Analyze with AI

Get AI-powered insights from this Mad Devs article:

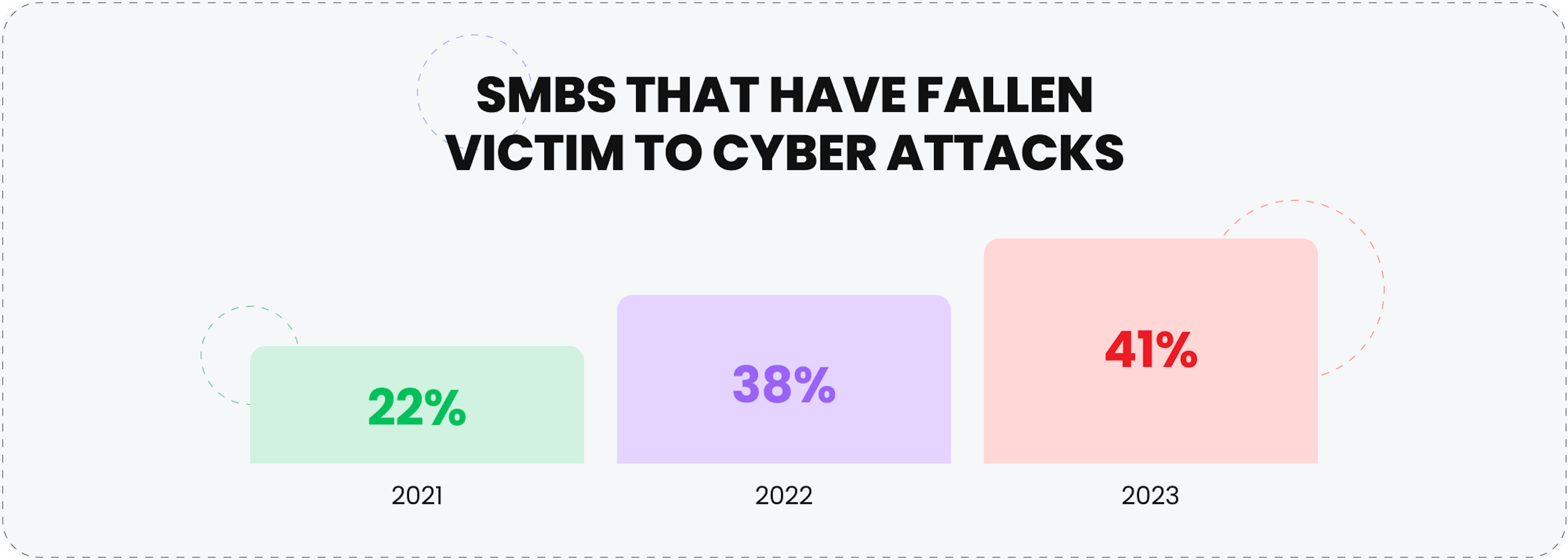

41% of small businesses fell victim to a cyber attack in 2023, an increase from 38% of attacks in 2022, and there is no sign that the number will decrease in the near future. Data has become an essential part of our lives, from making purchases to saving money and tracking our health. Consumers share personal information with many companies and services, which in turn makes these businesses targets for attacks.

While no company is safe from the prying eyes of threat actors, small and medium businesses (SMB) are more at risk than larger companies and enterprises due to the sensitive data they process and a typical lack of robust cybersecurity infrastructure.

The repercussions of a cyberattack can be devastating for SMBs, from damage to their reputation to even business closure. Luckily, insurance companies have adjusted to this new reality and offer businesses cyber liability insurance. This article will explain what this type of insurance is and how it can help SMBs.

What is cyber liability insurance?

Cyber liability insurance is a type of coverage designed to protect businesses from financial losses from cyberattacks, data breaches, and other cyber-related incidents. We'll explain in detail what these plans can cover, but they typically include a business's expenses pre-breach and post-breach. Cyber liability insurance helps businesses mitigate the financial impact of cyber risks and ensures they can recover more quickly after an attack.

Who needs cyber insurance and why?

Given the increasing frequency of cyber threats, it's an essential component of a comprehensive risk management strategy for businesses of all sizes. Data is everywhere today, including sensitive personal information. Any SMB with online purchases will have access to a customer's card information and address. Likewise, healthcare organizations hold other types of personal data. Educational businesses have access to more data, as do government and public services.

What does cyber liability insurance cover?

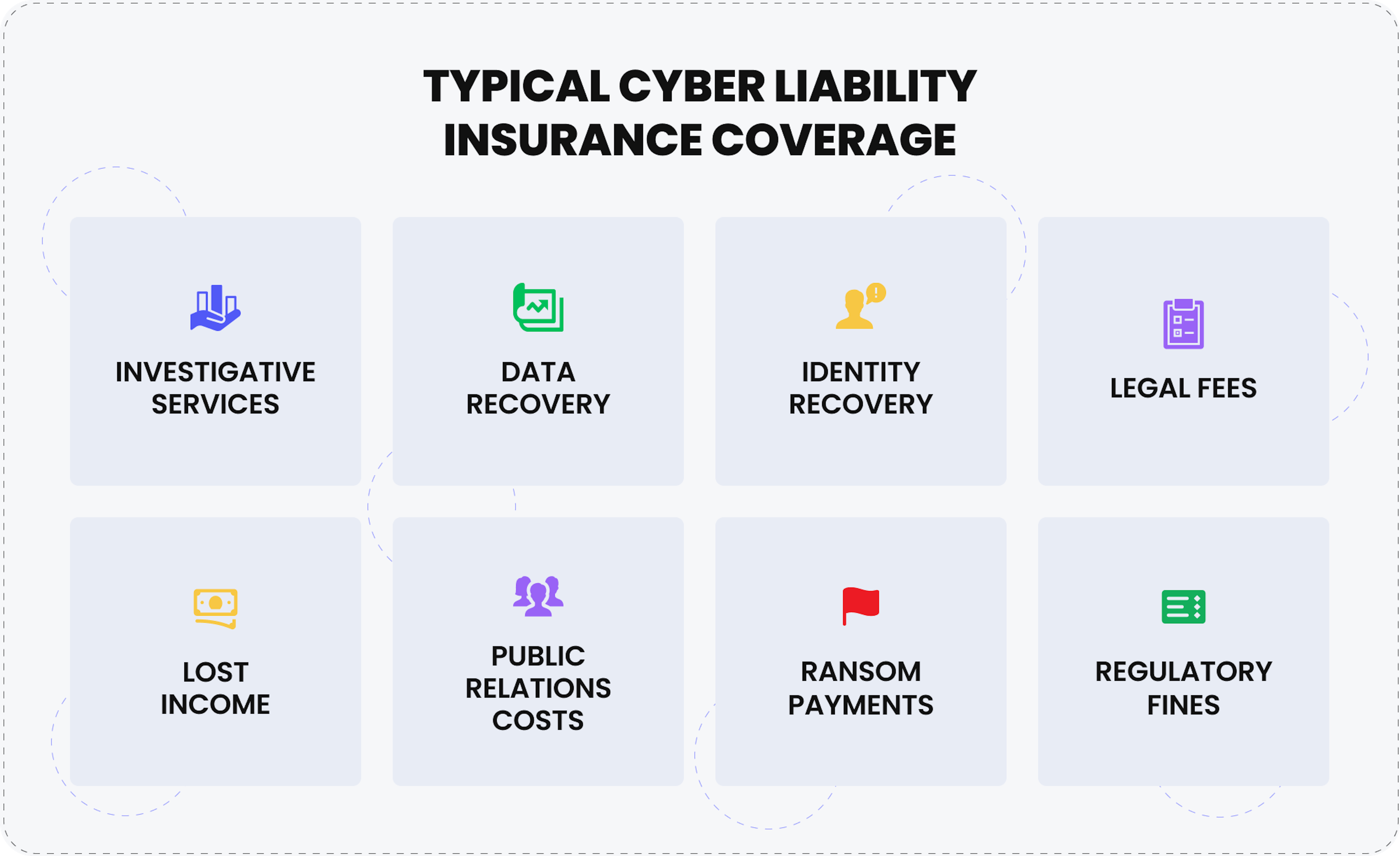

It typically covers costs associated with data recovery, legal fees, regulatory fines, and customer notification following a breach. This insurance may also include protection against third-party claims for damages caused by a business's failure to safeguard sensitive information.

Here is a list of specific cases that are covered by cybersecurity insurance:

- Investigative services: Costs related to determining the source of a cybersecurity breach.

- Data recovery: In cases when data has been lost or corrupted.

- Identity recovery: These are expenses related to securing identity after a breach.

- Legal fees: If customers or partners sue a business due to damages caused by the breach.

- Lost income: Expenses connected with network outages.

- Public relations costs: Such as marketing and other activities to restore the company's reputation after a data breach.

- Ransom payments: Sometimes threat actors steal data or deny users access and demand money to restore the data.

- Regulatory fines: These may be imposed due to a breach.

What are the common exclusions in cyber liability insurance policies?

Each plan will differ in terms of its coverage and exceptions. However, certain circumstances and expenses are not typically included in cyber insurance for small businesses:

- When third-party systems are at fault: If your business was affected by a breach at another company. Some plans include add-ons for “dependent system failure.”

- Criminal proceedings: Policy may not cover legal fees connected with criminal proceedings.

- Intentional acts: If it is found that you are responsible for the breach or you or your employees have knowingly committed fraud.

If you remove the context of cyber security, these terms are similar to those in any insurance policy. If a business is shown to be involved in the damage or to have committed the breach on purpose, there is no chance of covering it under a policy.

How much does cyber liability insurance cost?

Like any insurance policy, cyber security insurance costs are affected by many factors, such as:

- Industry and risk factor: Certain businesses are more likely to be targeted for attacks and will pay more for coverage.

- Type of coverage: Add-ons to a policy, such as coverage for breaches of third-party systems, can increase the cost. You can also choose to cover only direct attacks on your business.

- Number of employees: More employees could mean a higher level of risk.

- Policy limits and deductibles: Many policies allow you to select a level of coverage based on your specifications.

- Previous history: Any previous data-related incidents could affect the final cost of your policy.

Despite the variables involved, there are statistics on the average cybersecurity insurance cost. According to Insureon, it was $145 per month. While the benefits can outweigh the costs of a policy, especially given the risks associated with data breaches, businesses may find it hard to allocate the funds if other expenses are also high.

How can I reduce the cost of cyber liability insurance?

Fortunately, there are steps businesses can take to keep the cost of their policy as low as possible while still enjoying the benefits of its protection. Here is what you can do:

Take steps to protect your data

Demonstrate to the insurance company that you take security seriously by getting ISO 27001 or SOC 2 certification. You can also define clear protocols and guidelines for working with data. This will reduce the chance of breaches and help keep your premium low.

Bundle policies

If your business requires other types of insurance or you already have policies with a particular provider, consider purchasing all the coverage you require from one company. You can get a discount and having all your policies in one place makes them easier to manage.

Pay the annual premium immediately

If the options mentioned above aren’t available to your business, you can pay the premium right away. While this can be a large up-front expense, it can save a business money in the long term.

Research policies to see which ones offer the largest discounts.

How do I choose the right cyber liability insurance policy?

Besides the obvious budget restrictions your business may face when choosing a policy, it is also helpful to consider some of the factors mentioned in previous sections of this article. The cyber security insurance requirements for any policy you review are based on:

- Your industry

- The type and volume of data you use

- Your company's size and plans to scale

- Level of technical skill

Understanding these aspects will help you filter through the many options available for business owners to find those that best suit your needs. Once you have done this, you can use our list of ten of the most highly-rated cyber security insurance providers globally for 2024 to start your research.

Top 10 cyber security insurance companies

These companies have been highlighted for their ability to innovate, provide strong financial backing, and offer Comprehensive coverage tailored to the evolving landscape of cyber threats.

1. Beazley

A leader in the cyber insurance market, particularly noted for its strong claims performance and innovation in covering complex cyber risks.

Pros

- Claims handling: Beazley is highly regarded for its efficient and reliable claims process, receiving awards for its claims performance.

- Specialized coverage: They offer tailored policies for various industries, ensuring coverage meets specific needs.

- Proactive risk management: Beazley provides comprehensive resources and tools to help companies manage and mitigate cyber risks.

Cons:

- Higher premiums: Due to their specialized coverage and strong reputation, Beazley’s policies may come with higher premiums.

- Complex policy terms: The detailed and specialized nature of their policies might make them complex and difficult to understand for some businesses.

- Limited global reach: While strong in the UK and US, Beazley’s presence may be limited in other regions compared to some competitors.

2. Chubb

Offers a comprehensive range of cyber insurance products, focusing on coverage for both large corporations and small to medium-sized enterprises (SMEs)

Pros:

- Global coverage: Chubb offers extensive global cyber insurance coverage, making it suitable for businesses in different regions.

- Comprehensive services: Their policies often include incident response services, helping businesses manage breaches effectively.

- Customizable policies: Chubb provides highly customizable options to fit the needs of different industries and businesses of different sizes.

Cons:

- Stringent underwriting: Chubb's underwriting process can be strict, potentially making it difficult for some businesses to qualify for coverage.

- Potentially high costs: Their comprehensive and customizable options can lead to higher policy costs.

- Complex claims process: Some clients have reported challenges in navigating Chubb’s claims process, especially in complex cases.

3. AIG

Known for its broad cyber insurance offerings and strong financial backing, AIG is a top choice for companies seeking robust cyber protection.

Pros:

- Financial strength: AIG's strong financial backing ensures reliability and trust in their cyber insurance offerings.

- Wide range of coverage: They offer a broad spectrum of cyber insurance products, covering various cyber risks and incidents.

- Global expertise: AIG's global presence and expertise make them a preferred choice for multinational businesses.

Cons:

- Higher premiums: AIG's Comprehensive coverage options often come with higher premiums.

- Lengthy underwriting process: The underwriting process can be lengthy and detailed, which might slow down the policy issuance.

- Complexity of policies: The wide range of options and coverage can make it difficult for businesses to select the most appropriate policy.

4. Tokio Marine HCC

Recognized for its educational resources and financial strength, Tokio Marine HCC has consistently won awards for its cyber insurance products.

Pros:

- Educational resources: Tokio Marine HCC offers policyholders extensive educational materials and resources, enhancing their understanding of cyber risks.

- Strong financial stability: The company's financial strength adds a layer of security and reliability to its policies.

- Innovative coverage options: Tokio Marine HCC is known for its innovative approach to cyber insurance, offering cutting-edge coverage options.

Cons:

- Limited availability: Their policies may not be available in all regions, limiting their global reach.

- Targeted at larger businesses: Some of their offerings may be more suited for larger enterprises, potentially limiting appeal for SMEs.

- Complex policy structures: The innovative nature of their policies may lead to complex terms and conditions.

5. AXA XL

Offers extensive global coverage and has a strong reputation for providing tailored cyber insurance solutions for various industries.

Pros:

- Comprehensive coverage: AXA XL offers extensive coverage, including specialized options for different industries.

- Strong global network: Their global network allows them to offer consistent coverage and support across multiple regions.

- Risk management support: AXA XL provides robust risk management tools and services to help businesses mitigate cyber threats.

Cons:

- High costs: The extensive coverage and global reach of AXA XL can result in higher premiums.

- Complex policy wording: Their policies can be complex, which may require businesses to spend more time understanding the terms.

- Strict underwriting criteria: AXA XL may have stringent underwriting requirements, potentially limiting access for some businesses.

6. Munich Re

A major player in reinsurance, Munich Re also provides cyber insurance products that are backed by its vast experience in risk management.

Pros:

- Reinsurance expertise: As a major reinsurer, Munich Re brings extensive risk management experience to its cyber insurance products.

- Tailored coverage: Their policies are highly customizable, allowing businesses to get coverage that suits their specific needs.

- Global presence: Munich Re's global operations provide consistent and reliable coverage worldwide.

Cons:

- High premiums: Munich Re's specialized and tailored policies often come with higher premiums.

- Complexity: The customization options can make the policies complex and harder to navigate for some businesses.

- Potential limited direct coverage: As primarily a reinsurer, some businesses may find their direct offerings less accessible.

7. Liberty Mutual

Offers a variety of cyber insurance solutions with a focus on risk prevention and incident response services.

Pros:

- Comprehensive cyber services: Liberty Mutual offers a range of cyber services, including incident response and risk management.

- SME focus: They provide policies tailored for small to medium-sized enterprises, making them accessible to a wider range of businesses.

- Strong claims support: Liberty Mutual is known for its strong support in handling and processing claims.

Cons:

- Limited global reach: Compared to other global giants, Liberty Mutual’s presence might be less extensive in some regions.

- Less specialized: While comprehensive, their offerings might be less specialized compared to niche cyber insurance providers.

- Potentially higher costs for SMEs: Despite their focus on SMEs, some smaller businesses might find the premiums slightly higher.

8. Allianz

Provides a wide range of cyber insurance policies with a strong emphasis on global reach and comprehensive risk management strategies.

Pros:

- Global coverage: Allianz provides cyber insurance with a truly global reach, making it ideal for multinational companies.

- Comprehensive risk management: They offer robust risk management services alongside their insurance products, helping businesses mitigate risks proactively.

- Financial stability: Allianz's strong financial position adds security and reliability to their offerings.

Cons:

- Higher premiums: The global reach and comprehensive services of Allianz can lead to higher insurance premiums.

- Complex claims process: Some clients have reported challenges with the claims process, particularly for complex cases.

- Less tailored for SMEs: Allianz's offerings may be more geared towards larger corporations, potentially limiting appeal for smaller businesses.

9. Zurich

Known for its tailored cyber insurance products, Zurich offers coverage for data breaches, business interruption, and other cyber risks.

Pros:

- Tailored solutions: Zurich is known for providing customized cyber insurance solutions that meet the specific needs of different industries.

- Global expertise: Their global presence and experience make them a strong choice for multinational enterprises.

- Strong risk management support: Zurich offers extensive risk management services to help businesses prevent and respond to cyber incidents.

Cons:

- High costs: Zurich's customized and Comprehensive coverage options can result in higher premiums.

- Complexity of coverage: The tailored nature of their policies can make them complex and difficult to understand for some businesses.

- Strict underwriting criteria: Zurich may have strict underwriting guidelines, making it harder for some businesses to qualify for coverage.

10. CFC Underwriting

Specializes in cyber insurance for SMEs, providing Comprehensive coverage that includes risk management and response tools.

Pros:

- SME focus: CFC Underwriting specializes in providing cyber insurance for small to medium-sized enterprises, offering accessible and affordable coverage.

- Innovative products: They are known for their innovative approach, offering products that cater to emerging cyber threats.

- Strong claims handling: CFC has a reputation for efficient and supportive claims handling, particularly for SMEs.

Cons:

- Limited large enterprise focus: CFC's offerings are primarily tailored for SMEs, which might not be ideal for larger enterprises.

- Regional limitations: Their coverage may be more limited geographically compared to larger global insurers.

- Potentially higher premiums for high-risk industries: SMEs in high-risk industries might find premiums slightly higher.

Expert assistance

Cyber security and insurance policies may sound like a complex topic. Still, starting to take basic steps to protect business and user data is easy. When the details start to become confusing, Mad Devs is ready to help advise your company on best practices and conduct analyses of your current security measures to demonstrate your serious approach to data safety to insurance companies.