sequencing to targeted sequencing of specific genes, and are crucial in advancing our understanding of genetics and personalized medicine. This block will provide an overview of the top DNA sequencing startup companies and their services.

| Startups | 23andMe | Helix |

|---|---|---|

| Investors | Genentech, Google Ventures, and Fidelity Investments. | Illumina, GV (formerly Google Ventures), and Warburg Pincus. |

| Funds raised | $1.1 billion | No data |

| Fundraising rounds | 20 rounds | No data |

| Certification | CLIA licenses, FDA approvals, ISO 13485 | CLIA licenses, and FDA approvals |

23andMe

- Headquarters location: South San Francisco, California, United States

- Last funding type: Post-IPO Equity

- Total funding amount: $1.1 billion

23andMe is a genetics and research company offering at-home genetic testing services that reveal insights into users' ancestral origins, health risks, and genetic traits. The company also conducts genetic research to advance our understanding of diseases. 23andMe's customers can participate in studies by sharing their genetic data. Despite regulatory scrutiny, the company has raised over $1.1 billion in funding and remains popular with consumers.

Helix

- Headquarters location: San Mateo, California, United States

- Last funding type: Series C

- Total funding amount: $403 million

Helix is a genomics and personalized health company that offers DNA sequencing services and genetic insights to consumers. They partner with genetic testing companies to offer various DNA sequencing products, including ancestry testing, carrier screening, and wellness testing. One unique feature is that they provide access to third-party apps and services built on top of genetic data. Helix's services have been used globally to understand individuals' genetic makeup better and make more informed health decisions.

Please note that this is not an exhaustive list, and there may be many other biotech companies working in these fields.

Why should investors pay attention to biotech startups?

Most biotech startups often develop new and innovative technologies that have the potential to address unmet medical needs and improve patient outcomes.

Additionally, successful biotech startups may attract the attention of larger pharmaceutical companies or may be acquired, potentially resulting in significant financial gains for early investors. However, investing in biotech startups also comes with risks, as the industry is highly regulated and subject to scientific and clinical uncertainties. Therefore, investors should conduct thorough due diligence when considering investments in biotech startups.

According to various search results, the global biotechnology market revenue is projected to reach USD 1.68 trillion by 2030 or USD 3.44 trillion by 2030, with a compound annual growth rate (CAGR) of 13.9%. The actual revenue may vary depending on various factors, including market trends, regulatory environments, and the success of individual companies within the industry.

Increasing demand for nucleic acid and protein sequencing, private and government initiatives, and growth in proteomics and genomics, as well as advancing research on molecular biology and drug discovery, all contribute to the development of the bioinformatics segment. As a result of these factors, the bioinformatics segment is expected to see rapid growth during the forecast period.

In 2022, the nanobiotechnology sector held the largest market share. It dominated the biotechnology industry, with a compound annual growth rate (CAGR) of approximately 12.4% from 2022 to 2030, thanks to substantial investment in research and development. The rising need for treatments for severe illnesses drives the strong growth of this segment. At the same time, the polymerase chain reaction (PCR) technology segment is the fastest-growing within the biotechnology market, propelled by increasing demand for personalized and precise medicine, as well as advances in technology and its applications in drug development, leading to significant growth throughout the projected period.

| Technology | 2021 | 2022 | 2030 | CAGR(%) |

|---|---|---|---|---|

| Fermentation | 91.24 | 103.04 | 277.01 | 13.2% |

| Tissue Engineering and Regeneration | 211.43 | 236.90 | 598.08 | 12.3% |

| PCR Technology | 56.23 | 63.08 | 160.78 | 12.4% |

| Nanobiotechnology | 106.86 | 120.60 | 322.60 | 13.1% |

| Chromatography | 38.05 | 43.28 | 123.21 | 14.0% |

| Spectroscopy | 27.53 | 30.41 | 68.63 | 10.7% |

| Cell-Based Assay | 138.61 | 157.35 | 440.75 | 13.7% |

| DNA Sequencing | 181.22 | 203.70 | 526.48 | 12.6% |

| Others | 236.30 | 265.94 | 693.18 | 12.7% |

Currently, many institutions, venture capitalists, and companies provide various resources to assist with developing startup ideas. However, before embarking on this journey, it is beneficial to speak with individuals who have already established a startup, whether they are within your own. Although the journey is, challenging and strategic preparation can aid in reducing the impact of obstacles encountered along the way. In the end, the difficulties you will face are worthwhile in transforming innovations, papers, and concepts into products that enhance the quality of life for individuals.

Why do biotech startups fail?

Biotech startups may fail due to various factors, including scientific or management flaws, lack of funding, and regulatory barriers. However, beyond these common causes, several unexpected commonalities can lead to failure. These depend not on whether the founders come from academia or business but on their practical thinking abilities, common sense, and street smarts to navigate the challenges inherent in the biotech industry.

Not every failure shuts the doors. Some just fail to launch. They raise early money and survive on grants.

Several factors contribute to the failure of biotech startups. Here are some common reasons:

- Flawed science. Biotech startups often fail because the science behind their products is flawed or unproven. This can include issues with the efficacy or safety of the product.

- Inexperienced management. Poor management can also contribute to failure. Some startups may lack the necessary business acumen to successfully navigate the complexities of the biotech industry.

- Insufficient funding. Biotech startups often require significant amounts of capital to fund research and development. If they cannot secure adequate funding or mismanage their finances, they may run out of money and fail.

- Regulatory hurdles. The regulatory process for bringing a biotech product to market can be lengthy and complex. Startups may face difficulty navigating the process and obtaining necessary approvals.

- Timing. Bringing a biotech product to market can be a race against time. If a startup is unable to bring a product to market before competitors, it may miss its window of opportunity and fail.

It's important to note that many biotech startups fail despite their best efforts. The industry is inherently risky, and even the most promising companies may fail due to factors beyond their control.

Final thoughts

Despite the inherent risks, the biotech industry remains attractive for investors seeking high-growth potential. Although past performance cannot guarantee future success, investors can pinpoint some leading companies to track in 2024. By conducting comprehensive research, exercising due diligence, and staying informed about industry developments and trends, investors can make more informed choices regarding which biotech startups to invest in and increase their likelihood of success.

If you have decided to start your own biotech startup or already have concerns about technology, team building, or development, please book a free consultation with our team. We would be happy to answer any questions you may have.