Analyze with AI

Get AI-powered insights from this Mad Devs article:

Bitcoin is a dynamic ecosystem that continually evolves. Following the adoption of the ordinal theory, known as Bitcoin NFT or Inscriptions, the community has now shifted its attention to the latest trend: BRC-20.

BRC-20 is a new standard for creating tokens on the Bitcoin blockchain. In this article, we'll explore how BRC-20 works, its advantages and limitations. We'll also take a closer look at the current impact of BRC-20 on the Bitcoin ecosystem, and discuss what this trend could mean for the future of Bitcoin.

What is BRC-20?

BRC-20 is a token standard that was created as an experimental demonstration of off-chain balance states with inscriptions. It serves as a demonstration of how such systems can be implemented on the Bitcoin blockchain. The standard was proposed by a developer named domo and is based on ordinal theory, which allows non-fungible assets on the Bitcoin blockchain. The creator of BRC-20 has acknowledged that there are other, better solutions such as Taro and RGB for issuing assets on the Bitcoin blockchain.

Although BRC-20 and ERC-20 tokens may have similar names, they are different token standards that operate differently on their respective blockchains. It's important not to confuse them based solely on their naming.

How Does BRC-20 Work?

The BRC-20 standard includes several basic functions, such as deploy, mint, transfer, and several variables. To create a new BRC-20 token, you need to inscribe a specific JSON. For example, to create a token called MADD:

{

"p": "brc-20",

"op": "deploy",

"tick": "madd",

"max": "21000000",

"lim": "1000"

}- "p" = protocol

- "op" = operation

- "tick" = four char ticker (case insensitive MADD=madd)

- "max" = max supply

- "lim" = limit of tokens that can be minted in 1 transaction

Once you've successfully deployed a new token using the BRC-20 standard, you can mint some tokens using the 'mint' function. For example, to mint 1000 units of the MADD token that we created earlier, you can use the following JSON:

{

"p": "brc-20",

"op": "mint",

"tick": "madd",

"amt": "1000"

}Note: "amt" should't exceed "lim" specified during token deployment.

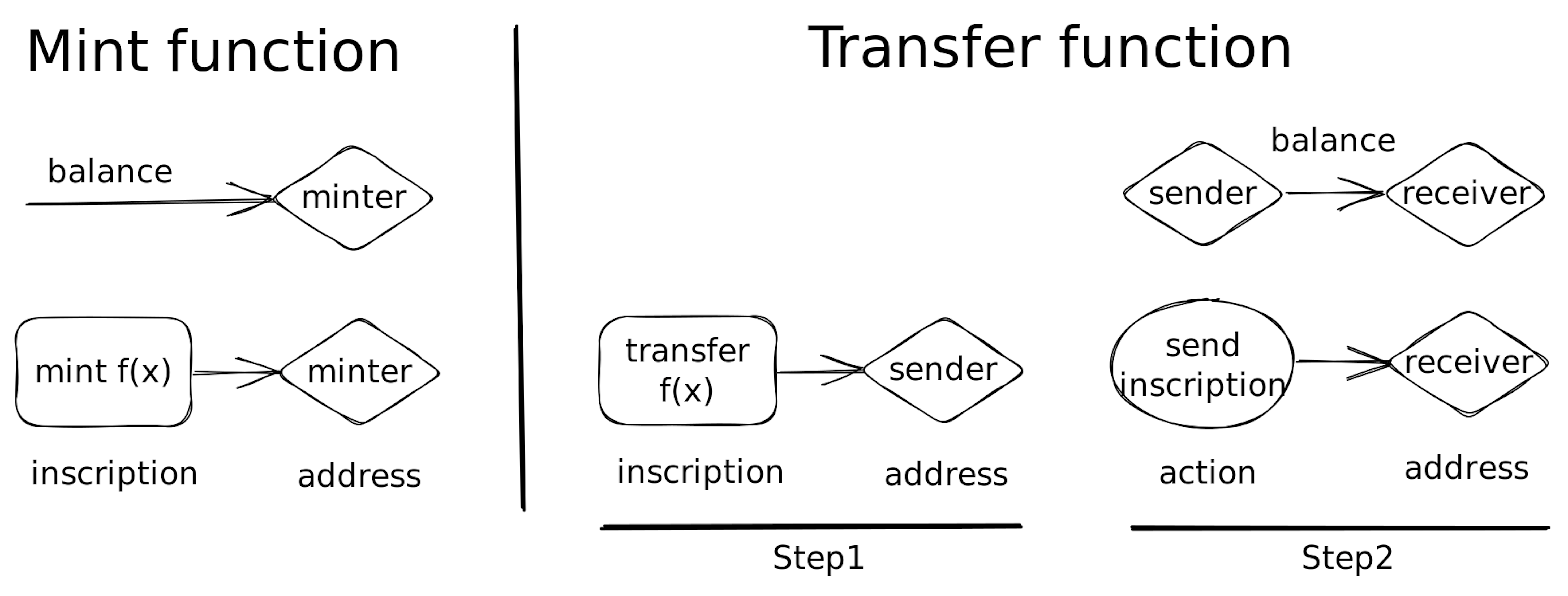

To send your newly-minted MADD tokens to your friends, you can use the 'transfer' function. For example:

{

"p": "brc-20",

"op": "transfer",

"tick": "madd",

"amt": "1000"

}To send BRC-20 tokens, two transactions are required. First, you must initiate a transfer to yourself by inscribing a 'transfer' operation. Then, you can send the tokens to another address by sending this inscription.

If you need more detailed information on how to create and use BRC-20 tokens, look at this diagram that illustrates the different operations or refer to this GitBook.

BRC-20 Limitations and Advantages

BRC-20 has its limitations and advantages. One of its main features, but also a limitation, is its immutability. Once a new BRC-20 token is created on the Bitcoin blockchain, its supply, minting limit per mint, and ticker are immutable after the initial deployment. Unlike on EVM chains, you cannot deploy more tokens using the same ticker.

However, this immutability also means that BRC-20 tokens cannot be updated or modified, which can be a disadvantage. In contrast, on some EVM chains, developers can change smart contracts, inflate/deflate amounts, or blacklist addresses. These options do not exist within BRC-20 tokens. There are no smart contracts and no risk of rug pulls.

Additionally, the minting of BRC-20 tokens is always a "fair mint" issuance. It runs over a number of blocks, and those who pay the most for the blockspace get an allocation. This can be seen as an advantage for those who prioritize fairness in token issuance.

Current impact of BRC-20 standard

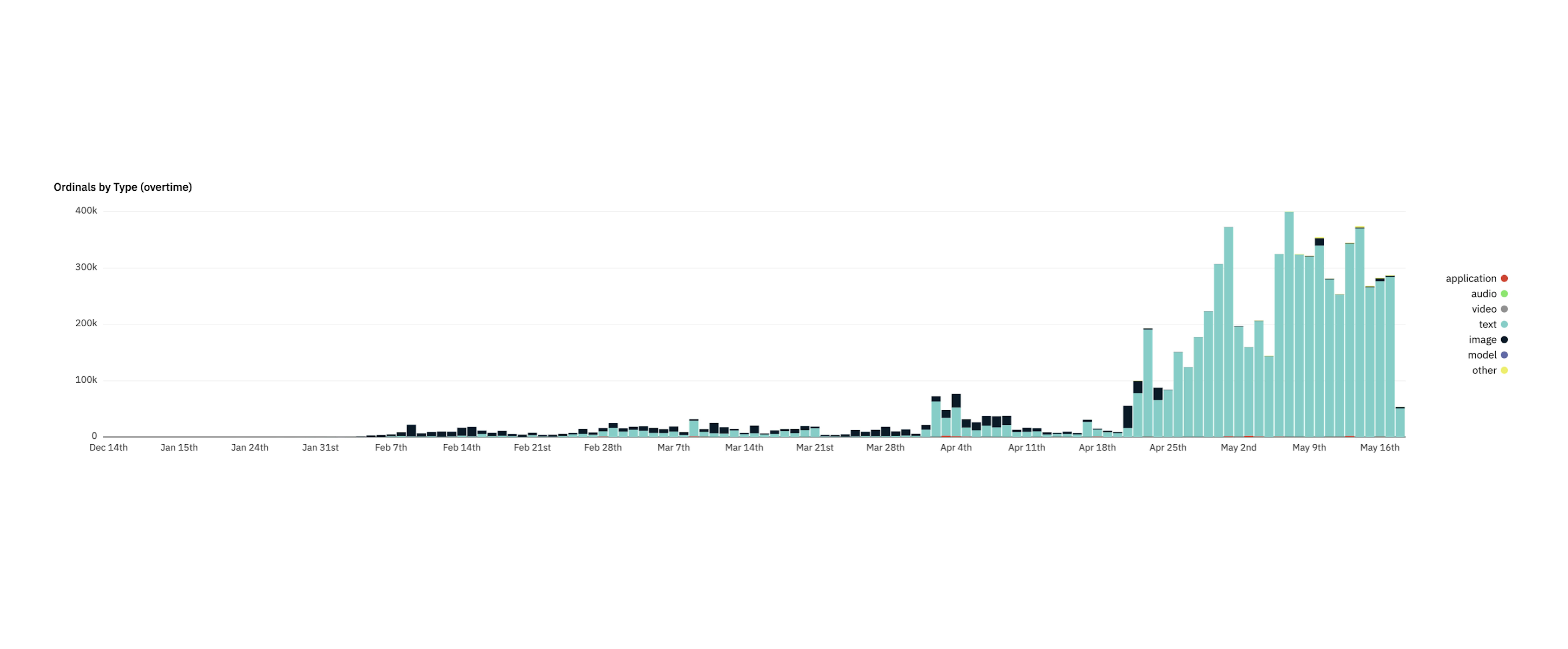

After a couple of months of primarily inscribing images, the community started massively inscribing text.

The sharp rise of text-type inscriptions started since Apr 25, 2023

Since BRC-20 is a relatively new standard, initially, there were not many web tools available to interact with it. Using inscription services at that time was not recommended since some services would inscribe to themselves first and then transfer them to the customer, resulting in the intermediate inscription service address keeping the balance. Now, the situation has evolved, and most services work correctly with BRC-20.

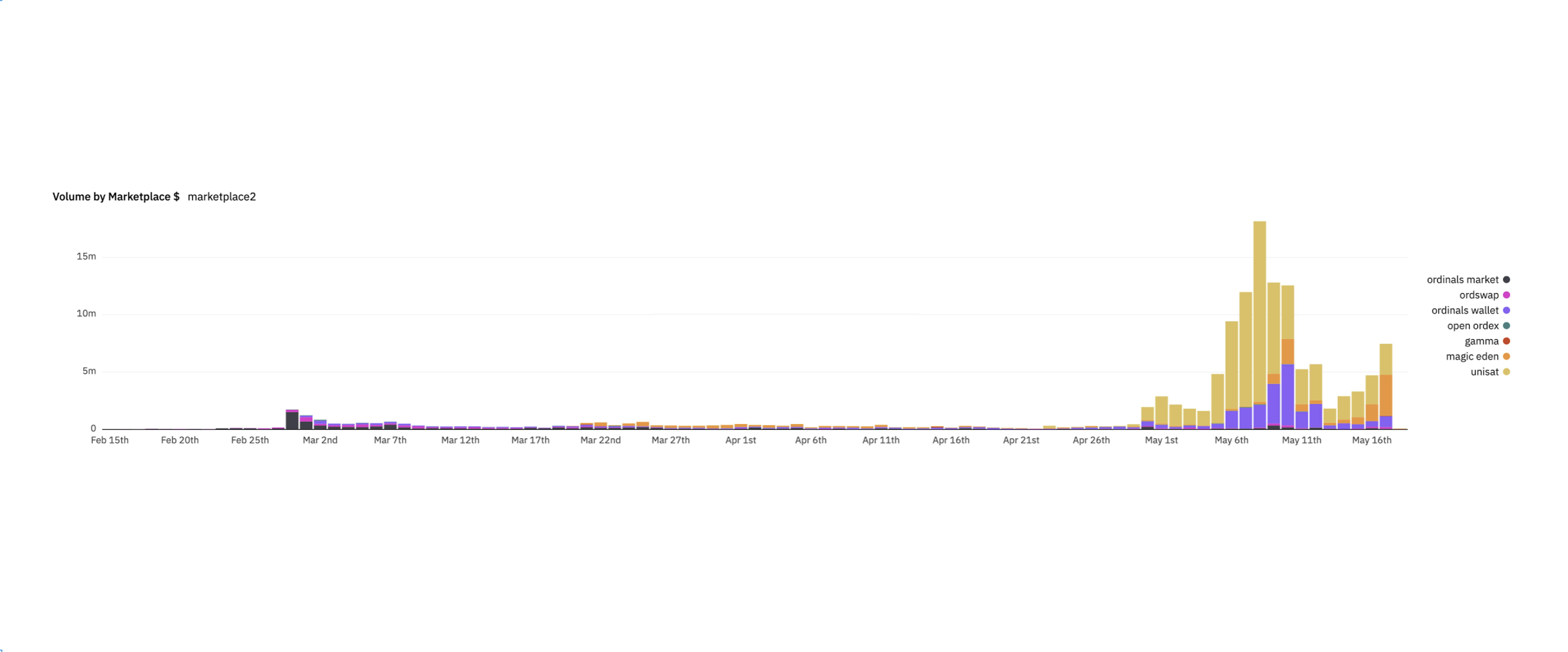

However, there was a savior for the BRC-20 community: UniSat. Highly recommended by the first BRC-20 adopters, UniSat offers both a wallet and a website. The UniSat wallet is an open-source Chrome extension for BRC-20 and inscriptions, while the UniSat website has an inscription service that is safe to use with BRC-20 tokens, a marketplace, and a BRC-20 indexer.

UniSat is nearly the only place for the general public to mint and deploy BRC-20 tokens, which has resulted in its popularity. Unisat quickly became a dominant player in the market.

Unisat inscription service volume is 2-3 times higher than inscription marketplaces

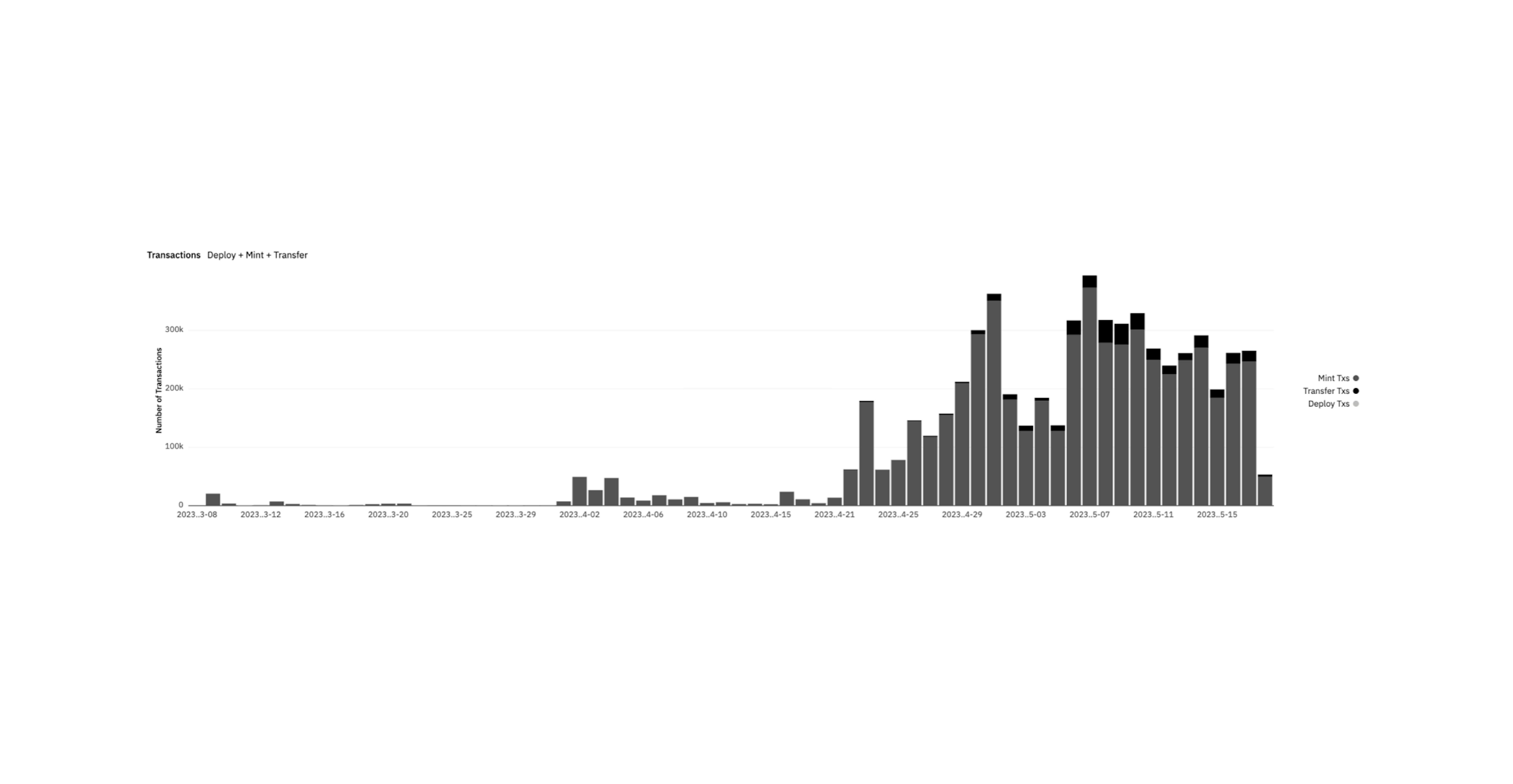

The idea of a fair launch has become increasingly popular within the community, resulting in a significant demand for the creation of new BRC-20 tokens.

85% of all BRC-20-related transactions are users minting new BRC-20 tokens

As the popularity of BRC-20 grows, there have been some unintended consequences. Users are competing to have their transactions included in the next block, which leads to a significant increase in fees paid for transactions. This competition has resulted in a surge in the Bitcoin fee market, with some users paying up to $15 in fees to guarantee priority processing in the Bitcoin blockchain.

Users are paying up to $15 in fees to ensure their transaction is included in the next block.

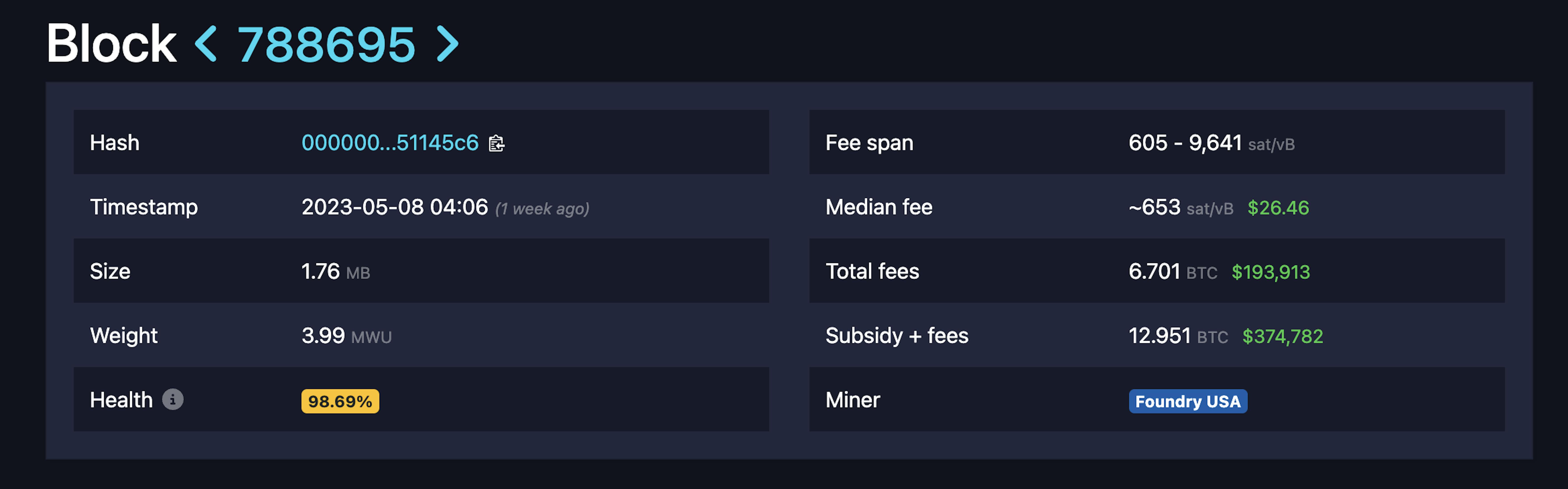

Fees became so unpredictable that even the major exchange platform Binance paused BTC withdrawals for a couple of hours. For the second time in Bitcoin history, fees collected by miners have exceeded the mining subsidy (currently 6.25 BTC per block) in block #788695. The first instance occurred during the block size wars in 2017 in block #500521.

Historical block with fees exceeded mining subsidy

Final words

These events have sparked important discussions within the Bitcoin community. Valid questions have been raised regarding the benefits of digital items priced in BTC and sold using the Bitcoin blockchain, as well as the implications of the rising number of users interested in this kind of innovation for Bitcoin. Additionally, there are concerns about the impact of users paying high fees for minting BRC-20 tokens, and whether it is beneficial for the Bitcoin security model or if it qualifies as spam on the network.

Prior to ordinals theory, only a small percentage of newly created outputs were taproot, but now it accounts for more than 50%. High fees could potentially incentivize more users to adopt Layer 2 scaling solutions like Lightning, or alternatively, it could lead to the emergence of new solutions such as drivechains, spacechains, or validity rollups.

While BRC-20 may not be a practical or widely-adopted standard, it is still an interesting development in the ongoing evolution of the Bitcoin ecosystem. Its experimentation with non-fungible assets could inspire other developers to explore new ways of using the Bitcoin blockchain for a wide range of applications.