The increasing number of banks and fintech firms using cash flow management software to improve their efficiency and boost the market's growth is expected to drive the market's development. Besides managing multiple functions, such as online banking and bill payments, this software provides users various advantages, such as mobile billing and report groups.

The global cash management market is expected to grow at a rate of 12.6% during the next few years. It is estimated that the market will be valued at around $25.37 billion by 2027. The primary factors that are driving the growth of the finance software market are the increasing number of people using mobile applications and the increasing number of enterprises focusing on digitization. The market is also growing due to the increasing number of internet users worldwide.

To ensure that your company's operations are running smoothly and efficiently, you should consider investing in a cash management system. It can manage your cash flows and provide you with the necessary insight to make informed decisions.

This article will describe the importance of cash flow management and provide a list of the most powerful and useful software.

Why should you use cash flow management software?

A study conducted by U.S. Bank revealed that 82% of small businesses fail when it comes to dealing with cash flow issues. The main reason why these businesses fail is due to their lack of knowledge about how to manage their cash flow.

Many companies and individuals' primary source of income is cash. To meet its obligations and maintain business stability, a company's cash flows must be managed properly. In addition to meeting its financial obligations, a cash management system can also help minimize risk by allowing employees to earn a return on their idle cash.

A cash management system is a tool that enables companies to manage their cash flows. It can be used to forecast and report on various aspects of their operations, such as their foreign exchange and interest payments.

It can integrate with various accounting software and ERP systems and can be customized to meet the needs of different companies. Depending on the complexity of the solution, the average cost of building a cash management system is $150,000 to $400,000.

Most companies have a chief financial officer or a business manager responsible for overseeing their cash flow management. Other individuals such as corporate treasurers and business managers are also usually responsible for the overall strategy and execution of cash management.

There are various metrics that cash management executives can use to monitor and analyze their company's cash flows. These include quarterly, monthly, and annual reports.

The cash flow statement is a vital part of any cash management system. It is typically reported to the company's stakeholders on a quarterly basis, but it can also be maintained and tracked daily. This report shows all of the company's cash flows, including all of its interest payments and foreign exchange transactions, and determines how much money it has available.

Here is case study how Mad Devs implemented the B2B payment management solution – BandPay. BandPay is a milestone based payments platform that takes on the duties of a project manager, a lawyer, and an accounting officer, enabling people to run their business effectively.

Challenges without cash flow management

Poor liquidity: Without a cash management system, it is hard to keep track of the company's available cash. If a company goes short on cash, it can be forced to make late payments to banks and vendors, which can result in higher interest rates and damage the company's credit score.

High costs: Maintaining a cash flow is a complex operation that involves a variety of expenses, such as advertising, legal fees, accounting fees, repairs, taxes, and supplies. Without a cash management system, it can be very costly to perform this process.

Poor decision-making: The lack of cash flow management can lead to various problems, such as inaccurate reports and confusion. This can also affect the company's ability to make sound business decisions. Having a poor cash management system can prevent the treasury from seeing the trends and issues in the company's operations.

What is the difference between revenue, profit, and cash flow?

When it comes to starting a business, one of the most common questions that new entrepreneurs ask is, "What is the difference between profit and cash flow?" While profit and cash flow are important financial measures, they are not the same.

First of all, let's clarify the difference between revenue and profit:

Revenue: The amount of money that’s come into your business from direct business activity (such as sales) or investors.

Profit: The amount of money that's left over after all of your expenses are paid is known as profit. To determine this, take the revenue coming into your company and divide it by the number of expenses. If the amount of money coming into your business is lower than what's required to pay your expenses, you're not making a profit.

And cash flow refers to the amount of money that a business is able to spend on and out of its operations at a given time. It's the money that it has available to meet its current and near-term obligations, such as paying employees and suppliers.

Types of cash flow

6 types of cash flows are used in financial analysis. These tools are powerful tools that can help you run your business and make informed decisions.

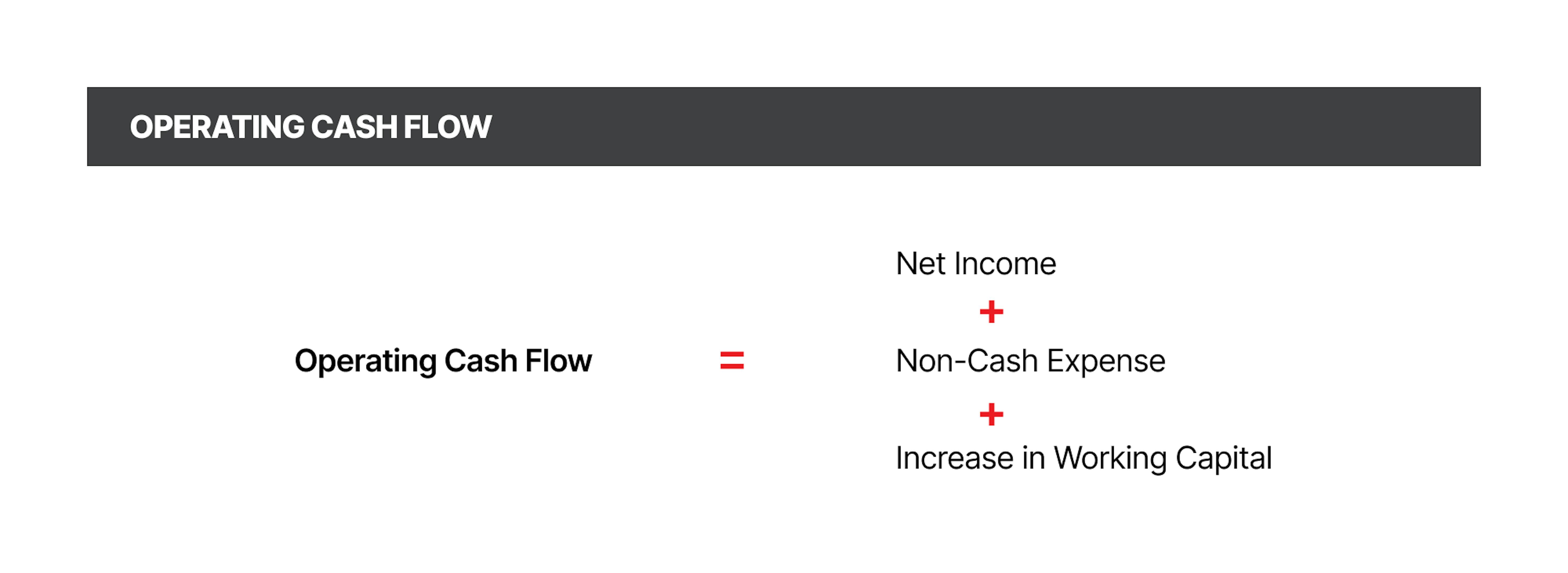

Cash flow from operations

The cash flow from operations is a measure of a company's ability to generate money from its regular operations. It shows whether or not it has enough funds available to pay its bills and operating expenses. Having more operating cash flows than cash outflows is considered to be a sustainable business strategy.

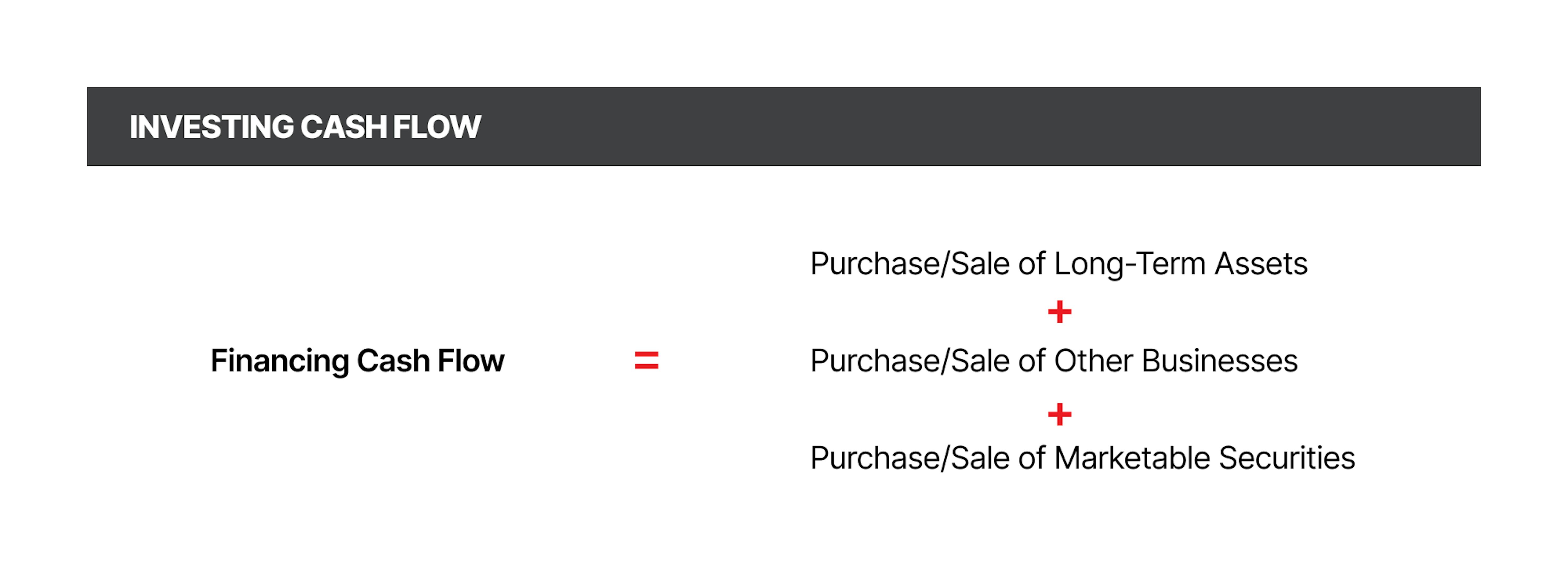

Cash flow from investing

The cash flow from investing is a measure of the amount of money that a company generates from its various investments. These activities include the purchase of securities or assets, as well as the sale of those assets.

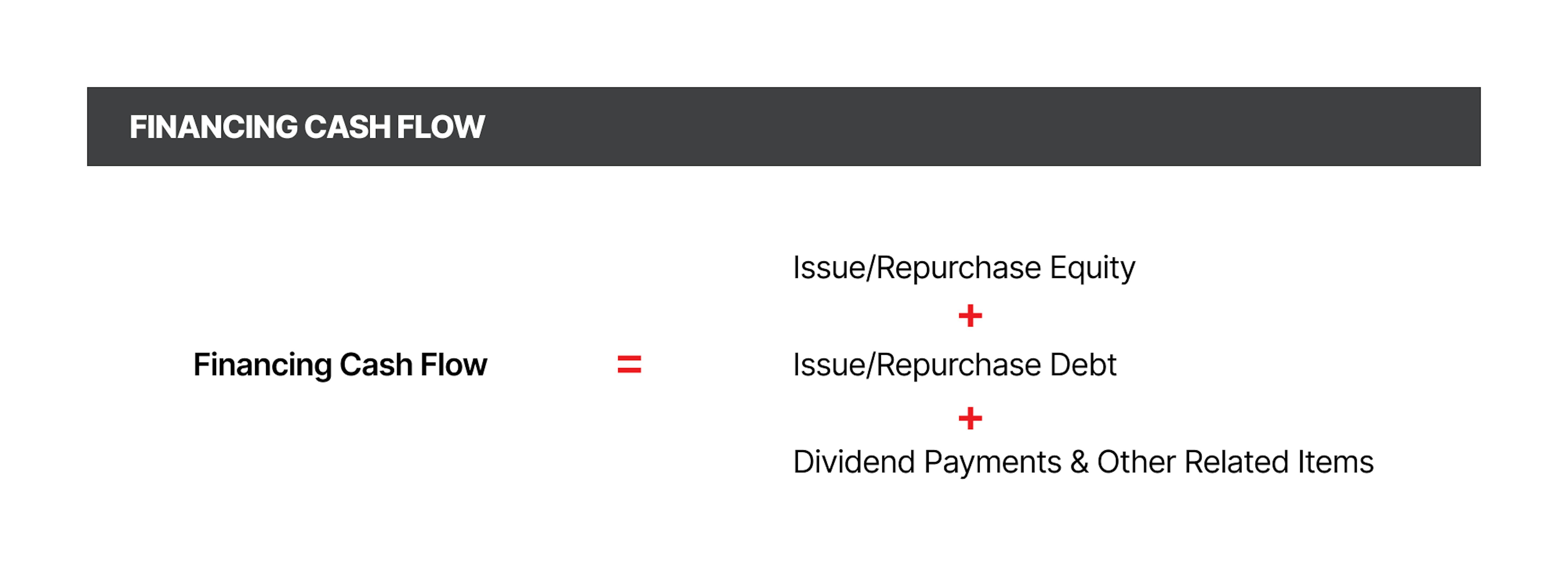

Cash flow from financing

The cash flow from financing activities is a measure of the company's ability to fund its operations and capital. These activities include the issuing of debt and equity, as well as the payment of dividends.

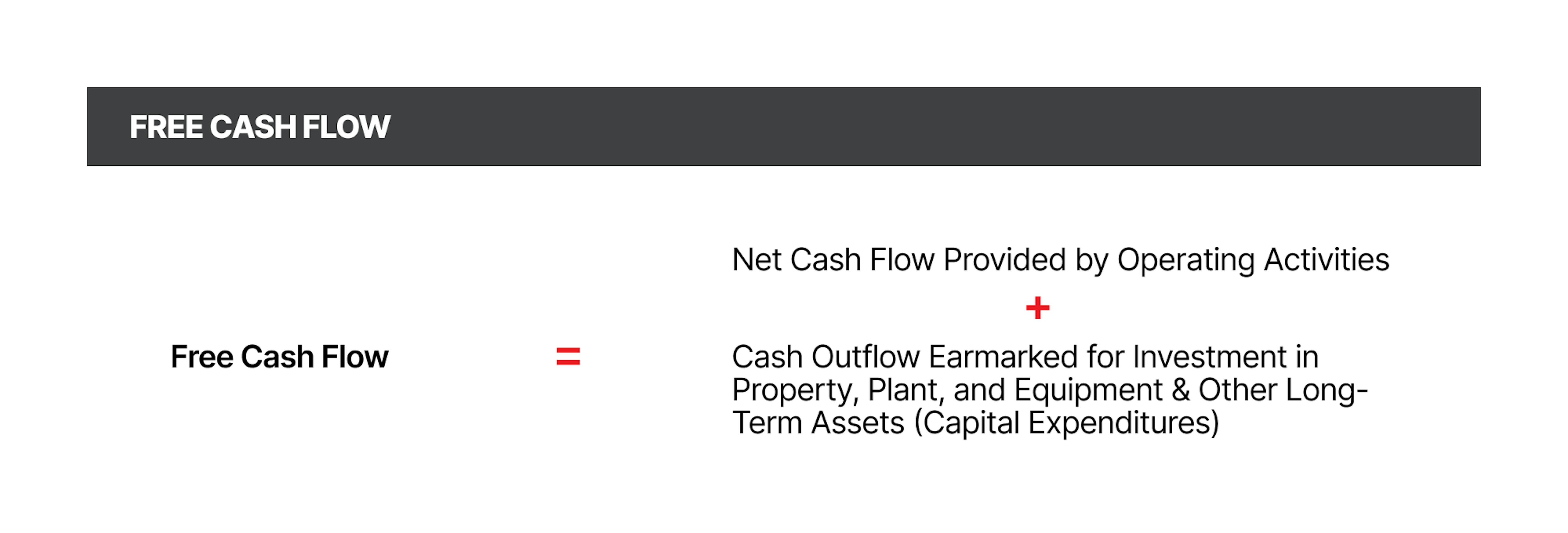

Free cash flow

The free cash flow of a company is a measure of its profitability. It shows how much money it has left over to reinvest in the business or return to its shareholders.

Unlevered free cash flow

Unlevered free cash flow is a measure of a company's overall financial flexibility. It excludes interest payments and other financial obligations. Before taking into account these obligations, UFCF shows how much cash a company has available.

The unlevered free cash flow of a company is different from the levered free cash flow of a company. It shows whether the business is operating with a healthy level of debt or overextended.

Discounted cash flow

A discounter cash flow analysis is a method that takes into account the expected cash flows from an investment. It then tries to estimate the value of an asset by taking into account how much money it will earn in the future.

How do you manage cash flow and profit?

The timing of your cash flow management strategy is the most important to ensure that it's working properly. For instance, if your bills are due at the start of the month, you might not have the money in the bank to pay them. On the other hand, if you make more than you spend during the month, you might have a cash flow problem.

Here is how to deal with profit – If you're not profitable on paper, you're in a poor position and need to either increase or decrease your expenses to stay in business. Even though you're profitable, it's still important to maintain proper cash flow control to avoid running on autopilot.

Although it can be very intimidating, cash flow management can benefit a company. It can help manage the money flow and ensure that the company has the necessary resources to meet its financial obligations. One of the most common types of cash management that is used by companies is the management of their outflows and incoming flows.

The cash flow spreadsheet is a great tool to visualize and manage your cash flow. It shows you when and how much money is coming in and going out. It can also help you adjust your approach to cash flow management. This process can be very complex since different banks and accounts are involved. Having the right software can help make the process easier for an individual. There are many paid tools that can help with this.

It's very easy to customize and adapt to your specific situation. You can also choose to create and maintain a wide range of different types of charts and graphs. Creating and updating these spreadsheets can help you better understand your current situation.

5 top cash flow management software

Agicap

A cloud-based platform offers comprehensive cash flow management with robust forecasting and liquidity planning capabilities. It's ideal for businesses that require a powerful and versatile solution.

Pros:

- Integrates seamlessly with multiple accounting and ERP software programs, ensuring a cohesive financial ecosystem. No more data silos!

- Powerful cash flow forecasting tools to predict future financial health with greater accuracy.

- Supports transactions in multiple currencies, making it perfect for businesses operating internationally.

Cons:

- May have a steeper learning curve compared to some competitors due to its advanced features.

- Pricing plans can be higher for larger businesses with complex needs.

💲Pricing: Free trial, paid plans start at €39/month

Float

Float caters specifically to freelancers and startups, offering a user-friendly cash flow management solution.

Pros:

- Streamlines cash flow with automatic bank account syncing and bill payment functionalities.

- Provides real-time cash flow forecasting, enabling proactive financial decisions.

- Affordable pricing plans make it accessible for early-stage businesses.

Cons:

- May lack advanced reporting features compared to some competitors.

- Scalability might be limited for rapidly growing businesses.

💲Pricing: Free trial, paid plans start at $19/month

Pulse

Pulse is a cloud-based software application and mobile app solution designed to streamline cash flow management for small businesses. It focuses on user-friendliness and provides features to help you gain real-time insights into your finances and make informed decisions.

Pros:

- Offers a user-friendly interface, making it easy to adopt for non-finance professionals within your company.

- Provides real-time cash flow tracking, keeping you updated on your financial standing at all times.

- Enables scenario planning, allowing you to explore the impact of different financial decisions before implementing them. This can be crucial for minimizing risks.

Cons:

- Integrates with a limited number of accounting software programs. This might be a concern if you already use a specific accounting software.

- May not be suitable for large businesses with complex cash flow needs and extensive data management requirements.

💲Pricing: Free trial, paid plans start at $29/month

QuickBooks

QuickBooks, a popular accounting software, offers a built-in cash flow management tool. While not as powerful as dedicated software, it can be convenient for existing users. It allows basic cash flow forecasting for up to 90 days and integrates with invoice management and bill pay functionalities within QuickBooks, providing a streamlined cash flow overview.

Pros:

- User-friendly interface with a familiar feel for those already using QuickBooks products.

- Integrates seamlessly with other QuickBooks applications.

- Offers basic cash flow forecasting functionalities.

Cons:

- Limited customization options in the free plan.

- Forecasting features might be too basic for complex business needs.

💲Pricing: Free plan, paid plans start at $25/month

CashAnalytics

CashAnalytics caters to mid-market companies with a robust cash flow management solution. It automates forecasting and tracking across multiple currencies, banks, and ledgers. Leveraging historical client and vendor behavior data, it provides insightful predictions to optimize cash flow management.

Pros:

- Manages transactions across multiple banks and currencies for a global financial view.

- Analyzes accounts payable and receivable to predict cash flow based on historical client and vendor behavior

- Offers configurable plans with robust security features to ensure user data remains protected.

- Integrates seamlessly with popular business software like NetSuite, Oracle, and SAP.

Cons:

- High cost

- The interface might require a steeper learning curve compared to some competitors.

💲Pricing: Starts at $420 per month

How to choose cash flow management software

Look for software that will help improve your efficiency and visibility into your company's financial data while being flexible enough to help you meet the needs of your business.

One of the most important factors that you want to consider when it comes to choosing cash management software is its ability to operate in real time. This is because it will allow you to spend more time improving the efficiency of your organization and less time managing the software itself.

Key questions:

- Is the information real-time and accurate?

- Is it capable of handling all of your data according to your bank API, or is it only loaded at the end of the day?

- Is the system capable of handling your future needs? As you expand into more accounts, currencies, and banks, can it keep up with your growing needs?

- Is it flexible enough to allow you to create insights quickly without the need for manual export-to-Excel workflows?

- Does it have risk management?

- Does it include automation and standardization core features?

To wrap up

Proper cash flow management is very important for any business, as it can help it avoid failure and success during times of uncertainty. Having the proper amount of money to hand can help you weather the storms that may come your way. One of the most important steps that you can take to improve your financial situation is to regularly schedule time for planning. Follow these steps and ensure you always have access to professional advice. The necessary tools and resources can help you improve efficiency and manage your cash flow.

Running a business can be very challenging, but with the right tools and resources, you can easily grow your business. If the functionality of the current tools is insufficient and you are considering creating your own software, you can always contact our specialists.